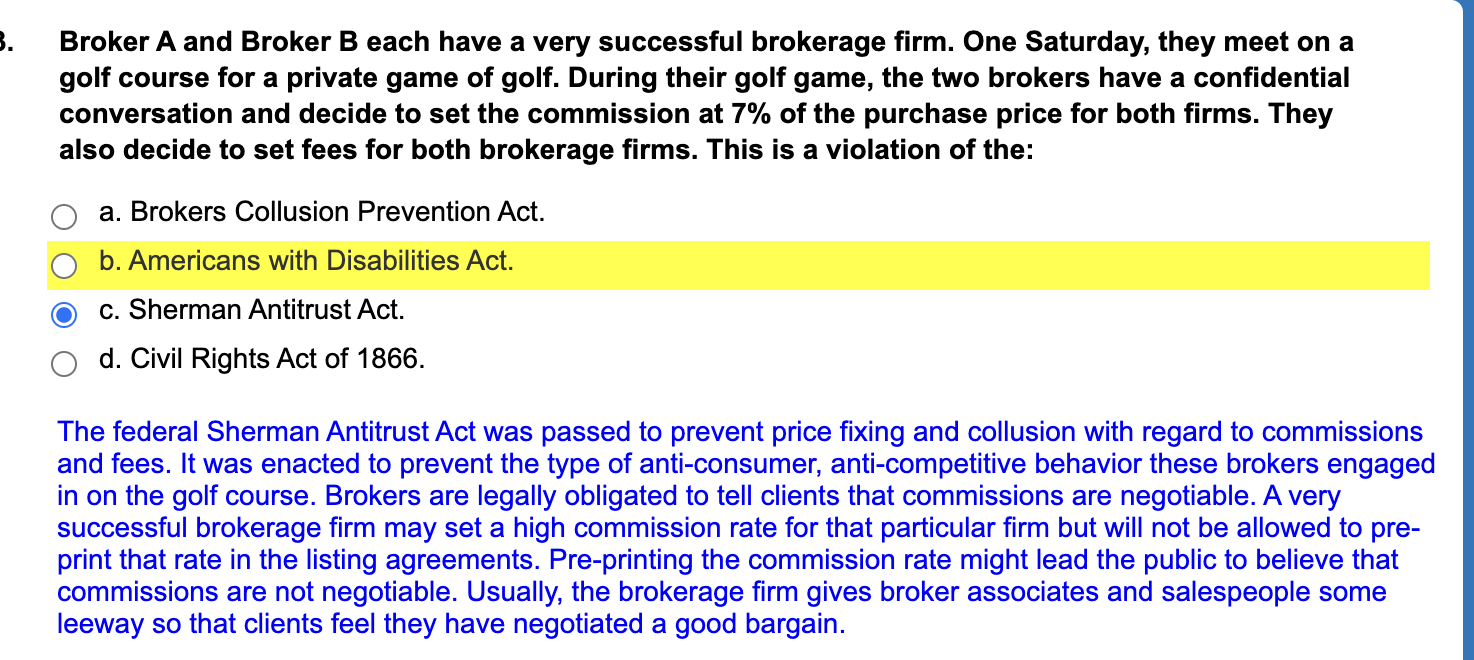

Broker A and Broker B each have a very successful brokerage firm. One Saturday, they meet on a golf course for a private game of golf. During their golf game, the two brokers have... Broker A and Broker B each have a very successful brokerage firm. One Saturday, they meet on a golf course for a private game of golf. During their golf game, the two brokers have a confidential conversation and decide to set the commission at 7% of the purchase price for both firms. They also decide to set fees for both brokerage firms. This is a violation of the:

Understand the Problem

The question presents a scenario involving two brokers who have colluded to fix commission prices, asking which act this behavior violates. The answer choices include four different laws, and the correct option highlights the Sherman Antitrust Act, which addresses anti-competitive practices.

Answer

Sherman Antitrust Act.

The final answer is Sherman Antitrust Act.

Answer for screen readers

The final answer is Sherman Antitrust Act.

More Information

The Sherman Antitrust Act is designed to prevent anti-competitive practices, such as price fixing or collusion, which is what the brokers were doing by agreeing on a fixed commission.

Tips

A common mistake is thinking the Americans with Disabilities Act applies, but it is unrelated to this scenario.

AI-generated content may contain errors. Please verify critical information