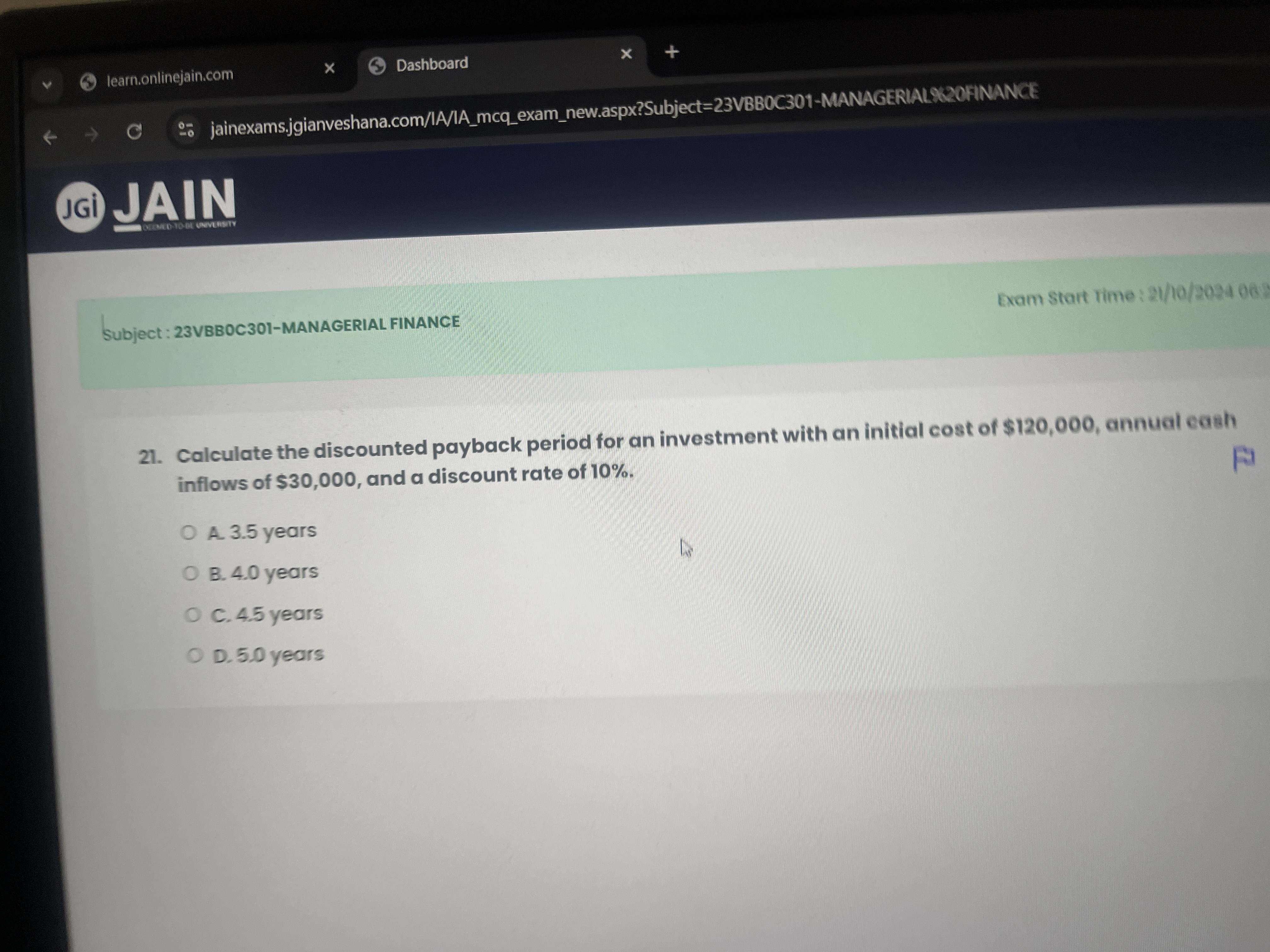

Calculate the discounted payback period for an investment with an initial cost of $120,000, annual cash inflows of $30,000, and a discount rate of 10%.

Understand the Problem

The question is asking for the calculation of the discounted payback period for an investment with a specified initial cost, annual cash inflows, and a discount rate. We will determine how long it takes for the investment to break even after accounting for the time value of money.

Answer

The discounted payback period is approximately $5.34$ years.

Answer for screen readers

The discounted payback period is approximately $5.34$ years.

Steps to Solve

-

Identify the variables

- Initial investment cost, $C = 120,000$

- Annual cash inflows, $CF = 30,000$

- Discount rate, $r = 10% = 0.10$

-

Calculate the present value of cash inflows

- The present value (PV) of cash inflows for each year must be calculated using the formula: $$ PV = \frac{CF}{(1 + r)^n} $$ where $n$ is the year.

-

Calculate cumulative discounted cash flows

-

Calculate the present value for each year until the cumulative present value equals or exceeds the initial investment.

-

For Year 1: $$ PV_1 = \frac{30,000}{(1 + 0.10)^1} = \frac{30,000}{1.10} \approx 27,273 $$

-

For Year 2: $$ PV_2 = \frac{30,000}{(1 + 0.10)^2} = \frac{30,000}{1.21} \approx 24,793 $$

-

For Year 3: $$ PV_3 = \frac{30,000}{(1 + 0.10)^3} = \frac{30,000}{1.331} \approx 22,533 $$

-

For Year 4: $$ PV_4 = \frac{30,000}{(1 + 0.10)^4} = \frac{30,000}{1.4641} \approx 20,485 $$

-

For Year 5: $$ PV_5 = \frac{30,000}{(1 + 0.10)^5} = \frac{30,000}{1.61051} \approx 18,637 $$

-

-

Sum the discounted cash flows

- Cumulative cash flows:

- After Year 1: $27,273$

- After Year 2: $27,273 + 24,793 = 52,066$

- After Year 3: $52,066 + 22,533 = 74,599$

- After Year 4: $74,599 + 20,485 = 95,084$

- After Year 5: $95,084 + 18,637 = 113,721$

- Cumulative cash flows:

-

Determine the year of payback

- The cumulative cash flow exceeds the initial investment of $120,000$ in Year 5.

- Calculate the exact time for payback in Year 5: $$ \text{Remaining amount} = 120,000 - 95,084 = 24,916 $$ $$ \text{Fraction of Year 5 to recover} = \frac{24,916}{18,637} \approx 1.34 \text{ years} $$

- Therefore, discounted payback period is: $$ 4 + 1.34 = 5.34 \text{ years} $$

The discounted payback period is approximately $5.34$ years.

More Information

The discounted payback period takes into account the time value of money, which means it assesses the worth of cash inflows at present value rather than simple cash flow counting.

Tips

- Forgetting to discount the cash inflows properly.

- Not cumulating the present values correctly.

- Miscalculating the remaining balance in the final year.

AI-generated content may contain errors. Please verify critical information