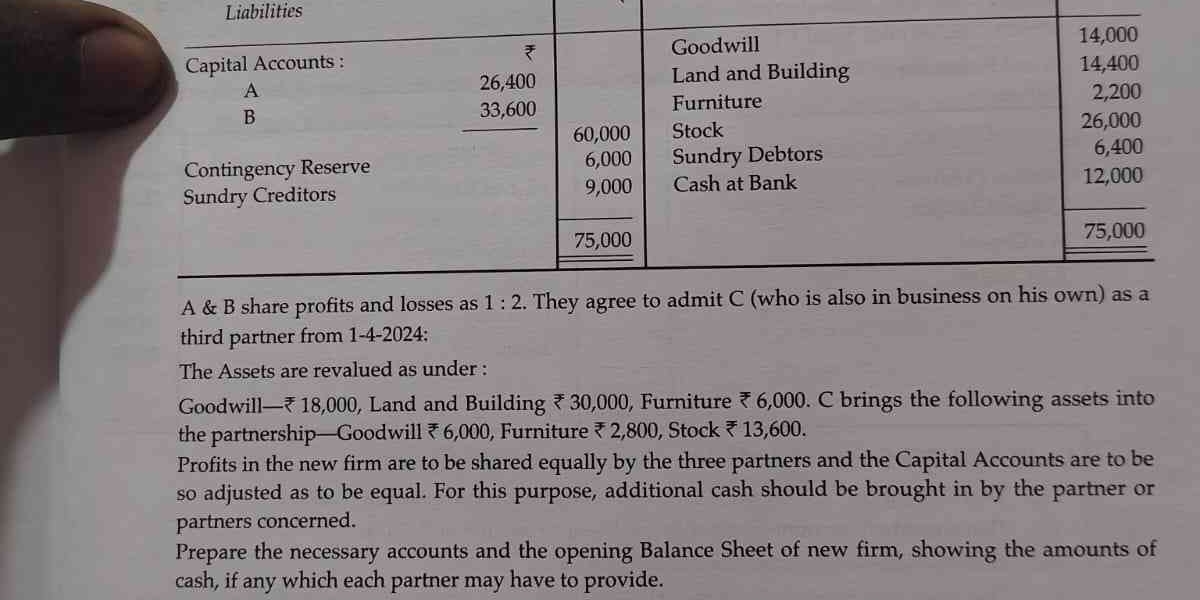

A & B share profits and losses as 1:2. They agree to admit C (who is also in business on his own) as a third partner from 1-4-2024. The Assets are revalued as under: Goodwill 18,00... A & B share profits and losses as 1:2. They agree to admit C (who is also in business on his own) as a third partner from 1-4-2024. The Assets are revalued as under: Goodwill 18,000, Land and Building 30,000, Furniture 6,000. C brings the following assets into the partnership - Goodwill 6,000, Furniture 2,800, Stock 13,600. Profits in the new firm are to be shared equally by the three partners and the Capital Accounts are to be so adjusted as to be equal. For this purpose, additional cash should be brought in by the partner or partners concerned. Prepare the necessary accounts and the opening Balance Sheet of new firm, showing the amounts of cash, if any which each partner may have to provide.

Understand the Problem

The question is related to partnership accounting. Two partners, A and B, share profits and losses in the ratio of 1:2. They admit C as a new partner with effect from April 1, 2024. The assets are revalued, and C brings in certain assets. The new profit-sharing ratio is equal among all three partners, and capital accounts are adjusted accordingly, potentially requiring additional cash infusions. The task is to prepare the necessary accounts and the opening balance sheet of the new firm, detailing the cash contributions of each partner.

Answer

A brings in ₹1,066.67, B withdraws ₹13,933.33, and C brings in ₹12,866.67. The Balance Sheet and Capital Accounts are reflected above.

Answer for screen readers

Revaluation Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| Goodwill | 4,000 | ||

| Land and Building | 15,600 | ||

| Furniture | 3,800 | ||

| To Partner's A/c | 7,800 | ||

| To Partner's B/c | 15,600 | ||

| Total | 31,200 | Total | 31,200 |

Partner's Capital Account

| Particulars | A (₹) | B (₹) | C (₹) | Particulars | A (₹) | B (₹) | C (₹) |

|---|---|---|---|---|---|---|---|

| To Cash A/c | 13,933.33 | By Balance b/d | 26,400 | 33,600 | |||

| To Balance c/d | 35,266.67 | 35,266.67 | 35,266.67 | By Revaluation A/c | 7,800 | 15,600 | |

| By Goodwill | 6,000 | ||||||

| By Furniture | 2,800 | ||||||

| By Stock | 13,600 | ||||||

| To Cash A/c | 1,066.67 | 12,866.67 | |||||

| Total | 36,333.34 | 49,200 | 48,133.34 | Total | 34,200 | 49,200 | 22,400 |

Balance Sheet as on April 1, 2024

| Liabilities | Amount (₹) | Assets | Amount (₹) |

|---|---|---|---|

| Capital Accounts: | Goodwill | 24,000 | |

| A | 35,266.67 | Land and Building | 30,000 |

| B | 35,266.67 | Furniture | 8,800 |

| C | 35,266.67 | Stock | 39,600 |

| Contingency Reserve | 6,000 | Sundry Debtors | 6,400 |

| Sundry Creditors | 9,000 | Cash at Bank | 12,000 |

| Total | 120,800 | Total | 120,800 |

Summary of Cash Brought In/Withdrawn:

A brings in: ₹1,066.67 B withdraws: ₹13,933.33 C brings in: ₹12,866.67

Steps to Solve

- Calculate the Revaluation Profit/Loss

First, we need to calculate the net effect of the asset revaluations. This involves comparing the original values with the revalued amounts.

Goodwill increased from ₹14,000 to ₹18,000: Increase of ₹4,000 Land and Building increased from ₹14,400 to ₹30,000: Increase of ₹15,600 Furniture increased from ₹2,200 to ₹6,000: Increase of ₹3,800

Total Revaluation Profit = $4,000 + 15,600 + 3,800 = ₹23,400$

- Distribute the Revaluation Profit to A and B

This profit is distributed between A and B in their old profit-sharing ratio, which is 1:2.

A's share = $\frac{1}{3} \times 23,400 = ₹7,800$ B's share = $\frac{2}{3} \times 23,400 = ₹15,600$

- Adjust Capital Accounts of A and B for Revaluation Profit

Add the revaluation profit to the existing capital balances of A and B.

A's adjusted capital = $26,400 + 7,800 = ₹34,200$ B's adjusted capital = $33,600 + 15,600 = ₹49,200$

- Calculate C's Capital Contribution

C brings in Goodwill ₹6,000, Furniture ₹2,800, and Stock ₹13,600. Her total capital contribution is the sum.

C's total contribution = $6,000 + 2,800 + 13,600 = ₹22,400$

- Calculate Total Capital of the New Firm

Sum the adjusted capital of A, B and C

Total capital = $34,200 + 49,200 + 22,400 = ₹105,800$

- Determine the New Capital Balance for Each Partner

The new profit-sharing ratio is equal, so each partner should have an equal share of the total capital.

Each partner's new capital = $\frac{105,800}{3} = ₹35,266.67$ (rounded to 2 decimal places)

- Calculate Cash to be Brought In or Withdrawn by Each Partner

Compare each partner's adjusted capital (including C's contribution) with their new capital balance.

A's cash adjustment = $35,266.67 - 34,200 = ₹1,066.67$ (A needs to bring in) B's cash adjustment = $35,266.67 - 49,200 = -₹13,933.33$ (B needs to withdraw) C's cash adjustment = $35,266.67 - 22,400 = ₹12,866.67$ (C needs to bring in)

- Prepare the Opening Balance Sheet

Assets: Cash at Bank: $12,000 + 1,066.67 + 12,866.67 - 13,933.33 = ₹12,000 + ₹6600.01 = ₹11,999.99$ (Approximated to ₹12,000) Goodwill: ₹18,000 + ₹6000 = ₹24,000 Land and Building: ₹30,000 Furniture: ₹6,000 + ₹2,800 = ₹8,800 Stock: ₹26,000 + ₹13,600 = ₹39,600 Sundry Debtors: ₹6,400

Liabilities: Sundry Creditors: ₹9,000 Contingency Reserve: ₹6,000 Capital: A: ₹35,266.67 B: ₹35,266.67 C: ₹35,266.67

Total Assets and Liabilities must match. It's essential to prepare the full balance sheet (which is provided in the answer).

Revaluation Account

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| Goodwill | 4,000 | ||

| Land and Building | 15,600 | ||

| Furniture | 3,800 | ||

| To Partner's A/c | 7,800 | ||

| To Partner's B/c | 15,600 | ||

| Total | 31,200 | Total | 31,200 |

Partner's Capital Account

| Particulars | A (₹) | B (₹) | C (₹) | Particulars | A (₹) | B (₹) | C (₹) |

|---|---|---|---|---|---|---|---|

| To Cash A/c | 13,933.33 | By Balance b/d | 26,400 | 33,600 | |||

| To Balance c/d | 35,266.67 | 35,266.67 | 35,266.67 | By Revaluation A/c | 7,800 | 15,600 | |

| By Goodwill | 6,000 | ||||||

| By Furniture | 2,800 | ||||||

| By Stock | 13,600 | ||||||

| To Cash A/c | 1,066.67 | 12,866.67 | |||||

| Total | 36,333.34 | 49,200 | 48,133.34 | Total | 34,200 | 49,200 | 22,400 |

Balance Sheet as on April 1, 2024

| Liabilities | Amount (₹) | Assets | Amount (₹) |

|---|---|---|---|

| Capital Accounts: | Goodwill | 24,000 | |

| A | 35,266.67 | Land and Building | 30,000 |

| B | 35,266.67 | Furniture | 8,800 |

| C | 35,266.67 | Stock | 39,600 |

| Contingency Reserve | 6,000 | Sundry Debtors | 6,400 |

| Sundry Creditors | 9,000 | Cash at Bank | 12,000 |

| Total | 120,800 | Total | 120,800 |

Summary of Cash Brought In/Withdrawn:

A brings in: ₹1,066.67 B withdraws: ₹13,933.33 C brings in: ₹12,866.67

More Information

The question involves the reconstitution of a partnership firm due to the admission of a new partner. This requires the revaluation of assets and liabilities, adjustment of capital accounts, and the preparation of a new balance sheet. The basic financial accounting principles are applied to solve this problem.

Tips

-

Incorrectly calculating and distributing revaluation profit/loss: Failing to correctly calculate the changes in asset values or distributing the profit/loss in the correct old ratio.

-

Forgetting to adjust capital accounts before calculating new capital balances: If revaluation or other adjustments such as unrecorded assets or liabilities are not correctly accounted for, the capital balances will be incorrect.

-

Miscalculating the amount of cash to be brought in or withdrawn: This often results from not correctly determining each partner's share of the total capital in the reconstituted firm.

-

Not balancing the final balance sheet: The total assets must equal the total liabilities plus capital.

AI-generated content may contain errors. Please verify critical information