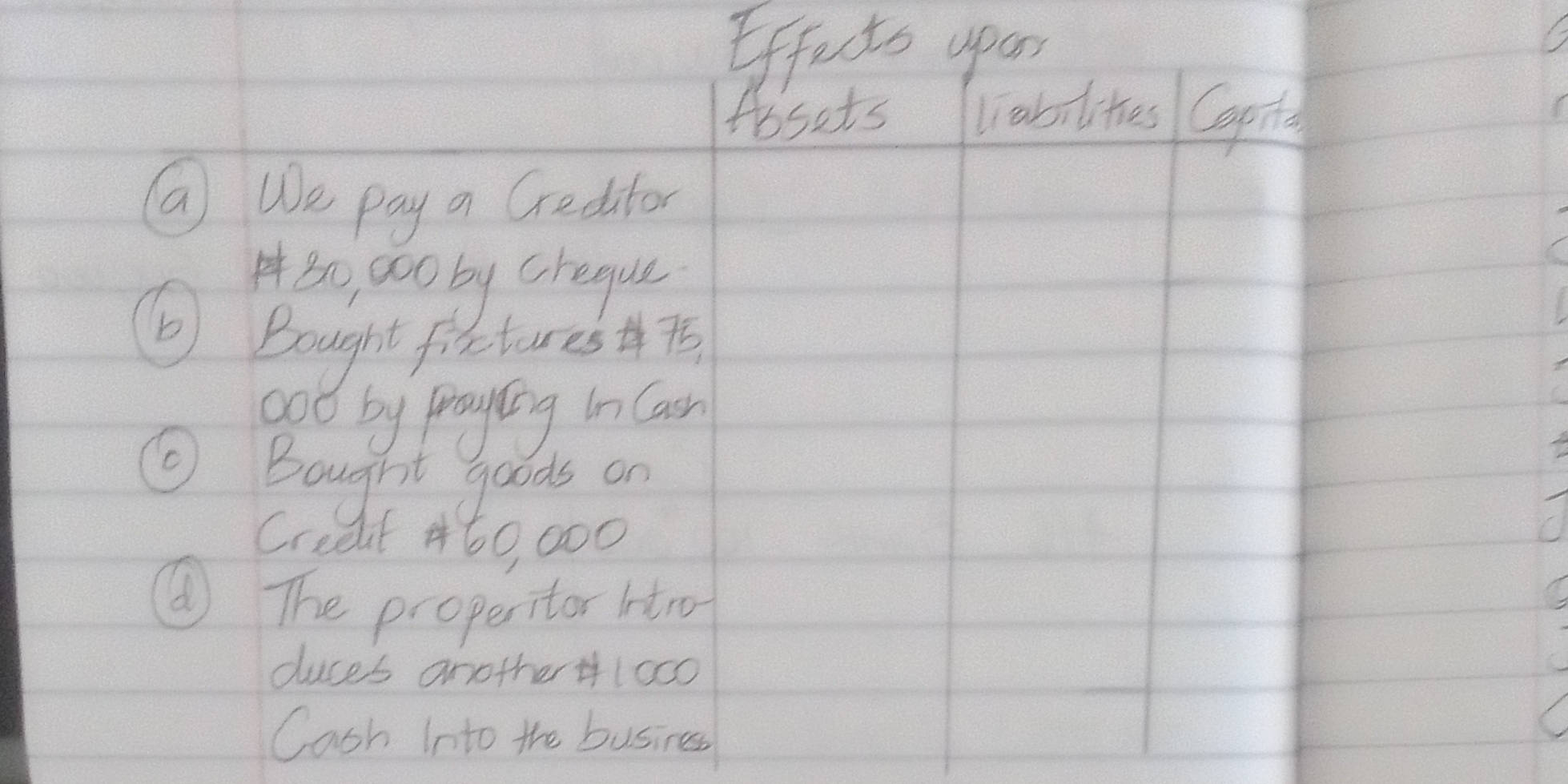

Analyze the effects of the following transactions on assets, liabilities, and capital: a) We pay a creditor ₦80,000 by cheque. b) Bought fixtures $75,000 paying in cash. c) Bought... Analyze the effects of the following transactions on assets, liabilities, and capital: a) We pay a creditor ₦80,000 by cheque. b) Bought fixtures $75,000 paying in cash. c) Bought goods on credit ₦60,000. d) The proprietor introduces another ₦1,000 cash into the business.

Understand the Problem

The image presents a series of accounting transactions. The task involves analyzing the effects of each transaction on the accounting equation (Assets = Liabilities + Capital). Specifically, for each transaction, we need to determine how it impacts assets, liabilities, and capital, and then fill in the provided table accordingly.

Answer

a) Assets decrease (₦80,000), Liabilities decrease (₦80,000); b) Assets increase ($75,000) and decrease ($75,000); c) Assets increase (₦60,000), Liabilities increase (₦60,000); d) Assets increase (₦1,000), Capital increase (₦1,000).

Here's an analysis of the effects of the transactions:

a) We pay a creditor ₦80,000 by cheque:

- Assets: Decrease in assets (bank) by ₦80,000.

- Liabilities: Decrease in liabilities (creditors) by ₦80,000.

- Capital: No effect.

b) Bought fixtures $75,000 paying in cash:

- Assets: Increase in assets (fixtures) by $75,000 and decrease in assets (cash) by $75,000.

- Liabilities: No effect.

- Capital: No effect.

c) Bought goods on credit ₦60,000:

- Assets: Increase in assets (inventory/stock) by ₦60,000.

- Liabilities: Increase in liabilities (creditors) by ₦60,000.

- Capital: No effect.

d) The proprietor introduces another ₦1,000 cash into the business:

- Assets: Increase in assets (cash) by ₦1,000.

- Liabilities: No effect.

- Capital: Increase in capital by ₦1,000.

Answer for screen readers

Here's an analysis of the effects of the transactions:

a) We pay a creditor ₦80,000 by cheque:

- Assets: Decrease in assets (bank) by ₦80,000.

- Liabilities: Decrease in liabilities (creditors) by ₦80,000.

- Capital: No effect.

b) Bought fixtures $75,000 paying in cash:

- Assets: Increase in assets (fixtures) by $75,000 and decrease in assets (cash) by $75,000.

- Liabilities: No effect.

- Capital: No effect.

c) Bought goods on credit ₦60,000:

- Assets: Increase in assets (inventory/stock) by ₦60,000.

- Liabilities: Increase in liabilities (creditors) by ₦60,000.

- Capital: No effect.

d) The proprietor introduces another ₦1,000 cash into the business:

- Assets: Increase in assets (cash) by ₦1,000.

- Liabilities: No effect.

- Capital: Increase in capital by ₦1,000.

More Information

The accounting equation (Assets = Liabilities + Equity) is the base for double entry accounting.

Tips

Ensure that the accounting equation always balances after each transaction. If an asset increases, either another asset decreases, or a liability or capital increases by the same amount.

Sources

- The Basic Accounting Equation | Financial Accounting - courses.lumenlearning.com

- Fixed-Asset Accounting Basics - NetSuite - netsuite.com

AI-generated content may contain errors. Please verify critical information