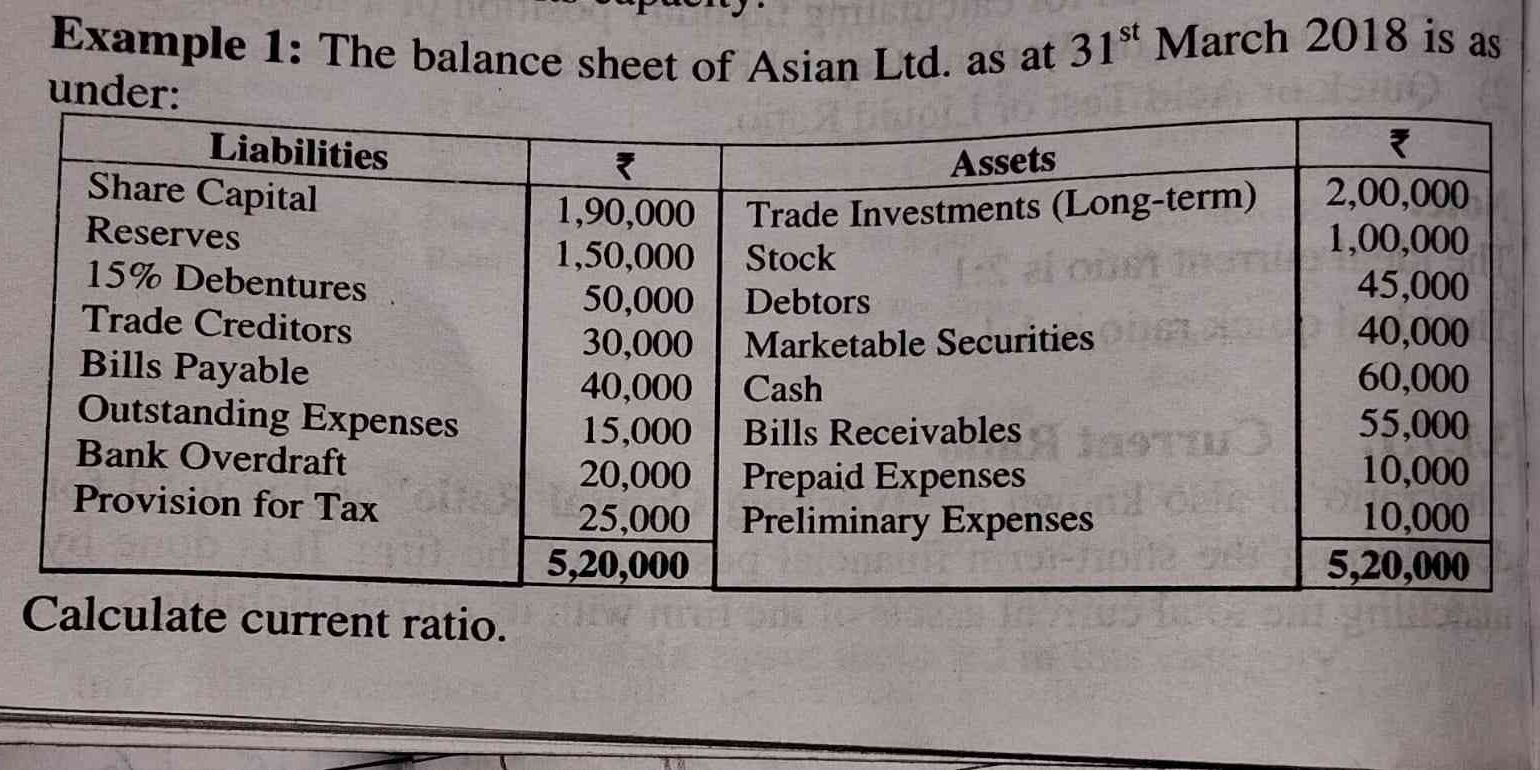

Calculate current ratio.

Understand the Problem

The question is asking us to calculate the current ratio based on the balance sheet data provided. The current ratio is calculated by dividing current assets by current liabilities, and we need to identify those figures from the given data.

Answer

The current ratio is approximately $1.94$.

Answer for screen readers

The current ratio is approximately $1.94$.

Steps to Solve

- Identify Current Assets

From the balance sheet, current assets include:

- Stock: ₹100,000

- Debtors: ₹45,000

- Marketable Securities: ₹40,000

- Cash: ₹60,000

- Bills Receivables: ₹55,000

- Prepaid Expenses: ₹10,000

- Preliminary Expenses: ₹10,000

Add these amounts together to find total current assets:

$$ \text{Total Current Assets} = 100,000 + 45,000 + 40,000 + 60,000 + 55,000 + 10,000 + 10,000 $$

-

Calculate Total Current Assets

Now compute the total:

$$ \text{Total Current Assets} = 100,000 + 45,000 + 40,000 + 60,000 + 55,000 + 10,000 + 10,000 = 320,000 $$ -

Identify Current Liabilities

From the balance sheet, current liabilities include:

- Trade Creditors: ₹50,000

- Bills Payable: ₹30,000

- Outstanding Expenses: ₹40,000

- Bank Overdraft: ₹20,000

- Provision for Tax: ₹25,000

Add these amounts together to find total current liabilities:

$$ \text{Total Current Liabilities} = 50,000 + 30,000 + 40,000 + 20,000 + 25,000 $$

-

Calculate Total Current Liabilities

Now compute the total:

$$ \text{Total Current Liabilities} = 50,000 + 30,000 + 40,000 + 20,000 + 25,000 = 165,000 $$ -

Calculate Current Ratio

The current ratio is calculated by dividing total current assets by total current liabilities:

$$ \text{Current Ratio} = \frac{\text{Total Current Assets}}{\text{Total Current Liabilities}} = \frac{320,000}{165,000} $$ -

Simplify the Current Ratio

Now perform the division to find the current ratio:

$$ \text{Current Ratio} \approx 1.94 $$

The current ratio is approximately $1.94$.

More Information

The current ratio is a financial metric used to evaluate a company's ability to pay short-term obligations. A ratio above 1 suggests that the company has more current assets than current liabilities, indicating good short-term financial health.

Tips

- Forgetting to include all current assets or liabilities when summing.

- Miscalculating the totals for either assets or liabilities.

- Confusing current assets with long-term investments.

AI-generated content may contain errors. Please verify critical information