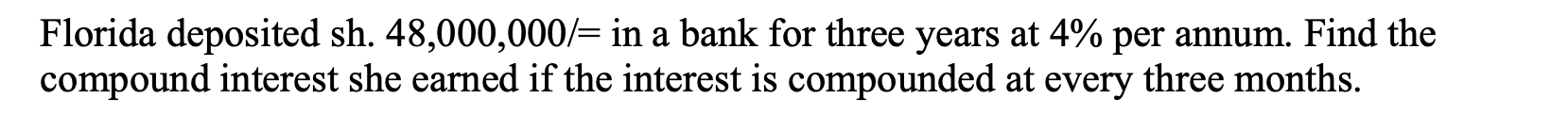

Florida deposited 48,000,000 shillings in a bank for three years at 4% per annum. Find the compound interest she earned if the interest is compounded every three months.

Understand the Problem

The question requires calculating the compound interest earned on a deposit of 48,000,000 shillings over three years at an annual interest rate of 4%, compounded quarterly.

Answer

sh. 6,087,601.45

Answer for screen readers

The compound interest earned is sh. 6,087,601.45.

Steps to Solve

-

Determine the number of compounding periods per year Since the interest is compounded every three months (quarterly), there are 4 compounding periods in a year.

-

Calculate the interest rate per compounding period The annual interest rate is 4%, so the quarterly interest rate is $\frac{4%}{4} = 1% = 0.01$.

-

Calculate the total number of compounding periods The investment is for 3 years, and interest is compounded quarterly, therefore the total number of compounding periods is $3 \times 4 = 12$.

-

Calculate the future value of the investment Use the compound interest formula: $A = P(1 + r)^n$, where $A$ is the future value, $P$ is the principal amount, $r$ is the interest rate per period, and $n$ is the number of compounding periods. In this case, $P = 48,000,000$, $r = 0.01$, and $n = 12$. $$ A = 48,000,000(1 + 0.01)^{12} $$ $$ A = 48,000,000(1.01)^{12} $$ $$ A = 48,000,000 \times 1.12682503013 $$ $$ A = 54,087,601.45 $$

-

Calculate the compound interest earned Subtract the principal from the future value to find the compound interest. $$ CI = A - P $$ $$ CI = 54,087,601.45 - 48,000,000 $$ $$ CI = 6,087,601.45 $$

The compound interest earned is sh. 6,087,601.45.

More Information

Compound interest is calculated on the principal and the accumulated interest from previous periods. In this case, the interest is compounded quarterly, which slightly increases the overall return compared to annual compounding.

Tips

A common mistake is using the annual interest rate without dividing it by the number of compounding periods per year. Another mistake is using the number of years as the number of compounding periods instead of multiplying it by the number of compounding periods per year. Forgetting to subtract the initial deposit from the final amount to get the compound interest is also a common mistake.

AI-generated content may contain errors. Please verify critical information