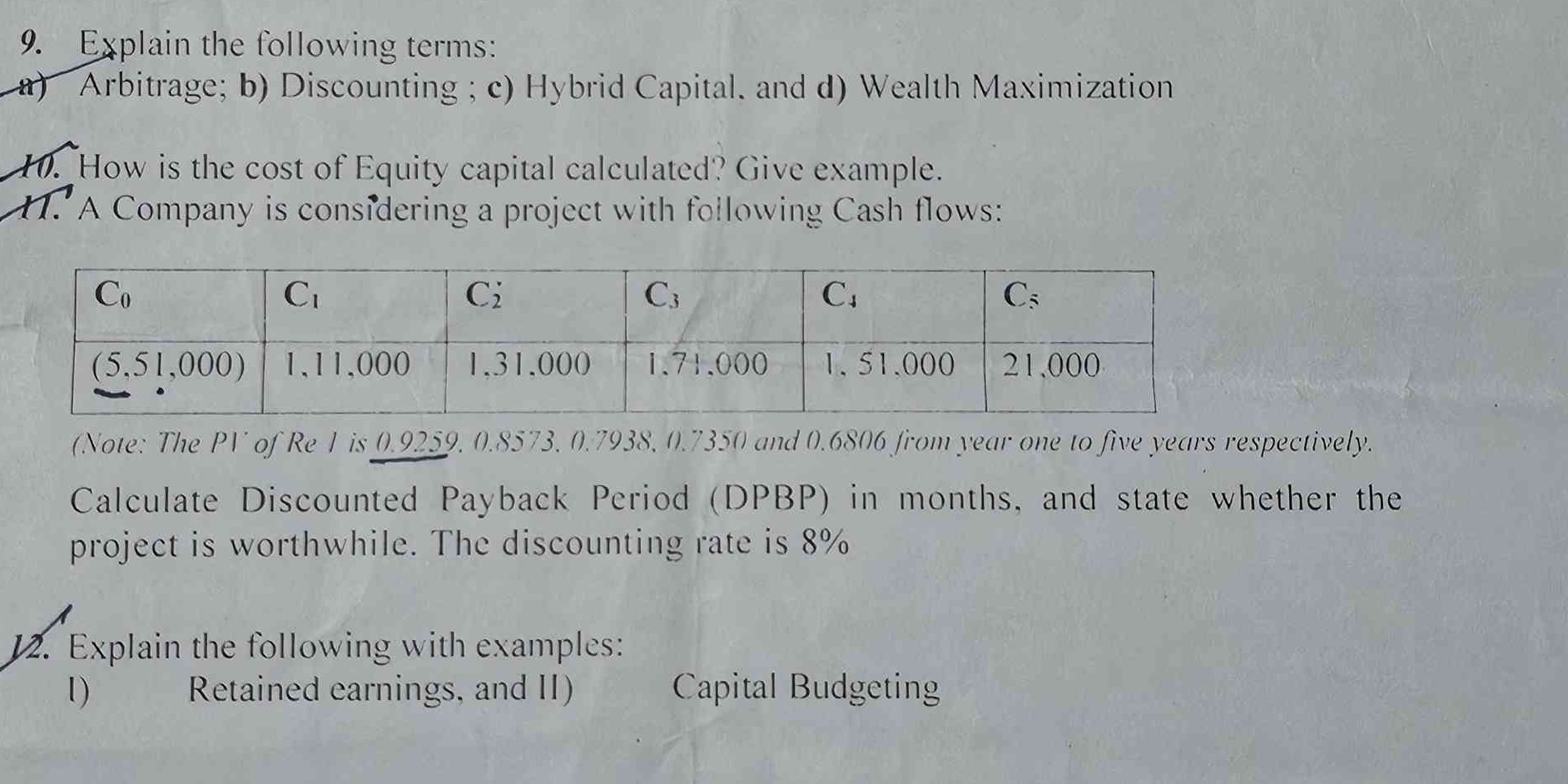

Explain the following terms: a) Arbitrage; b) Discounting; c) Hybrid Capital; d) Wealth Maximization. How is the cost of Equity capital calculated? Give an example. A Company is co... Explain the following terms: a) Arbitrage; b) Discounting; c) Hybrid Capital; d) Wealth Maximization. How is the cost of Equity capital calculated? Give an example. A Company is considering a project with the following cash flows: C0: (551,000), C1: 111,000, C2: 131,000, C3: 171,000, C4: 151,000, C5: 21,000. Calculate Discounted Payback Period (DPBP) in months, and state whether the project is worthwhile. The discounting rate is 8%. Explain the following with examples: I) Retained earnings; II) Capital Budgeting.

Understand the Problem

The question is requesting explanations of financial terms, the calculation of Equity capital, and the calculation of the Discounted Payback Period (DPBP) based on provided cash flows and a discount rate. It also asks for examples related to retained earnings and capital budgeting.

Answer

DPBP is 49.4 months. The project is not worthwhile.

The DPBP is approximately 49.4 months. The project is not worthwhile within a typical 5-year period.

Answer for screen readers

The DPBP is approximately 49.4 months. The project is not worthwhile within a typical 5-year period.

More Information

Discounted Payback Period provides a more accurate reflection of the project's value by accounting for the time value of money, but it's longer than 5 years, indicating the project may not meet investment horizons.

Tips

Misremembering the time value of money can lead to incorrect DPBP calculations. Ensure each cash flow is appropriately discounted.

AI-generated content may contain errors. Please verify critical information