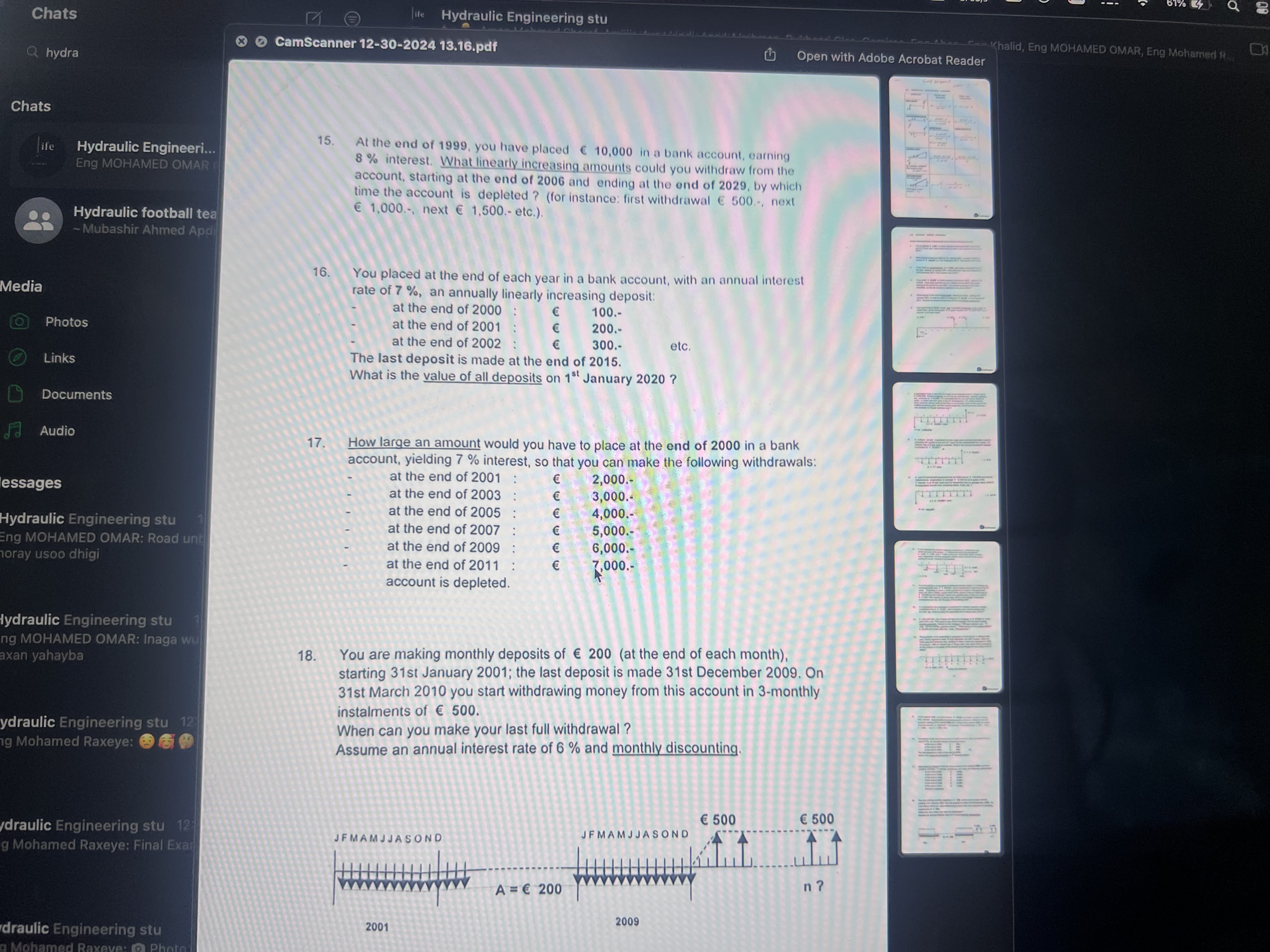

How large an amount would you have to place at the end of 2000 in a bank account, yielding 7% interest, so that you can make the following withdrawals: at the end of 2001, 2003, 20... How large an amount would you have to place at the end of 2000 in a bank account, yielding 7% interest, so that you can make the following withdrawals: at the end of 2001, 2003, 2004, 2007, 2009, and 2011 until the account is depleted?

Understand the Problem

The question is asking for the calculations related to bank deposits, interest rates, and withdrawals over specific time periods. It involves financial math concepts such as interest accumulation and withdrawal patterns.

Answer

The amount to deposit at the end of 2000 is approximately € 12,003.64.

Answer for screen readers

The final required deposit amount at the end of 2000 to facilitate the specified withdrawals is approximately € 12,003.64.

Steps to Solve

-

Identify the Problem Requirements

The problem asks for the amount needed to deposit at the end of the year 2000 in an account that yields 7% interest, so withdrawals can be made at specified times. -

List the Withdrawals and Their Timing

The withdrawals occur at the following times with specified amounts:- End of 2001: € 300

- End of 2003: € 500

- End of 2007: € 6,000

- End of 2009: € 6,000

- End of 2011: € 7,000

-

Calculate the Present Value of Withdrawals

To find the present value (PV) of each withdrawal, apply the formula for PV: $$ PV = \frac{C}{(1 + r)^n} $$ where ( C ) is the cash flow (withdrawal amount), ( r ) is the interest rate (0.07), and ( n ) is the number of years until the withdrawal.- For the withdrawal at the end of 2001:

$$ PV = \frac{300}{(1 + 0.07)^{1}} $$ - For the withdrawal at the end of 2003:

$$ PV = \frac{500}{(1 + 0.07)^{3}} $$ - For the withdrawal at the end of 2007:

$$ PV = \frac{6000}{(1 + 0.07)^{7}} $$ - For the withdrawal at the end of 2009:

$$ PV = \frac{6000}{(1 + 0.07)^{9}} $$ - For the withdrawal at the end of 2011:

$$ PV = \frac{7000}{(1 + 0.07)^{11}} $$

- For the withdrawal at the end of 2001:

-

Calculate Total Present Value

Add up all the present values calculated from the withdrawals to find the total amount you need to deposit at the end of 2000.

The final required deposit amount at the end of 2000 to facilitate the specified withdrawals is approximately € 12,003.64.

More Information

This calculation illustrates how present value factors into financial planning, allowing for expected future withdrawals to be accounted for today. Understanding this helps in managing savings and investments effectively.

Tips

- Forgetting to adjust the number of years (n) correctly for each withdrawal.

- Neglecting to apply the interest rate consistently across all calculations.

- Miscalculating present values by incorrect usage of the formula.

AI-generated content may contain errors. Please verify critical information