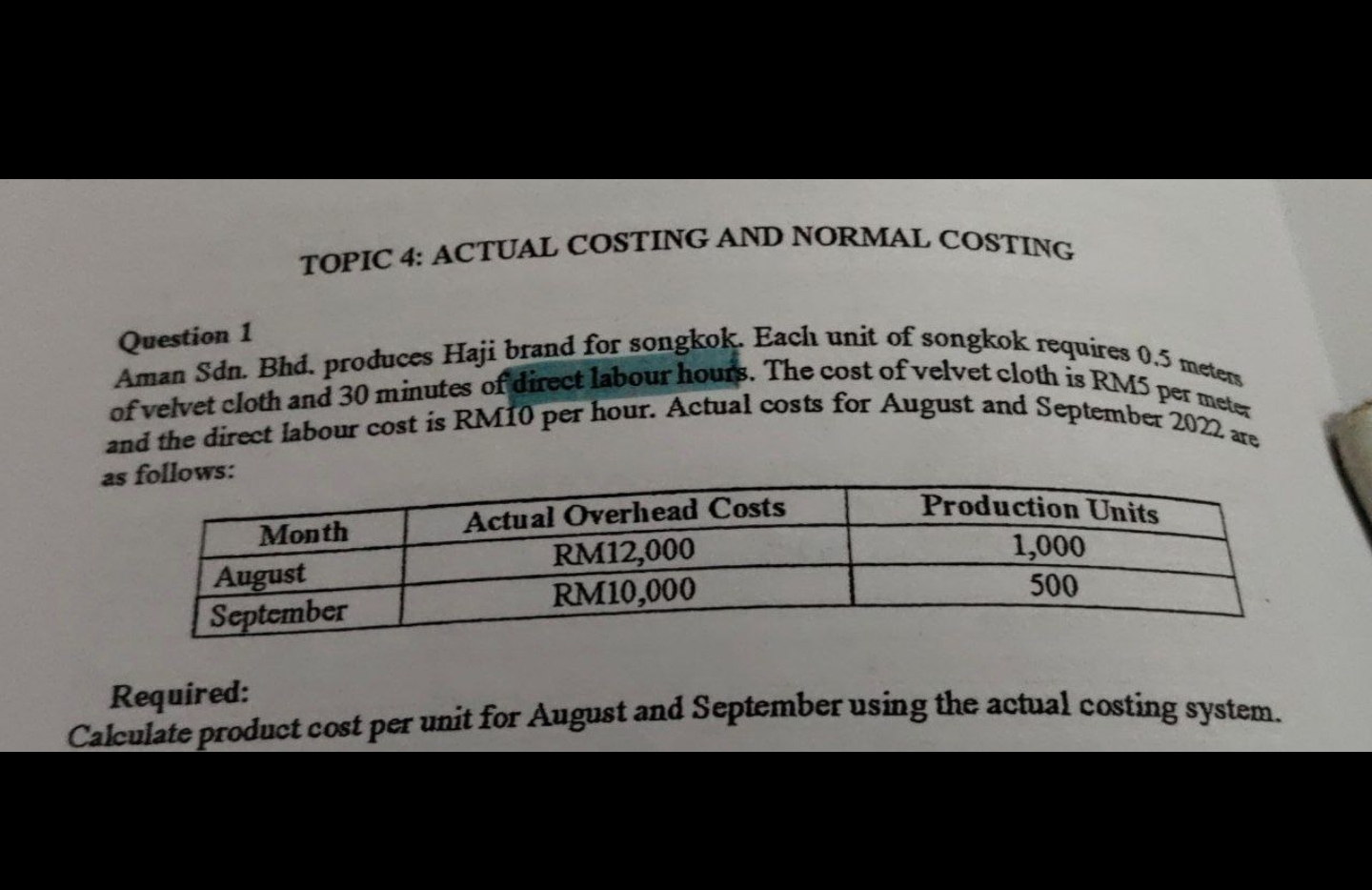

Calculate product cost per unit for August and September using the actual costing system.

Understand the Problem

The question is asking to calculate the product cost per unit for two months (August and September) based on given production units, overhead costs, material costs, and labor costs. This involves determining the total costs and dividing by the number of units produced.

Answer

August: RM19.50; September: RM27.50

Answer for screen readers

- Product cost per unit for August: RM19.50

- Product cost per unit for September: RM27.50

Steps to Solve

-

Calculate Material Cost for Each Month

Each unit of songkok requires 0.5 meters of velvet cloth. The cost per meter is RM5.

For August:

- Total production units = 1,000

- Material cost = $1,000 \times 0.5 \times 5 = RM2,500$

For September:

- Total production units = 500

- Material cost = $500 \times 0.5 \times 5 = RM1,250$

-

Calculate Labor Cost for Each Month

Each unit requires 30 minutes of labor, which is 0.5 hours. The labor cost is RM10 per hour.

For August:

- Total labor cost = $1,000 \times 0.5 \times 10 = RM5,000$

For September:

- Total labor cost = $500 \times 0.5 \times 10 = RM2,500$

-

Calculate Total Costs for Each Month

The total cost includes overheads, material costs, and labor costs.

For August:

- Total cost = Overhead + Material Cost + Labor Cost

- Total cost = $12,000 + 2,500 + 5,000 = RM19,500$

For September:

- Total cost = Overhead + Material Cost + Labor Cost

- Total cost = $10,000 + 1,250 + 2,500 = RM13,750$

-

Calculate Product Cost Per Unit for Each Month

The product cost per unit is calculated by dividing the total cost by production units.

For August:

- Product cost per unit = $\frac{19,500}{1,000} = RM19.50$

For September:

- Product cost per unit = $\frac{13,750}{500} = RM27.50$

- Product cost per unit for August: RM19.50

- Product cost per unit for September: RM27.50

More Information

The calculations incorporate all relevant costs in manufacturing including overhead, material, and labor costs to derive the product cost per unit. This kind of cost analysis helps in pricing decisions for products and overall financial planning for the company.

Tips

- Forgetting to include all cost components (material, labor, and overhead) when calculating total costs.

- Miscalculating labor costs by not converting minutes into hours correctly.

- Not dividing total costs accurately by the number of units produced.

AI-generated content may contain errors. Please verify critical information