Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether the... Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether the variances are favorable or unfavorable.

Understand the Problem

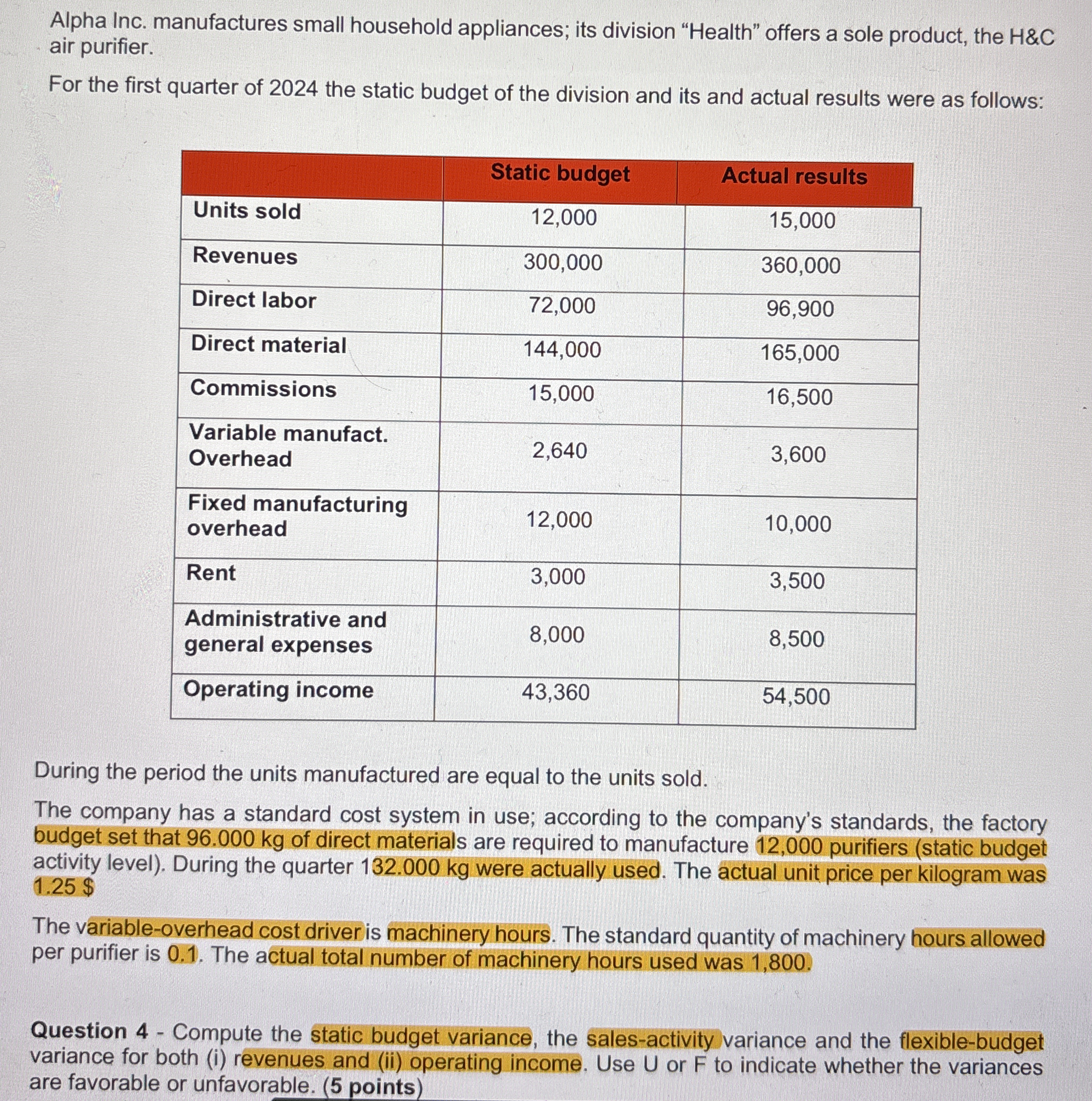

The question requires computing variances related to a static budget, including static budget variance for revenues and operating income. It involves analyzing budgeted versus actual figures in a cost accounting context.

Answer

Static Budget Variance for Revenues: $60,000 (F) Static Budget Variance for Operating Income: $11,140 (F) Sales-Activity Variance for Revenues: $75,000 (F) Sales-Activity Variance for Operating Income: $49,640 (F)

Answer for screen readers

- Static Budget Variance for Revenues: $60,000 (Favorable)

- Static Budget Variance for Operating Income: $11,140 (Favorable)

- Sales-Activity Variance for Revenues: $75,000 (Favorable)

- Sales-Activity Variance for Operating Income: $49,640 (Favorable)

Steps to Solve

- Calculate the Static Budget Variance for Revenues

The static budget variance for revenues is calculated as follows:

[ \text{Static Budget Variance for Revenues} = \text{Actual Revenues} - \text{Static Budget Revenues} ]

Substituting the values gives:

[ \text{Static Budget Variance for Revenues} = 360,000 - 300,000 = 60,000 ]

- Calculate the Static Budget Variance for Operating Income

The static budget variance for operating income is calculated similarly:

[ \text{Static Budget Variance for Operating Income} = \text{Actual Operating Income} - \text{Static Budget Operating Income} ]

Using the given figures:

[ \text{Static Budget Variance for Operating Income} = 54,500 - 43,360 = 11,140 ]

- Determine the Sales-Activity Variance for Revenues

The sales-activity variance adjusts the static budget to the actual level of activity, and it is calculated as:

[ \text{Sales-Activity Variance for Revenues} = \text{Flexible Budget Revenues} - \text{Static Budget Revenues} ]

First, we need to calculate the flexible budget revenues, which are calculated using the actual units sold:

[ \text{Flexible Budget Revenues} = \text{Actual Units Sold} \times \text{Revenue per Unit} ]

Revenue per unit from the static budget is:

[ \text{Revenue per Unit} = \frac{300,000}{12,000} = 25 ]

Thus:

[ \text{Flexible Budget Revenues} = 15,000 \times 25 = 375,000 ]

So:

[ \text{Sales-Activity Variance for Revenues} = 375,000 - 300,000 = 75,000 ]

- Determine the Sales-Activity Variance for Operating Income

To find the sales-activity variance for operating income, we need to calculate the flexible-budget operating income. First, we will calculate the variable costs based on the actual volume:

- Direct labor: ( 96,900 )

- Direct material: ( 165,000 )

- Commissions: ( 16,500 )

- Variable manufacturing overhead: ( 3,600 )

Then, the flexible-budget operating income is calculated as follows:

[ \text{Flexible Budget Operating Income} = \text{Flexible Budget Revenues} - \text{Total Variable Costs} ]

Where:

[ \text{Total Variable Costs} = \text{Direct Labor} + \text{Direct Material} + \text{Commissions} + \text{Variable Overhead} ]

Calculating the total variable costs:

[ \text{Total Variable Costs} = 96,900 + 165,000 + 16,500 + 3,600 = 282,000 ]

Then:

[ \text{Flexible Budget Operating Income} = 375,000 - 282,000 = 93,000 ]

Finally, the sales-activity variance for operating income:

[ \text{Sales-Activity Variance for Operating Income} = 93,000 - 43,360 = 49,640 ]

- Static Budget Variance for Revenues: $60,000 (Favorable)

- Static Budget Variance for Operating Income: $11,140 (Favorable)

- Sales-Activity Variance for Revenues: $75,000 (Favorable)

- Sales-Activity Variance for Operating Income: $49,640 (Favorable)

More Information

The variances indicate how well the company performed against its static budget. A favorable variance means that actual results exceeded budget expectations, which is typically considered positive for the business's financial health.

Tips

- Failing to correctly identify variable and fixed costs when calculating variances.

- Forgetting to check if the variances are favorable or unfavorable, which is important for analysis.

- Not using the correct actual units sold in calculations for flexible budgets.

AI-generated content may contain errors. Please verify critical information