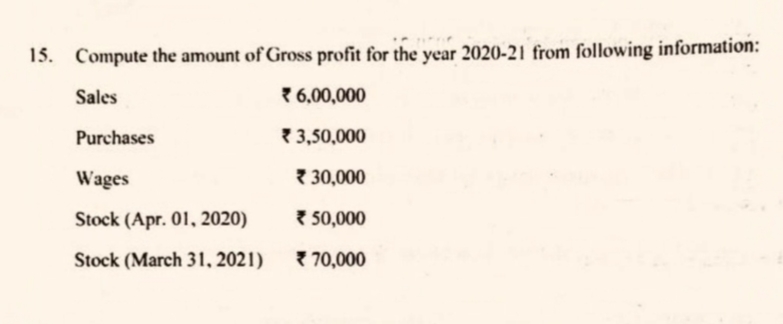

Compute the amount of Gross profit for the year 2020-21 from the following information: Sales: ₹6,00,000 Purchases: ₹3,50,000 Wages: ₹30,000 Stock (Apr. 01, 2020): ₹50,000 Stock (M... Compute the amount of Gross profit for the year 2020-21 from the following information: Sales: ₹6,00,000 Purchases: ₹3,50,000 Wages: ₹30,000 Stock (Apr. 01, 2020): ₹50,000 Stock (March 31, 2021): ₹70,000

Understand the Problem

The question asks to compute the gross profit for the year 2020-21 using the provided sales, purchases, wages, opening stock (April 1, 2020), and closing stock (March 31, 2021) information. The typical approach to solving this problem involves using the formula for Gross Profit, which takes into account Sales, Cost of Goods Sold (COGS), opening and closing stock, and purchases.

Answer

₹ 2,40,000

Answer for screen readers

₹ 2,40,000

Steps to Solve

-

Calculate the Cost of Goods Sold (COGS) COGS is calculated using the formula: $COGS = \text{Opening Stock} + \text{Purchases} + \text{Direct Expenses} - \text{Closing Stock}$. In this case, direct expenses are wages.

-

Plug in the values into the COGS formula $\text{Opening Stock} = ₹ 50,000$ $\text{Purchases} = ₹ 3,50,000$ $\text{Wages} = ₹ 30,000$ $\text{Closing Stock} = ₹ 70,000$

So, $COGS = 50,000 + 3,50,000 + 30,000 - 70,000$

-

Calculate the value of COGS $COGS = 4,30,000 - 70,000 = ₹ 3,60,000$

-

Calculate Gross Profit Gross Profit is calculated using the formula: $Gross \ Profit = \text{Sales} - COGS$

-

Plug in the values into the Gross Profit formula $\text{Sales} = ₹ 6,00,000$ $COGS = ₹ 3,60,000$

So, $Gross \ Profit = 6,00,000 - 3,60,000$

- Calculate the value of Gross Profit $Gross \ Profit = ₹ 2,40,000$

₹ 2,40,000

More Information

The gross profit represents the profit a company makes after deducting the costs associated with producing and selling its goods or services. It provides insight into how efficiently a company manages its production costs.

Tips

A common mistake is forgetting to include direct expenses like wages in the COGS calculation. Another mistake could be mixing up opening and closing stock values or using the wrong formula.

AI-generated content may contain errors. Please verify critical information