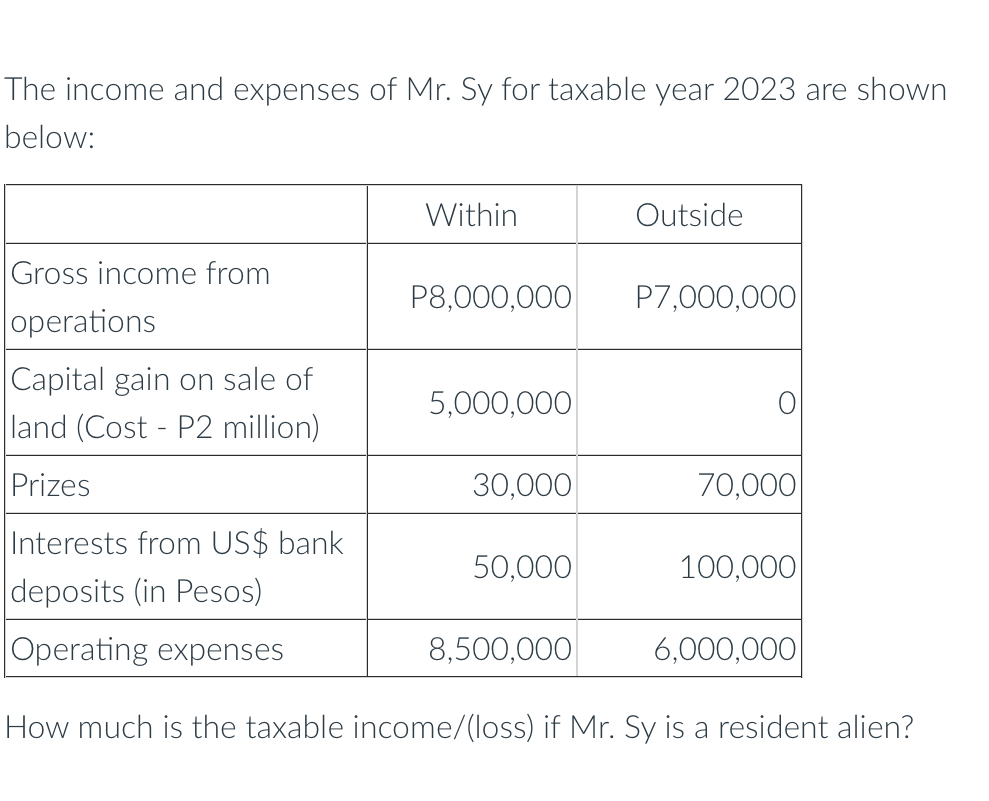

How much is the taxable income/(loss) if Mr. Sy is a resident alien given the following data: Gross income from operations: Within: P8,000,000 Outside: P7,000,000 Capital gain on... How much is the taxable income/(loss) if Mr. Sy is a resident alien given the following data: Gross income from operations: Within: P8,000,000 Outside: P7,000,000 Capital gain on sale of land (Cost - P2 million): Within: 5,000,000 Outside: 0 Prizes: Within: 30,000 Outside: 70,000 Interests from US$ bank deposits (in Pesos): Within: 50,000 Outside: 100,000 Operating expenses: Within: 8,500,000 Outside: 6,000,000

Understand the Problem

The question provides a table of income and expenses for Mr. Sy, separated into "within" and "outside" categories, for the taxable year 2023. Given that Mr. Sy is a resident alien, the question asks to calculate his taxable income or loss.

Answer

P5,750,000

Answer for screen readers

P5,750,000

Steps to Solve

-

Calculate total income from within the Philippines Add all income earned within the Philippines: Gross income from operations, capital gain on sale of land, prizes, and interests from US$ bank deposits. $8,000,000 + 5,000,000 + 30,000 + 50,000 = 13,080,000$

-

Calculate total income from outside the Philippines Add all income earned outside the Philippines: Gross income from operations, prizes, and interests from US$ bank deposits. $7,000,000 + 70,000 + 100,000 = 7,170,000$

-

Calculate total expenses from within the Philippines The total expenses from within the Philippines is given as $8,500,000$.

-

Calculate total expenses from outside the Philippines The total expenses from outside the Philippines is given as $6,000,000$.

-

Compute Net Income Within Compute Net Income Within by subtracting total expenses from total income within the Philippines. $13,080,000 - 8,500,000 = 4,580,000$

-

Compute Net Income Outside Compute Net Income Outside by subtracting total expenses from total income outside the Philippines. $7,170,000 - 6,000,000 = 1,170,000$

-

Calculate Taxable Income Since Mr. Sy is a resident alien, his taxable income is his worldwide income. Add the net income from within and outside the Philippines to arrive at the taxable income. $4,580,000 + 1,170,000 = 5,750,000$

P5,750,000

More Information

A resident alien is taxable on income derived from sources within and outside the Philippines.

Tips

A common mistake is to only include income from within the Philippines when calculating taxable income for a resident alien. Remember that resident aliens are taxed on their worldwide income. Another mistake is to forget to subtract the operating expenses to find the net income.

AI-generated content may contain errors. Please verify critical information