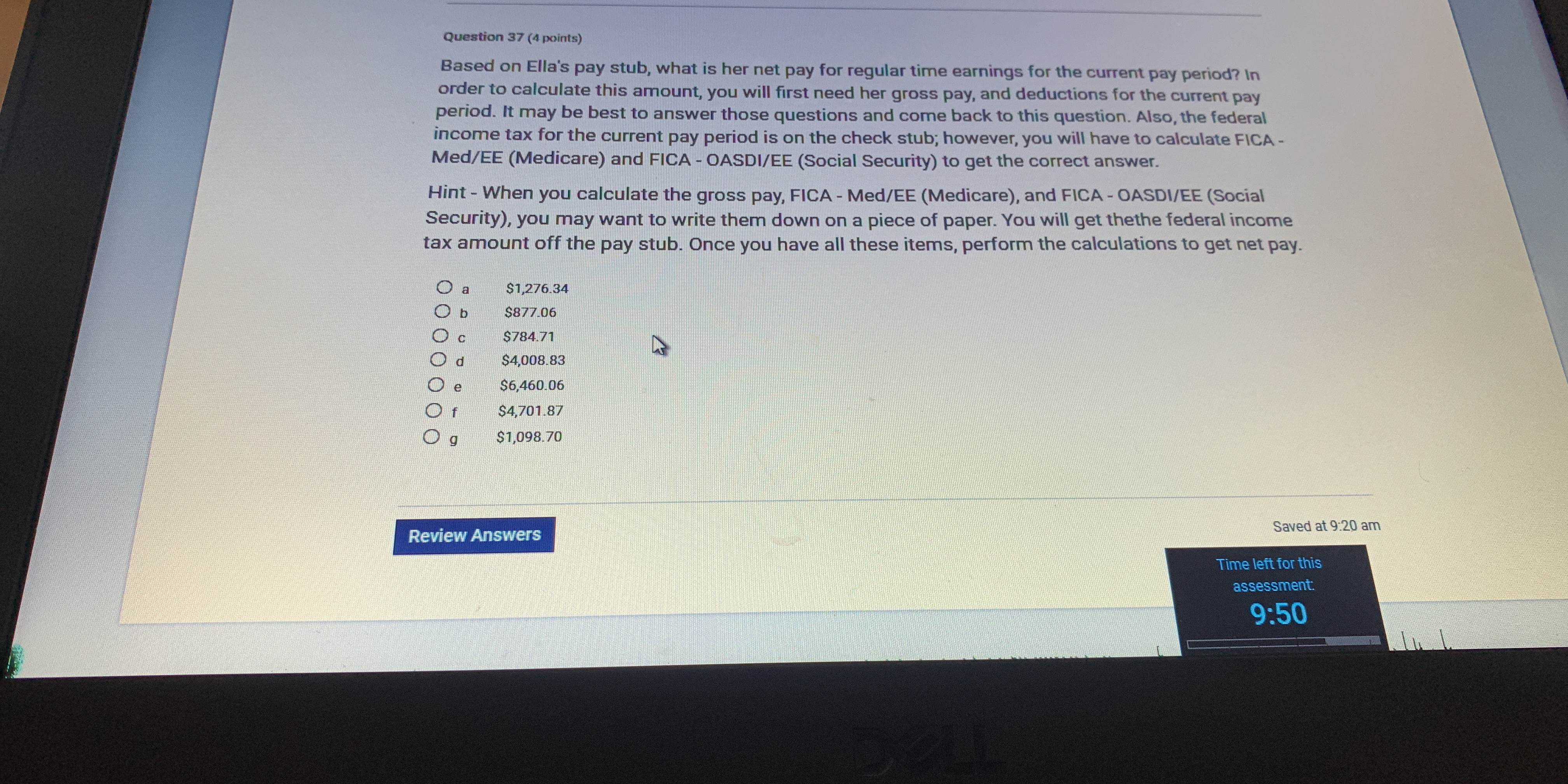

Based on Ella's pay stub, what is her net pay for regular time earnings for the current pay period?

Understand the Problem

The question asks us to calculate Ella's net pay for the current pay period based on her pay stub. To find the net pay we need to know her gross pay and deductions, including federal income tax, FICA-Med/EE (Medicare), and FICA-OASDI/EE (Social Security), which may be found on the check stub.

Answer

$1,098.70

Answer for screen readers

$1,098.70

Steps to Solve

- Identify Ella's gross pay

From the pay stub (in a previous question), Ella's gross pay for regular time earnings is $1,276.34.

- Calculate FICA-Med/EE (Medicare)

Medicare is calculated as 1.45% of gross pay. $Medicare = 0.0145 \times 1276.34 = 18.507 \approx 18.51$

- Calculate FICA-OASDI/EE (Social Security)

Social Security is calculated as 6.2% of gross pay. $Social Security = 0.062 \times 1276.34 = 79.133 \approx 79.13$

- Identify Federal Income Tax

From the pay stub (in a previous question), the federal income tax is $80.00.

- Calculate Total Deductions

$Total Deductions = Medicare + Social Security + Federal Income Tax$ $Total Deductions = 18.51 + 79.13 + 80.00 = 177.64$

- Calculate Net Pay

$Net Pay = Gross Pay - Total Deductions$ $Net Pay = 1276.34 - 177.64 = 1098.70$

$1,098.70

More Information

Net pay, often referred to as take-home pay, is what an employee receives after all deductions have been taken from their gross pay.

Tips

A common mistake is to forget to calculate both Medicare and Social Security taxes, or to use the wrong percentages. Also, simply subtracting only the federal income tax and not including Medicare and Social Security would lead to an incorrect result.

AI-generated content may contain errors. Please verify critical information