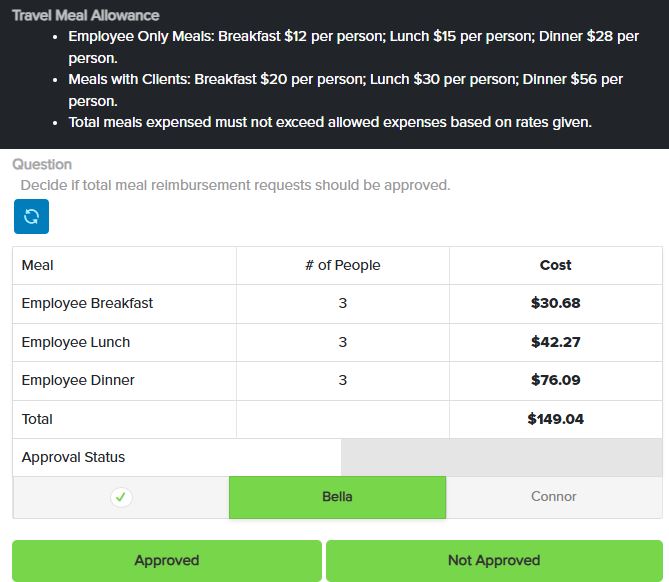

Decide if total meal reimbursement requests should be approved.

Understand the Problem

The question is asking whether the total meal reimbursement requests of $149.04 should be approved based on the provided meal allowance rates for employee meals. We need to determine if the total meets the expense criteria.

Answer

Approved.

Answer for screen readers

The total meal reimbursement request should be approved.

Steps to Solve

-

Identify Allowed Rates The reimbursement requests must comply with the given meal allowance rates. For employee meals:

- Breakfast: $12 per person

- Lunch: $15 per person

- Dinner: $28 per person

-

Calculate Maximum Allowable Costs Calculate the maximum total reimbursement based on the number of people for each meal:

- Maximum Employee Breakfast: $12 × 3 = $36

- Maximum Employee Lunch: $15 × 3 = $45

- Maximum Employee Dinner: $28 × 3 = $84

-

Sum Maximum Allowed Costs Now sum the maximum allowable costs calculated in the previous step:

- Total Allowed = $36 + $45 + $84 = $165

-

Compare Total Costs with Allowed Costs Compare the total meal reimbursement request ($149.04) with the total allowed ($165):

- Since $149.04 ≤ $165, the request complies.

-

Determine Approval Status Based on the comparison, since the total does not exceed the allowed amount, the reimbursement request should be approved.

The total meal reimbursement request should be approved.

More Information

The meal reimbursement is approved because the total expenses ($149.04) are less than the maximum allowable reimbursement ($165) based on the rates for employee meals.

Tips

- Confusing the rates for meals with clients and meals for employees.

- Not correctly calculating the total maximum allowable costs based on the number of people.

AI-generated content may contain errors. Please verify critical information