Podcast

Questions and Answers

How does an increase in accounts receivable typically impact the cash flow statement, and under which section is this impact reported?

How does an increase in accounts receivable typically impact the cash flow statement, and under which section is this impact reported?

An increase in accounts receivable typically decreases cash flow from operating activities. This is reported in the operating activities section as an adjustment to net income.

Explain the difference in how the purchase of a building and the annual depreciation of that building are reflected in a company's financial statements.

Explain the difference in how the purchase of a building and the annual depreciation of that building are reflected in a company's financial statements.

The purchase of a building is a cash outflow reported in the investing activities section of the cash flow statement and increases the PPE on the balance sheet. Depreciation is a non-cash expense reported on the income statement, reducing net income.

If a company issues bonds at a premium, how does this transaction affect the cash flow statement and balance sheet?

If a company issues bonds at a premium, how does this transaction affect the cash flow statement and balance sheet?

Issuing bonds is recorded as a cash inflow in the financing activities section of the cash flow statement, and the bonds payable is recorded as a liability on the balance sheet.

Describe how an increase in inventory levels, without a corresponding increase in sales, affects a company's net income and cash flow from operations.

Describe how an increase in inventory levels, without a corresponding increase in sales, affects a company's net income and cash flow from operations.

What is the primary difference between Cost of Goods Sold (COGS) and Selling, General & Administrative Expenses (SG&A) in terms of their impact on a business?

What is the primary difference between Cost of Goods Sold (COGS) and Selling, General & Administrative Expenses (SG&A) in terms of their impact on a business?

How do dividends paid to stockholders affect the balance sheet and cash flow statement?

How do dividends paid to stockholders affect the balance sheet and cash flow statement?

Explain the accounting equation and its significance in maintaining the balance sheet's integrity.

Explain the accounting equation and its significance in maintaining the balance sheet's integrity.

Describe how the sale of a piece of equipment for cash at a price higher than its book value affects the income statement and the cash flow statement.

Describe how the sale of a piece of equipment for cash at a price higher than its book value affects the income statement and the cash flow statement.

What is the significance of 'accumulated depreciation' and where is it reported on the balance sheet?

What is the significance of 'accumulated depreciation' and where is it reported on the balance sheet?

Explain how 'deferred revenue' arises and on which financial statement does it appear?

Explain how 'deferred revenue' arises and on which financial statement does it appear?

How does the cash flow statement help in evaluating a company's solvency, beyond what the balance sheet and income statement provide?

How does the cash flow statement help in evaluating a company's solvency, beyond what the balance sheet and income statement provide?

Describe how the write-off of an uncollectible account receivable affects the income statement and balance sheet.

Describe how the write-off of an uncollectible account receivable affects the income statement and balance sheet.

Explain how the amortization of intangible assets impacts the income statement and balance sheet.

Explain how the amortization of intangible assets impacts the income statement and balance sheet.

How do stock-based compensation expenses impact the income statement and the cash flow statement?

How do stock-based compensation expenses impact the income statement and the cash flow statement?

What is the difference between direct and indirect methods of preparing the operating activities section of the cash flow statement?

What is the difference between direct and indirect methods of preparing the operating activities section of the cash flow statement?

How does issuing new common stock affect the balance sheet and cash flow statement?

How does issuing new common stock affect the balance sheet and cash flow statement?

What is the role of retained earnings on the balance sheet, and what factors can cause it to increase or decrease?

What is the role of retained earnings on the balance sheet, and what factors can cause it to increase or decrease?

Explain how a significant purchase of treasury stock (repurchasing company's own shares) affects the balance sheet and cash flow statement.

Explain how a significant purchase of treasury stock (repurchasing company's own shares) affects the balance sheet and cash flow statement.

How does recording depreciation expense impact a company's tax liability?

How does recording depreciation expense impact a company's tax liability?

If a company changes its inventory valuation method (e.g., from FIFO to weighted-average), how would this change potentially impact its financial statements?

If a company changes its inventory valuation method (e.g., from FIFO to weighted-average), how would this change potentially impact its financial statements?

Flashcards

What are Assets?

What are Assets?

Resources owned by a company, such as cash, accounts receivable, and equipment.

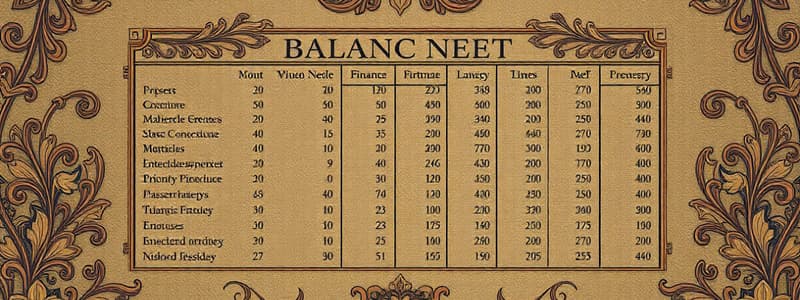

What is a Balance Sheet?

What is a Balance Sheet?

A report showing a company's assets, liabilities, and equity at a specific point in time.

What are Liabilities?

What are Liabilities?

Obligations of a company to external parties, such as accounts payable and loans.

What is Equity?

What is Equity?

Signup and view all the flashcards

What is Sales Revenue?

What is Sales Revenue?

Signup and view all the flashcards

What is COGS?

What is COGS?

Signup and view all the flashcards

What is an Income Statement?

What is an Income Statement?

Signup and view all the flashcards

What is SG&A?

What is SG&A?

Signup and view all the flashcards

What is Depreciation?

What is Depreciation?

Signup and view all the flashcards

What is Net Income?

What is Net Income?

Signup and view all the flashcards

What is a Cash Flow Statement?

What is a Cash Flow Statement?

Signup and view all the flashcards

What are Operating Activities?

What are Operating Activities?

Signup and view all the flashcards

What are Investing Activities?

What are Investing Activities?

Signup and view all the flashcards

What are Financing Activities?

What are Financing Activities?

Signup and view all the flashcards

What is Accumulated Depreciation?

What is Accumulated Depreciation?

Signup and view all the flashcards

What is Deferred Revenue?

What is Deferred Revenue?

Signup and view all the flashcards

What is Interest Revenue?

What is Interest Revenue?

Signup and view all the flashcards

What are Accrued Expenses?

What are Accrued Expenses?

Signup and view all the flashcards

Study Notes

- Financial statements provide insights into a company's financial performance and position.

- There are three key financial statements: the Balance Sheet, the Income Statement, and the Cash Flow Statement.

Balance Sheet (Statement of Financial Position)

- Shows a company's assets, liabilities, and equity at a specific point in time.

- The basic accounting equation is Assets = Liabilities + Equity.

Assets

- Represent the resources owned by the company.

- Assets are listed in order of liquidity

- Current assets include cash, accounts receivable (A/R), inventory, and prepaid expenses.

- Cash is a current asset and appears under "Cash & Cash Equivalents".

- Accounts Receivable (A/R) is a current asset listed under "Receivables".

- Inventory is a current asset shown under "Inventory".

- Prepaid Expenses are considered current assets.

- Non-current assets include property, plant, & equipment (PPE) and intangible assets.

- Property, Plant, & Equipment (PPE) is a non-current asset, also referred to as "Fixed Assets".

- Accumulated Depreciation is a contra-asset account that reduces the value of PPE.

- Intangible Assets are non-current assets reported as "Goodwill, Patents, Trademarks".

Liabilities

- Represent the obligations of the company to others.

- Current liabilities include accounts payable (A/P), accrued expenses, and short-term debt.

- Accounts Payable (A/P) is a current liability, found under "Payables".

- Accrued Expenses are a current liability, under "Accrued Liabilities".

- Short-term Debt is a current liability, shown under "Short-term Borrowings".

- Non-current liabilities include long-term debt.

- Long-term Debt is a non-current liability, appearing as "Loans & Bonds Payable".

- Deferred Revenue is a liability, under "Unearned Revenue".

Equity

- Represents the owner’s stake in the company.

- Equity includes common stock, retained earnings, and additional paid-in capital (APIC).

- Common Stock is equity, under "Share Capital".

- Retained Earnings, which shows accumulated profits, is also equity.

- Dividends Payable is a liability until paid out to shareholders.

- Additional Paid-in Capital (APIC) is equity, under "Capital Surplus".

Income Statement (Profit & Loss Statement)

- Reports a company's financial performance over a period of time.

- Key components include revenue, expenses, and net income.

Revenue

- Represents income earned from operations.

- Sales Revenue is the top-line revenue, listed under "Operating Revenue".

- Service Revenue, revenue from services, is under "Operating Revenue".

- Interest Revenue is non-operating income, under "Other Income".

Expenses

- Costs incurred in operations.

- Cost of Goods Sold (COGS) is a direct cost that reduces gross profit.

- Selling, General & Administrative Expenses (SG&A) are operating expenses, including salaries, rent, and marketing.

- Depreciation & Amortization are non-cash expenses, under "Operating Expenses."

- Interest Expense is a finance cost, under "Other Expenses".

- Tax Expense is a liability, under "Income Tax Expense".

Net Income Calculation

- The formula is Revenue - COGS = Gross Profit.

- Gross Profit - Operating Expenses = Operating Income.

- Operating Income - Interest & Tax = Net Income.

Cash Flow Statement

- Summarizes the movement of cash both into and out of a company.

- Divided into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

- Relate to the day-to-day business operations.

- Begins with Net Income from the Income Statement.

- Depreciation & Amortization are added back as they are non-cash expenses.

- Changes in Working Capital, like A/R, A/P, and Inventory, are adjusted.

Investing Activities

- Involve the purchase and sale of long-term investments and assets.

- Purchase of PPE is an outflow.

- Sale of Assets like Land or Equipment is an inflow.

- Acquisition of Other Businesses is an outflow.

Financing Activities

- Relate to raising or repaying capital.

- Issuance of Stock represents an inflow of cash.

- Borrowing through Loans & Bonds Issued is an inflow.

- Repayment of Debt is an outflow.

- Dividend Payments represent an outflow of cash.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.