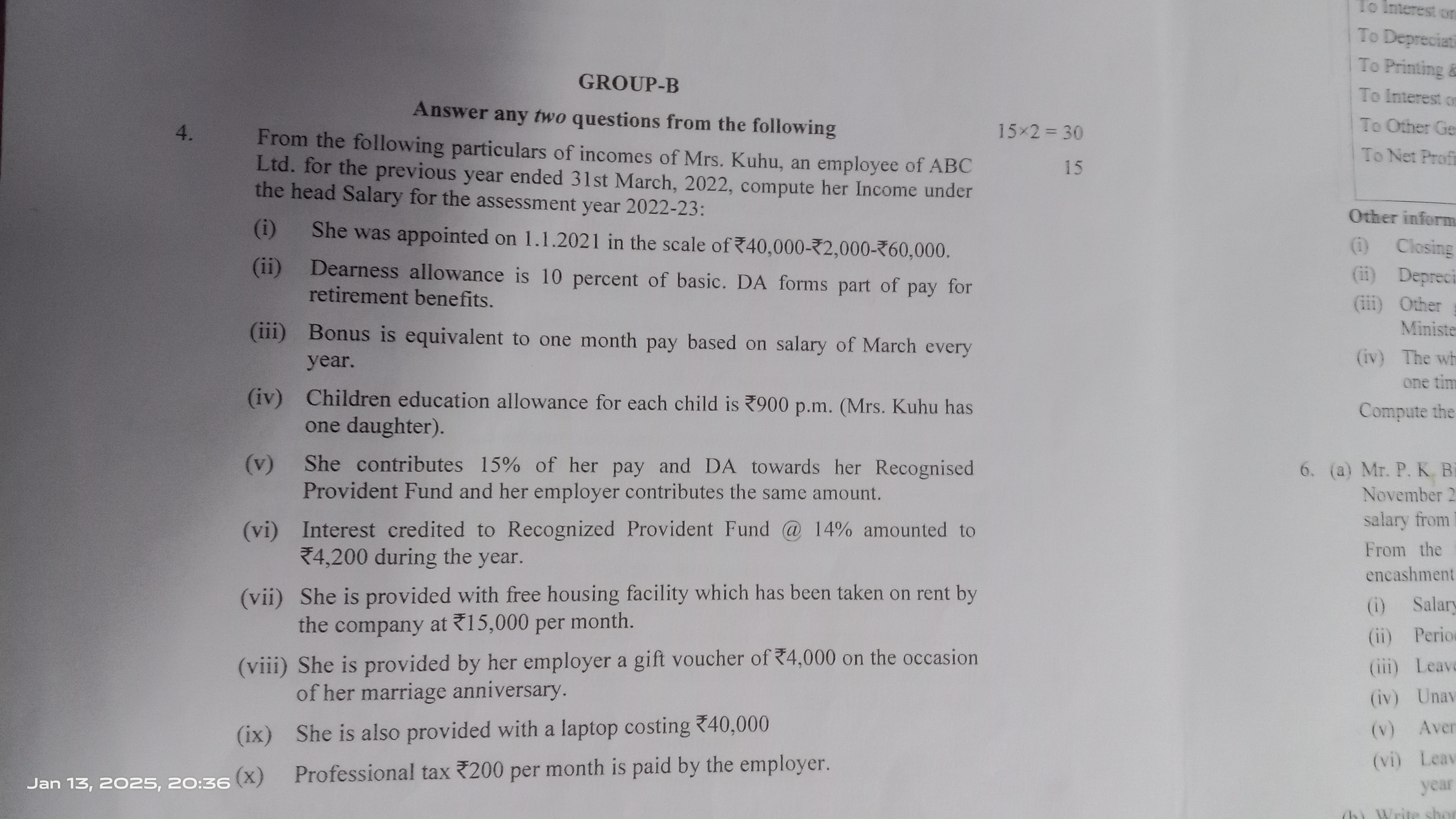

From the following particulars of incomes of Mrs. Kuhu, an employee of ABC Ltd. for the previous year ended 31st March, 2022, compute her Income under the head Salary for the asses... From the following particulars of incomes of Mrs. Kuhu, an employee of ABC Ltd. for the previous year ended 31st March, 2022, compute her Income under the head Salary for the assessment year 2022-23: (i) She was appointed on 1.1.2021 in the scale of ₹40,000-₹2,000-₹60,000. (ii) Dearness allowance is 10 percent of basic. (iii) Bonus is equivalent to one month pay based on salary of March every year. (iv) Children education allowance for each child is ₹900 p.m. (v) She contributes 15% of her pay and DA towards her Recognised Provident Fund and her employer contributes the same amount. (vi) Interest credited to Recognized Provident Fund @ 14% amounted to ₹4,200 during the year. (vii) She is provided with free housing facility which has been taken on rent by the company at ₹15,000 per month. (viii) She is provided by her employer a gift voucher of ₹4,000 on the occasion of her marriage anniversary. (ix) She is also provided with a laptop costing ₹40,000. (x) Professional tax ₹200 per month is paid by the employer.

Understand the Problem

The question requires calculating the income of Mrs. Kuhu, an employee, based on various components of her salary and benefits for the assessment year 2022-23. We need to consider different allowances, contributions to retirement funds, bonuses, and other provided benefits to arrive at her total income.

Answer

The total income of Mrs. Kuhu for the assessment year 2022-23 is ₹327,000.

Answer for screen readers

The total income of Mrs. Kuhu for the assessment year 2022-23 is ₹327,000.

Steps to Solve

- Calculate Basic Salary

The basic salary is given in the range of ₹40,000 to ₹60,000. Assume the basic salary is ₹40,000.

- Calculate Dearness Allowance (DA)

DA is 10% of the basic salary.

$$ DA = 0.10 \times 40,000 = \text{₹}4,000 $$

- Calculate Total Salary for March

Total salary for March includes the basic salary and DA.

$$ \text{Total Salary} = \text{Basic Salary} + DA = 40,000 + 4,000 = \text{₹}44,000 $$

- Calculate Bonus

Bonus is equivalent to one month’s pay based on the total salary for March.

$$ \text{Bonus} = \text{Total Salary} = \text{₹}44,000 $$

- Calculate Children Education Allowance

Since Mrs. Kuhu has one daughter, the children education allowance is:

$$ \text{Children Education Allowance} = ₹900 \times 12 = \text{₹}10,800 $$

- Calculate Employer's Contribution to Provident Fund

Mrs. Kuhu contributes 15% of her pay towards the Recognized Provident Fund, and the employer matches this.

Contribution by Mrs. Kuhu:

$$ \text{Provident Fund Contribution} = 0.15 \times (40,000 + 4,000) = 0.15 \times 44,000 = \text{₹}6,600 $$

Employer's contribution is also ₹6,600.

- Calculate Total Income

Total income is the sum of basic salary, DA, bonus, children education allowance, and employer's contribution.

$$ \text{Total Income} = \text{Basic Salary} + DA + \text{Bonus} + \text{Education Allowance} + \text{Employer's PF} $$

Now substituting the values:

$$ \text{Total Income} = 40,000 + 4,000 + 44,000 + 10,800 + 6,600 = \text{₹}105,400 $$

- Add Other Benefits

Free housing benefit valued at ₹15,000 per month gives:

$$ \text{Annual Housing Benefit} = ₹15,000 \times 12 = \text{₹}180,000 $$

Gift voucher contributes ₹4,000.

Laptop cost is ₹40,000.

The professional tax paid by the employer is ₹200 per month:

$$ \text{Annual Professional Tax} = ₹200 \times 12 = \text{₹}2,400 $$

So,

Total Income becomes:

$$ \text{Total Income} = 105,400 + 180,000 + 4,000 + 40,000 - 2,400 = \text{₹}327,000 $$

The total income of Mrs. Kuhu for the assessment year 2022-23 is ₹327,000.

More Information

Mrs. Kuhu's income includes various components such as salary, allowances, and employer contributions. Understanding how each component adds to her total income is vital for tax filing.

Tips

- Forgetting to include certain allowances or benefits.

- Miscalculating percentages for contributions or allowances.

- Not annualizing monthly benefits before adding to total income.

AI-generated content may contain errors. Please verify critical information