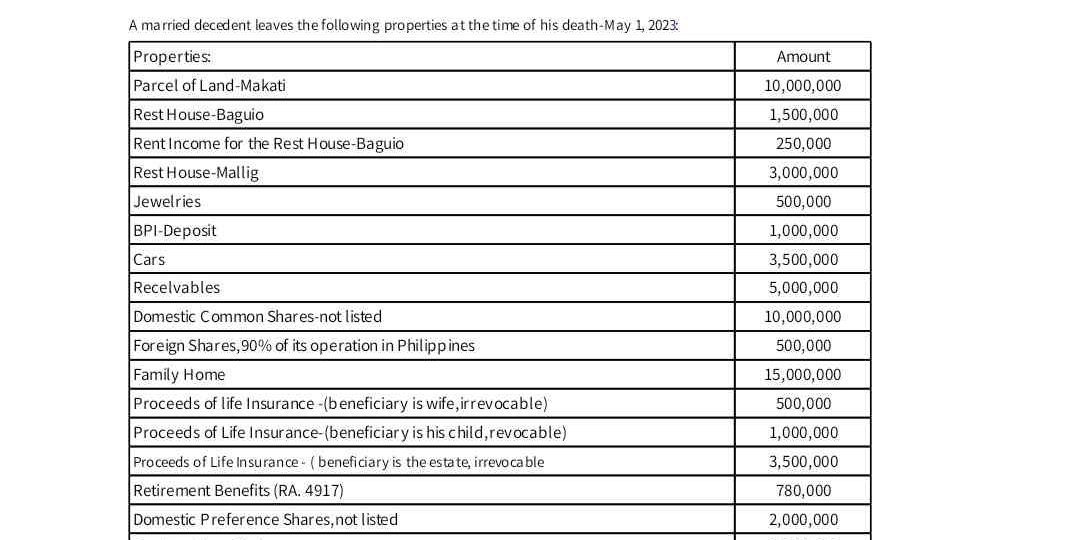

Calculate the total gross estate based on the list of properties and amounts provided.

Understand the Problem

The image shows a list of properties and their corresponding amounts left by a deceased person. It seems to be related to estate tax or inheritance calculation. The specific question isn't provided but based on this information it is likely asking to calculate the total gross estate.

Answer

The total gross estate is 61,750,000.

To calculate the total gross estate, sum the value of all properties.

10,000,000 + 1,500,000 + 250,000 + 3,000,000 + 500,000 + 1,000,000 + 3,500,000 + 5,000,000 + 10,000,000 + 500,000 + 15,000,000 + 1,000,000 + 3,500,000 + 2,000,000 = 71,750,000

The total gross estate is 61,750,000.

Answer for screen readers

To calculate the total gross estate, sum the value of all properties.

10,000,000 + 1,500,000 + 250,000 + 3,000,000 + 500,000 + 1,000,000 + 3,500,000 + 5,000,000 + 10,000,000 + 500,000 + 15,000,000 + 1,000,000 + 3,500,000 + 2,000,000 = 71,750,000

The total gross estate is 61,750,000.

More Information

The gross estate includes the total value of all the assets a person owns at the time of their death. It is important to note that the proceeds of life insurance with an irrevocable beneficiary are generally excluded from the gross estate, while proceeds of life insurance with a revocable beneficiary or payable to the estate are included.

Tips

Be careful to include all assets in the calculation. Some assets, like life insurance policies, may be overlooked. Also, pay attention to whether the beneficiary is revocable or irrevocable, as this affects the estate tax.

Sources

- Gross Estate: Definition, Calculation and Formula - SmartAsset - smartasset.com

- Calculating the Gross Estate for Federal Estate Tax Purposes - study.com

- Foundations of Law - The Gross Estate - LawShelf - lawshelf.com

AI-generated content may contain errors. Please verify critical information