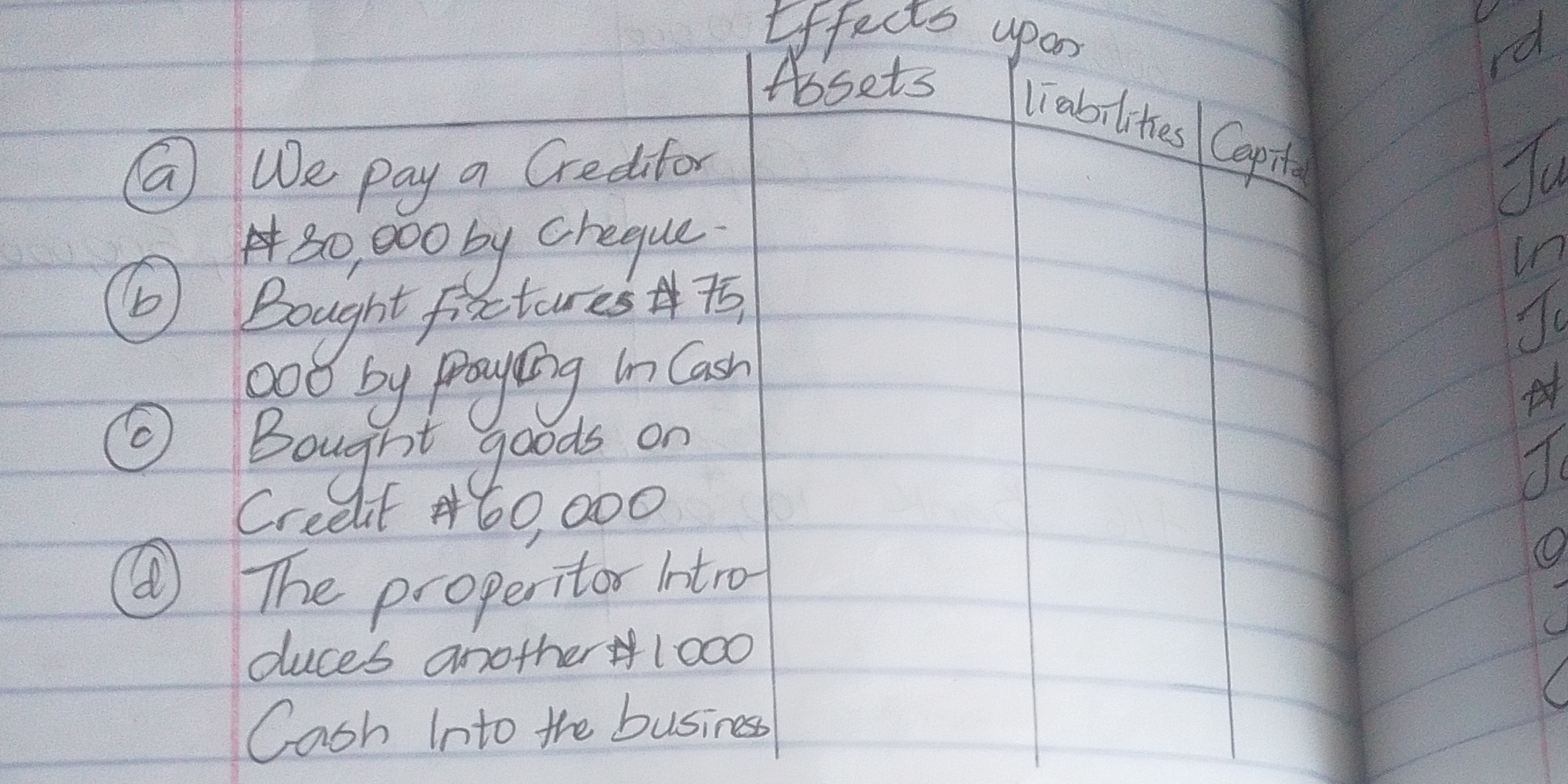

Determine the effects of the following transactions on Assets, Liabilities, and Capital: a) We pay a creditor $80,000 by cheque. b) Bought fixtures $75,000 by paying in cash. c) B... Determine the effects of the following transactions on Assets, Liabilities, and Capital: a) We pay a creditor $80,000 by cheque. b) Bought fixtures $75,000 by paying in cash. c) Bought goods on credit $60,000. d) The proprietor introduces another $1,000 cash into the business.

Understand the Problem

The question appears to be related to accounting principles, asking to determine the effects of various transactions on assets, liabilities, and capital. This involves understanding how each transaction impacts these three components of the accounting equation (Assets = Liabilities + Capital).

Answer

a) Assets decrease, liabilities decrease. b) Assets remain the same. c) Assets increase, liabilities increase. d) Assets increase, capital increases.

Here's the effect of each transaction on Assets, Liabilities, and Capital:

a) We pay a creditor $80,000 by cheque:

- Assets: Decrease by $80,000 (cash decreases)

- Liabilities: Decrease by $80,000 (accounts payable decreases)

- Capital: No effect

b) Bought fixtures $75,000 by paying in cash:

- Assets: No effect (Cash decreases by $75,000, and fixtures increase by $75,000)

- Liabilities: No effect

- Capital: No effect

c) Bought goods on credit $60,000:

- Assets: Increase by $60,000 (inventory increases)

- Liabilities: Increase by $60,000 (accounts payable increases)

- Capital: No effect

d) The proprietor introduces another $1,000 cash into the business:

- Assets: Increase by $1,000 (cash increases)

- Liabilities: No effect

- Capital: Increase by $1,000

Answer for screen readers

Here's the effect of each transaction on Assets, Liabilities, and Capital:

a) We pay a creditor $80,000 by cheque:

- Assets: Decrease by $80,000 (cash decreases)

- Liabilities: Decrease by $80,000 (accounts payable decreases)

- Capital: No effect

b) Bought fixtures $75,000 by paying in cash:

- Assets: No effect (Cash decreases by $75,000, and fixtures increase by $75,000)

- Liabilities: No effect

- Capital: No effect

c) Bought goods on credit $60,000:

- Assets: Increase by $60,000 (inventory increases)

- Liabilities: Increase by $60,000 (accounts payable increases)

- Capital: No effect

d) The proprietor introduces another $1,000 cash into the business:

- Assets: Increase by $1,000 (cash increases)

- Liabilities: No effect

- Capital: Increase by $1,000

More Information

The accounting equation (Assets = Liabilities + Equity) is the foundation of double-entry accounting. Each transaction affects at least two accounts to keep the equation in balance.

Tips

A common mistake is not recognizing the dual effect of each transaction. Remember, every transaction impacts at least two accounts.

Sources

- The Basic Accounting Equation | Financial Accounting - courses.lumenlearning.com

AI-generated content may contain errors. Please verify critical information