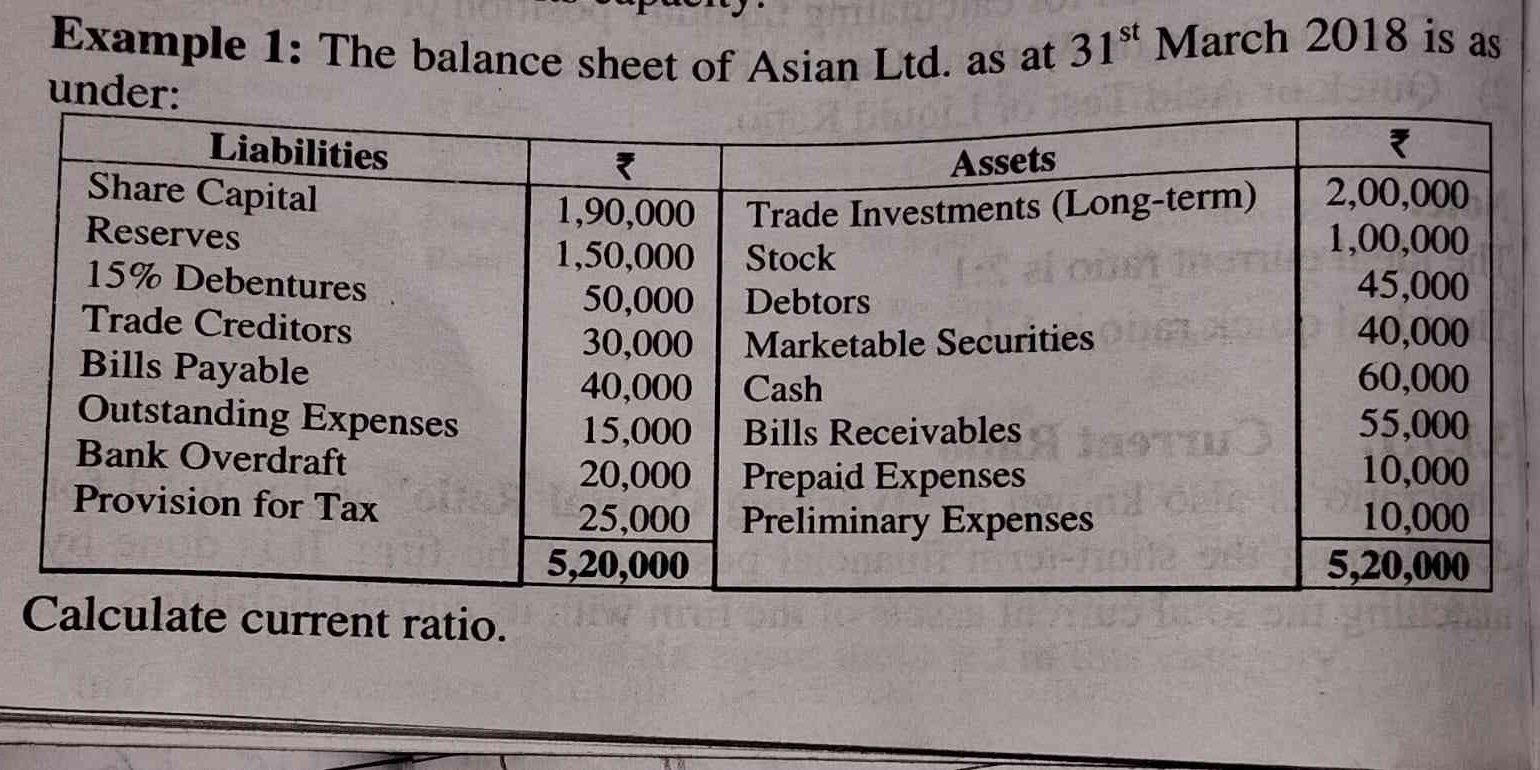

Calculate current ratio.

Understand the Problem

The question is asking to calculate the current ratio using the balance sheet data of Asian Ltd. The current ratio is calculated by dividing current assets by current liabilities.

Answer

The current ratio of Asian Ltd. is approximately $2.18$.

Answer for screen readers

$$ \text{Current Ratio} = \frac{ 100,000 + 45,000 + 40,000 + 60,000 + 55,000 + 10,000 + 10,000}{50,000 + 30,000 + 40,000 + 20,000 + 25,000} = \frac{ 360,000}{165,000} \approx 2.18 $$

Steps to Solve

- Identify Current Assets and Current Liabilities

The first step is to identify the current assets and current liabilities from the balance sheet.

-

Current Assets are:

- Stock: ₹100,000

- Debtors: ₹45,000

- Marketable Securities: ₹40,000

- Cash: ₹60,000

- Bills Receivables: ₹55,000

- Prepaid Expenses: ₹10,000

- Preliminary Expenses: ₹10,000

-

Current Liabilities are:

- Trade Creditors: ₹50,000

- Bills Payable: ₹30,000

- Outstanding Expenses: ₹40,000

- Bank Overdraft: ₹20,000

- Provision for Tax: ₹25,000

- Calculate Total Current Assets

Add all the current assets identified in the previous step:

$$ \text{Total Current Assets} = 100,000 + 45,000 + 40,000 + 60,000 + 55,000 + 10,000 + 10,000 $$

- Calculate Total Current Liabilities

Add all the current liabilities:

$$ \text{Total Current Liabilities} = 50,000 + 30,000 + 40,000 + 20,000 + 25,000 $$

- Calculate Current Ratio

Use the formula for current ratio:

$$ \text{Current Ratio} = \frac{\text{Total Current Assets}}{\text{Total Current Liabilities}} $$

-

Substitute the Values

Now substitute the totals calculated in the previous steps into the formula: -

Final Calculation

Perform the calculations to find the current ratio.

$$ \text{Current Ratio} = \frac{ 100,000 + 45,000 + 40,000 + 60,000 + 55,000 + 10,000 + 10,000}{50,000 + 30,000 + 40,000 + 20,000 + 25,000} = \frac{ 360,000}{165,000} \approx 2.18 $$

More Information

The current ratio is a measure of a company's ability to cover its short-term obligations with its short-term assets. A ratio greater than 1 generally indicates that the company has enough assets to cover its liabilities.

Tips

- Misidentifying current and non-current assets or liabilities.

To avoid this, carefully distinguish between current and long-term items by consulting definitions or guidelines.

AI-generated content may contain errors. Please verify critical information