Podcast

Questions and Answers

Short-term liabilities are obligations that can be settled within two years.

Short-term liabilities are obligations that can be settled within two years.

False (B)

Long-term liabilities include items like accounts payable and wages owed.

Long-term liabilities include items like accounts payable and wages owed.

False (B)

The quick ratio measures a company's ability to meet immediate financial demands using only fixed assets.

The quick ratio measures a company's ability to meet immediate financial demands using only fixed assets.

False (B)

The debt-to-equity ratio compares total liabilities to shareholders' equity to determine reliance on borrowed funds.

The debt-to-equity ratio compares total liabilities to shareholders' equity to determine reliance on borrowed funds.

Positive working capital occurs when current assets exceed current liabilities.

Positive working capital occurs when current assets exceed current liabilities.

Maintaining healthy levels of working capital ensures companies can manage growth strategically and survive demand fluctuations.

Maintaining healthy levels of working capital ensures companies can manage growth strategically and survive demand fluctuations.

Intangible assets are physical items owned by a business.

Intangible assets are physical items owned by a business.

Current assets can include inventory and accounts receivable.

Current assets can include inventory and accounts receivable.

Long-term assets are typically convertible into cash within one year.

Long-term assets are typically convertible into cash within one year.

Working capital is calculated by subtracting current liabilities from current assets.

Working capital is calculated by subtracting current liabilities from current assets.

Financial ratios are not derived from information on the balance sheet.

Financial ratios are not derived from information on the balance sheet.

Assets on a balance sheet represent items that hold value but cannot generate future cash flows.

Assets on a balance sheet represent items that hold value but cannot generate future cash flows.

Flashcards are hidden until you start studying

Study Notes

Understanding Balance Sheets: Assets, Liabilities, Ratios, and Working Capital

A balance sheet is a financial statement that provides a snapshot of a company's current financial position at a specific moment in time. At its core, it lists two primary categories — assets and liabilities. In this article, we will dive into these essential components, along with their interplay through financial ratios and working capital concepts.

Assets

Assets represent items or resources owned by a business that hold value or can generate future cash flows. They fall under three broad classifications:

- Current assets: These are typically convertible into cash within one year and include accounts receivable, inventory, cash, and marketable securities.

Example: A supermarket's inventory of fresh fruits and vegetables is classified as a current asset since they could sell them quickly.

- Long-term assets: Longer-lasting tangible assets like buildings, equipment, machinery, vehicles, etc., known collectively as property, plant & equipment (PP&E), are included here.

Example: An airline's fleet of commercial aircraft falls under PP&E.

- Intangible assets: Intangibles do not have physical existence yet offer economic benefits such as patents, trademarks, copyrights, goodwill, and inventory purchased below cost.

Example: Disney's valuable intellectual properties, including its iconic characters Mickey Mouse and Snow White, would appear as intangible assets on its balance sheet.

Liabilities

Liabilities present obligations arising from past events, whereby a firm must transfer goods or services, money, or other assets to others. They also come in several forms:

- Short-term liabilities: Debts payable within one year, such as accounts payable, wages owed, taxes payable, unearned revenue, etc., comprise short-term liabilities.

Example: A retail clothing store's outstanding invoices presented by suppliers constitute accounts payable.

- Long-term liabilities: Obligations extending beyond one year, including notes payable, bonds payable, deferred revenues, leases, pension obligations, etc..

Example: An automobile manufacturer's bond debt issued to raise funds toward new production lines qualifies as long-term liability.

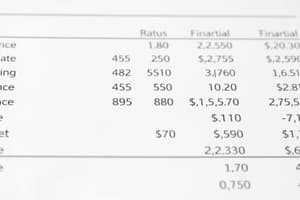

Financial Ratios

By examining the relationship between various elements found on the balance sheet, analysts calculate financial ratios to gauge overall health, solvency, profitability, efficiency, liquidity, and leverage. Some common ones include:

-

Quick ratio (acid test): This measures a company's ability to meet immediate financial demands using only highly liquid current assets.

-

Debt-to-equity ratio: This compares total liabilities to shareholders' equity to determine whether a firm relies more heavily on borrowed funds rather than retained earnings.

Working Capital

Working capital serves as the lifeblood of many enterprises because it represents the net amount available to fund daily operations and growth while meeting short-term commitments. It encompasses the difference between current assets and current liabilities. When current assets exceed current liabilities, there is positive working capital; when current liabilities surpass current assets, the situation becomes negative:

Accordingly, maintaining healthy levels of working capital and managing finances effectively ensures companies can handle day-to-day transactions efficiently, manage growth strategically, and remain financially stable during fluctuations in demand or unforeseen circumstances.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.