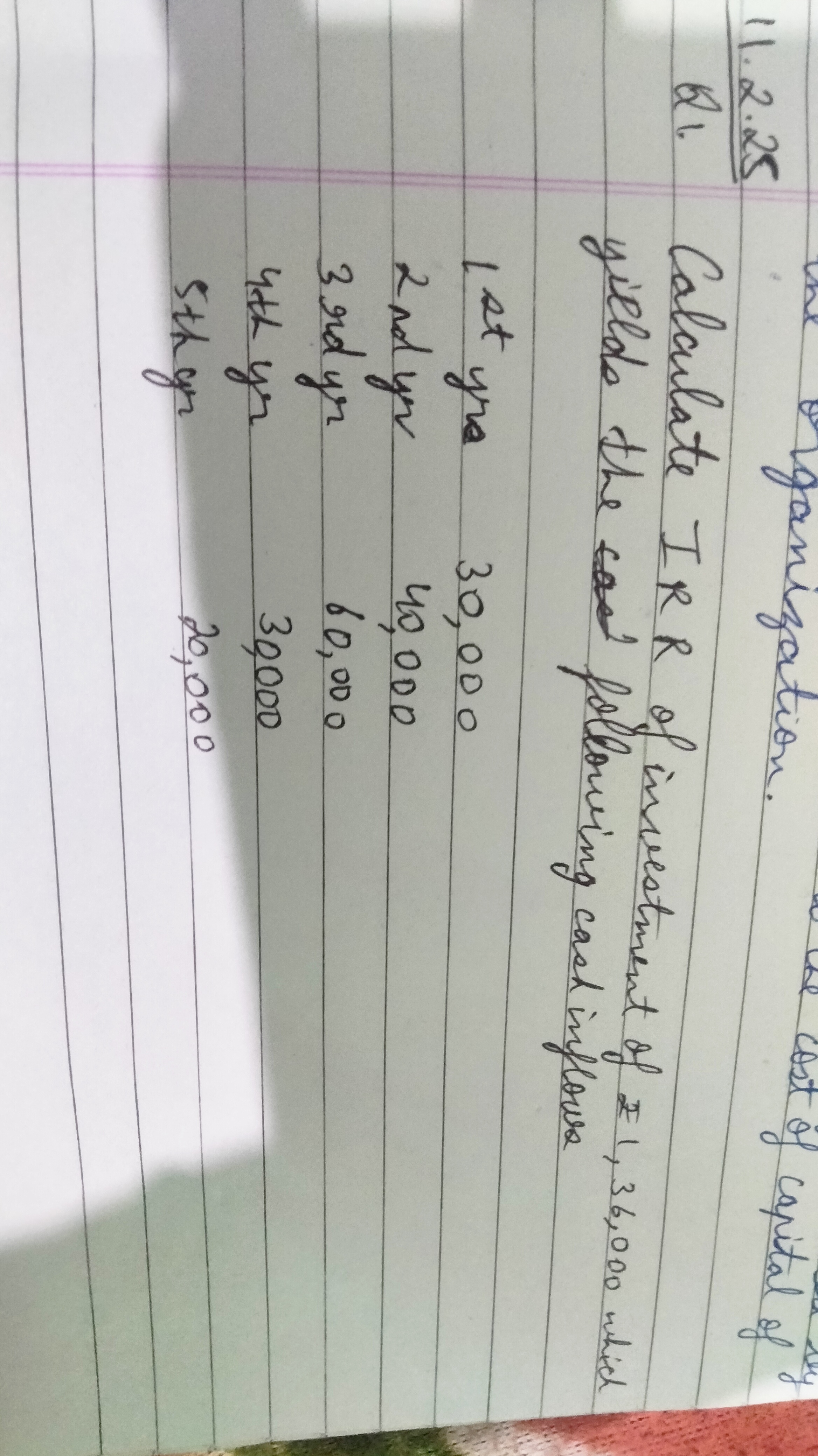

Calculate the IRR of an investment of ₹1,36,000 which yields the following cash inflows: 1st year: ₹30,000 2nd year: ₹40,000 3rd year: ₹60,000 4th year: ₹30,000 5th year: ₹20,000 Calculate the IRR of an investment of ₹1,36,000 which yields the following cash inflows: 1st year: ₹30,000 2nd year: ₹40,000 3rd year: ₹60,000 4th year: ₹30,000 5th year: ₹20,000

Understand the Problem

The question asks to calculate the Internal Rate of Return (IRR) for an investment of ₹1,36,000 given a series of cash inflows over 5 years. That requires us to determine the discount rate that makes the net present value (NPV) of all cash flows equal to zero. We must use trial and error or financial functions to find that single rate.

Answer

$IRR \approx 13\%$

Answer for screen readers

$IRR \approx 13%$

Steps to Solve

- Understanding Internal Rate of Return (IRR)

IRR is the discount rate at which the net present value (NPV) of an investment equals zero. It helps determine the profitability of a potential investment. We will use trial and error to find the IRR, since we can't directly solve for it in this case.

- Setting up the NPV equation

The Net Present Value (NPV) is calculated as follows.

$NPV = \sum_{t=1}^{n} \frac{CF_t}{(1+r)^t} - Initial Investment$

Where : $CF_t$ = Cash flow at period t $r$ = Discount rate $n$ = Number of periods

We want to find the $r$ (IRR) that makes the $NPV = 0$:

$0 = \frac{30000}{(1+r)^1} + \frac{40000}{(1+r)^2} + \frac{60000}{(1+r)^3} + \frac{30000}{(1+r)^4} + \frac{20000}{(1+r)^5} - 136000$

- First Trial Rate

Let's start with a rate of 5% (0.05). $NPV = \frac{30000}{(1+0.05)^1} + \frac{40000}{(1+0.05)^2} + \frac{60000}{(1+0.05)^3} + \frac{30000}{(1+0.05)^4} + \frac{20000}{(1+0.05)^5} - 136000$ $NPV = \frac{30000}{1.05} + \frac{40000}{1.1025} + \frac{60000}{1.157625} + \frac{30000}{1.21550625} + \frac{20000}{1.2762815625} - 136000$ $NPV = 28571.43 + 36281.18 + 51829.55 + 24679.86 + 15661.54 - 136000 = 21023.56$

Since the NPV is positive, we need to try higher rates.

- Second Trial Rate

Let's try 10% (0.10).

$NPV = \frac{30000}{(1+0.10)^1} + \frac{40000}{(1+0.10)^2} + \frac{60000}{(1+0.10)^3} + \frac{30000}{(1+0.10)^4} + \frac{20000}{(1+0.10)^5} - 136000$ $NPV = \frac{30000}{1.1} + \frac{40000}{1.21} + \frac{60000}{1.331} + \frac{30000}{1.4641} + \frac{20000}{1.61051} - 136000$ $NPV = 27272.73 + 33057.85 + 45078.89 + 20490.40 + 12418.43 - 136000 = 23018.30$

The NPV is still positive, so let's increase the rate further.

- Third Trial Rate

Let's try 15% (0.15).

$NPV = \frac{30000}{(1+0.15)^1} + \frac{40000}{(1+0.15)^2} + \frac{60000}{(1+0.15)^3} + \frac{30000}{(1+0.15)^4} + \frac{20000}{(1+0.15)^5} - 136000$ $NPV = \frac{30000}{1.15} + \frac{40000}{1.3225} + \frac{60000}{1.520875} + \frac{30000}{1.74900625} + \frac{20000}{2.0113571875} - 136000$ $NPV = 26086.96 + 30245.03 + 39450.74 + 17152.76 + 9943.53 - 136000 = -13120.98$

The NPV is now negative. This means the IRR is between 10% and 15%.

- Fourth Trial Rate

Let's try 13% (0.13).

$NPV = \frac{30000}{(1+0.13)^1} + \frac{40000}{(1+0.13)^2} + \frac{60000}{(1+0.13)^3} + \frac{30000}{(1+0.13)^4} + \frac{20000}{(1+0.13)^5} - 136000$ $NPV = \frac{30000}{1.13} + \frac{40000}{1.2769} + \frac{60000}{1.442897} + \frac{30000}{1.63047361} + \frac{20000}{1.84243518} - 136000$ $NPV = 26548.67 + 31325.94 + 41581.64 + 18400.46 + 10855.28 - 136000 = 2711.99$

The NPV is now positive. This means the IRR is between 13% and 15%.

- Fifth Trial Rate

Let's try 14% (0.14).

$NPV = \frac{30000}{(1+0.14)^1} + \frac{40000}{(1+0.14)^2} + \frac{60000}{(1+0.14)^3} + \frac{30000}{(1+0.14)^4} + \frac{20000}{(1+0.14)^5} - 136000$ $NPV = \frac{30000}{1.14} + \frac{40000}{1.2996} + \frac{60000}{1.481544} + \frac{30000}{1.68896016} + \frac{20000}{1.9254145824} - 136000$ $NPV = 26315.79 + 30779.16 + 40500.32 + 17762.06 + 10387.31 - 136000 = -10255.36$

The NPV is now negative. This means the IRR is between 13% and 14%. By interpolating, since 2711.99 is closer to zero than -10255.36, we can estimate the solution as somewhere between 13% and 13.5%, but in order to simplify, an estimate is required.

- Estimation

Without further interpolation, we can estimate the IRR to be closer to 13% than 14%. We can round the estimate to 13%.

$IRR \approx 13%$

More Information

The Internal Rate of Return provides an estimated discount rate where the investment breaks even. In order to estimate this properly, one would proceed with far more estimates between the ranges of 13 and 14, but due to time and calculator use constraints, an acceptable approximation of 13% is provided.

Tips

- Incorrectly calculating the present value of cash inflows.

- Using the wrong formula for NPV calculation.

- Making errors in the trial-and-error process when estimating the IRR.

- Failure to perform enough trials to determine an accurate estimate.

- Not understanding the basic concept of IRR

AI-generated content may contain errors. Please verify critical information