Financial Accounting exam questions

Understand the Problem

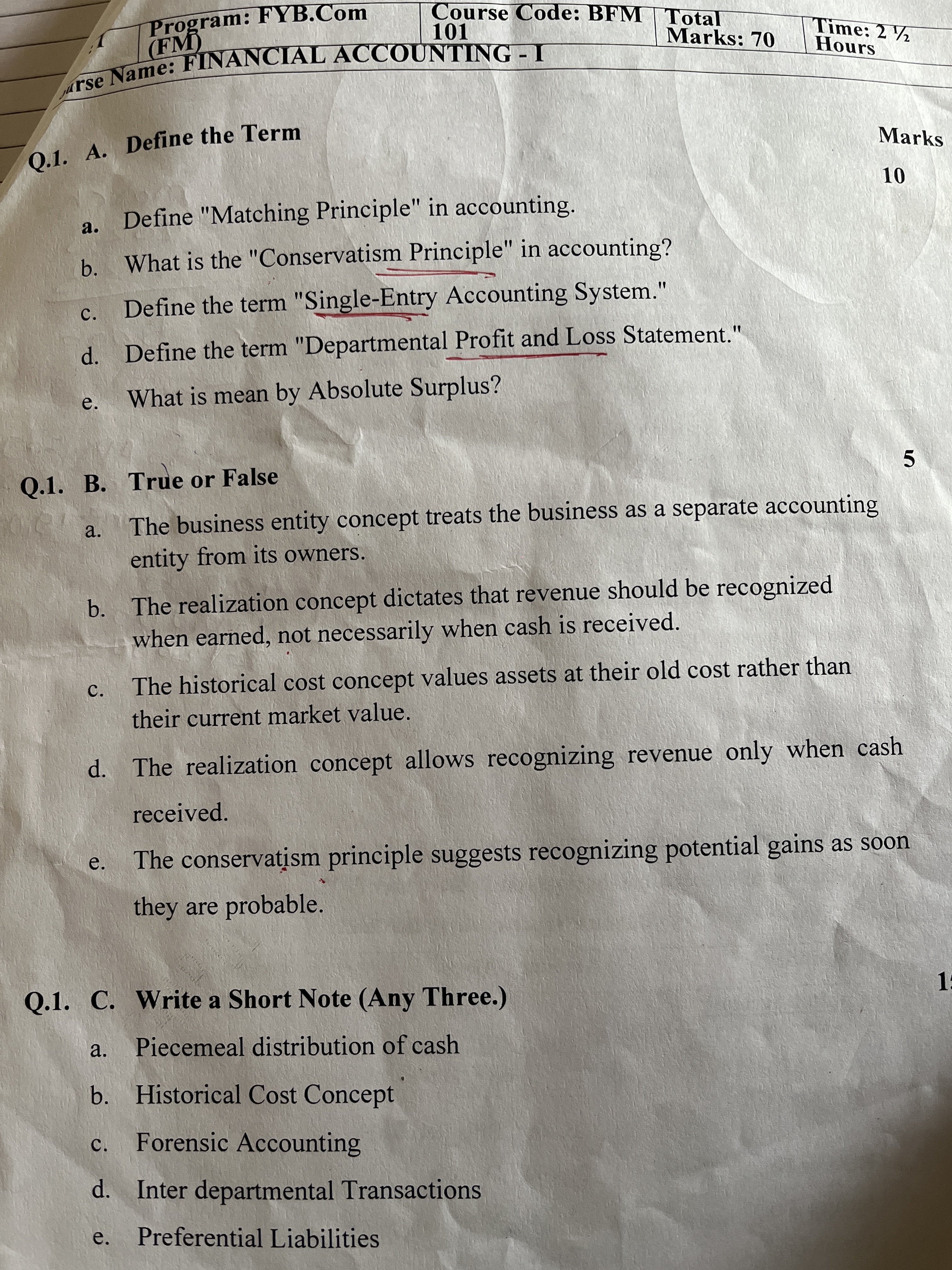

The image contains a financial accounting exam paper with multiple questions. The questions cover topics like defining terms (Matching Principle, Conservatism Principle, Single-Entry Accounting System, Departmental Profit and Loss Statement, Absolute Surplus), identifying true or false statements related to accounting concepts (business entity, realization, historical cost, conservatism), and writing short notes on accounting topics (Piecemeal distribution of cash, Historical Cost Concept, Forensic Accounting, Inter departmental Transactions, Preferential Liabilities). This is a homework question.

Answer

The questions from the Financial Accounting exam paper are listed above.

Here are the questions from the Financial Accounting exam paper:

Q.1. A. Define the Term a. Define "Matching Principle" in accounting. b. What is the "Conservatism Principle" in accounting? c. Define the term "Single-Entry Accounting System." d. Define the term "Departmental Profit and Loss Statement." e. What is mean by Absolute Surplus? Q.1. B. True or False a. The business entity concept treats the business as a separate accounting entity from its owners. b. The realization concept dictates that revenue should be recognized when earned, not necessarily when cash is received. c. The historical cost concept values assets at their old cost rather than their current market value. d. The realization concept allows recognizing revenue only when cash received. e. The conservatism principle suggests recognizing potential gains as soon they are probable. Q.1. C. Write a Short Note (Any Three.) 1 a. Piecemeal distribution of cash b. Historical Cost Concept c. Forensic Accounting d. Inter departmental Transactions e. Preferential Liabilities

Answer for screen readers

Here are the questions from the Financial Accounting exam paper:

Q.1. A. Define the Term a. Define "Matching Principle" in accounting. b. What is the "Conservatism Principle" in accounting? c. Define the term "Single-Entry Accounting System." d. Define the term "Departmental Profit and Loss Statement." e. What is mean by Absolute Surplus? Q.1. B. True or False a. The business entity concept treats the business as a separate accounting entity from its owners. b. The realization concept dictates that revenue should be recognized when earned, not necessarily when cash is received. c. The historical cost concept values assets at their old cost rather than their current market value. d. The realization concept allows recognizing revenue only when cash received. e. The conservatism principle suggests recognizing potential gains as soon they are probable. Q.1. C. Write a Short Note (Any Three.) 1 a. Piecemeal distribution of cash b. Historical Cost Concept c. Forensic Accounting d. Inter departmental Transactions e. Preferential Liabilities

More Information

The exam is for FYB.Com (FM), Course Code BFM 101, and is titled FINANCIAL ACCOUNTING - I.

Tips

Provide accurate definitions and clearly distinguish between accounting principles.

AI-generated content may contain errors. Please verify critical information