Distinguish between Realization Account and Revaluation Account. Also, prepare journal entries and Revaluation Account for partners Sita, Rita, and Meeta given their balance sheet... Distinguish between Realization Account and Revaluation Account. Also, prepare journal entries and Revaluation Account for partners Sita, Rita, and Meeta given their balance sheet and the situation for dissolution. Additionally, define a company and explain its types. Explain the Companies Act, 2013 and its structure. Lastly, calculate profits for a limited company based on the given expenses and sales data.

Understand the Problem

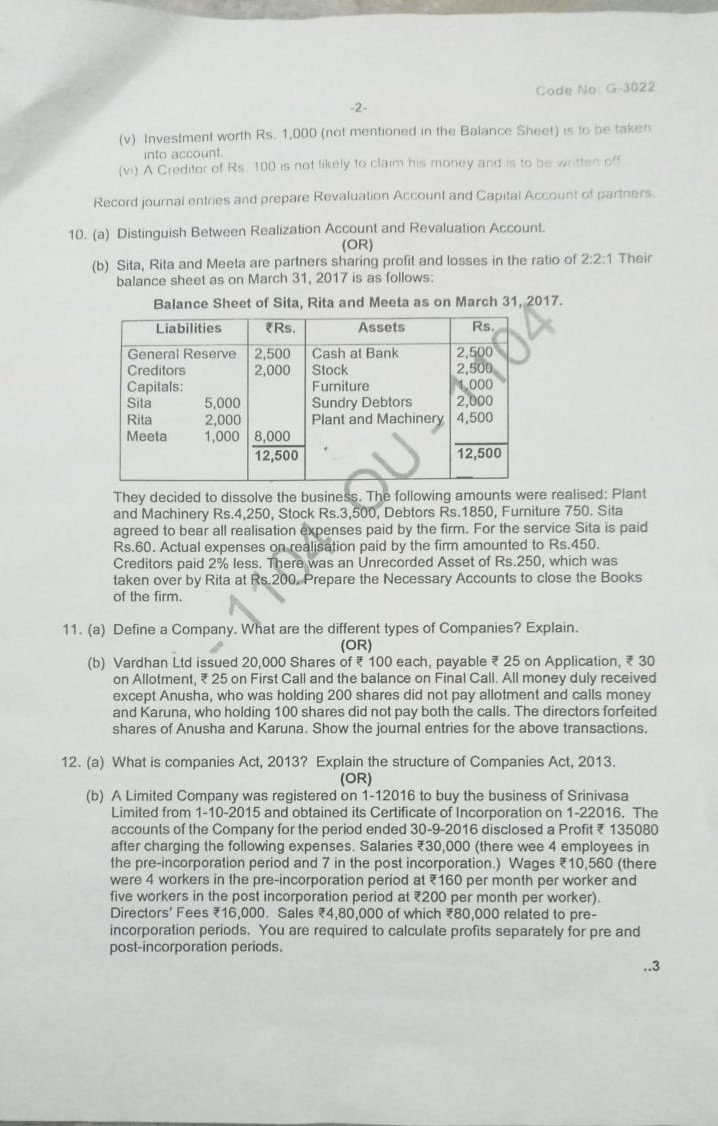

The question involves multiple parts related to accounting, specifically journal entries, the preparation of revaluation accounts, and understanding company laws. It includes scenarios about the dissolution of a partnership, types of companies, and calculation of financial figures in specific situations.

Answer

Realization handles dissolution sales; Revaluation adjusts asset values. A company is a legal business entity. Types: private and public. Companies Act, 2013 governs. Calculate profits by segregating expenses pre-/post-incorporation.

Realization Account records asset sales and liability payments during dissolution; Revaluation Account adjusts assets/liabilities to current values. For Sita, Rita, and Meeta, realisation handles asset sales. A company is a legal entity formed for business; types include private and public. The Companies Act, 2013 defines company laws. To calculate profits, allocate expenses and sales to pre- and post-incorporation periods.

Answer for screen readers

Realization Account records asset sales and liability payments during dissolution; Revaluation Account adjusts assets/liabilities to current values. For Sita, Rita, and Meeta, realisation handles asset sales. A company is a legal entity formed for business; types include private and public. The Companies Act, 2013 defines company laws. To calculate profits, allocate expenses and sales to pre- and post-incorporation periods.

More Information

Realization accounts are crucial for dissolving partnerships as they oversee asset liquidation and liability settlement. Revaluation accounts help in adjusting the carrying value of assets/liabilities accurately for fair presentation.

Tips

Ensure to differentiate clearly between realization (dissolution) and revaluation (value adjustment) purposes.

Sources

AI-generated content may contain errors. Please verify critical information