Podcast

Questions and Answers

What is the purpose of an Income Statement in financial reporting?

What is the purpose of an Income Statement in financial reporting?

To display a company's revenues, expenses, gains, losses, and net income over a specific time period.

How is profit calculated on an Income Statement?

How is profit calculated on an Income Statement?

By deducting total expenses from total revenues.

What does the term 'operating income' refer to?

What does the term 'operating income' refer to?

The profit calculated before taxes, interest payments, etc.

Why are financial statements considered transparent windows into a company's performance?

Why are financial statements considered transparent windows into a company's performance?

Can you name the four primary reports that make up financial statements?

Can you name the four primary reports that make up financial statements?

What does a balance sheet represent for a company?

What does a balance sheet represent for a company?

How does a balance sheet ensure its accuracy?

How does a balance sheet ensure its accuracy?

What insights can be gained from a statement of cash flows?

What insights can be gained from a statement of cash flows?

What purpose do the notes to financial statements serve?

What purpose do the notes to financial statements serve?

How do financial statements collectively help in drawing conclusions about a company?

How do financial statements collectively help in drawing conclusions about a company?

Flashcards are hidden until you start studying

Study Notes

Understanding Accounting Through Financial Statements

Accounting is a crucial discipline within business management, providing organizations with tools to record, analyze, interpret, and communicate their economic activities. At its core lies the preparation of financial statements, which serve as transparent windows into the health and performance of companies. In this exploration of accounting through financial statements, we'll dive deeper into these fundamental documents that you're likely to encounter in your professional or personal life.

Financial statements consist of four primary reports, each presenting information vital to understanding the company's current state and historical trends:

-

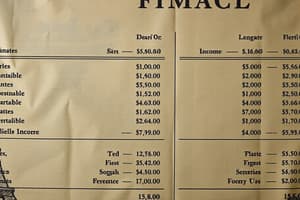

Income Statement: Also known as the profit & loss statement, it displays a company's revenues, expenses, gains, losses, and net income over a specific time period. This report offers insight into how well the organization generates revenue from its operations and manages costs, leading to earnings either increasing or decreasing.

For example, suppose Company XYZ reported $5 million in sales during Q4 while having total operating expenses of $4.8 million; its profit would be calculated by deducting the latter from the former ($5M -$4.8M = $200K), resulting in a quarterly profit before taxes, interest payments, etc., often referred to as operating income.

-

Balance Sheet: Often called the statement of financial position, it lists assets, liabilities, and equity holders' investments, providing a snapshot of what the company owns and owes at a certain point in time. A balance sheet must always balance—its total assets equal the sum of its total liabilities plus stockholders’ equity.

To illustrate, let's consider ABC Corporation's Balance Sheet on December 31st. If they have cash worth $1 million, accounts receivable valued at $300k, inventory totaling $700k, buildings worth $1.5M, and accounts payable amounting to $250k, their total assets would be $2.95M. On the downside, they owe suppliers $50k, employees' wages $100k, a bank loan $800k, and shareholder funds $1M. Adding all these values results in total liabilities and equity of $2.85M, ultimately balancing the ledger.

-

Statement of Cash Flows: This document highlights the movement of cash throughout a firm's operations, investment decisions, and financing activities. It provides insights into when cash inflows occur versus outflows, enabling users to assess whether the company has sufficient liquidity to cover short-term obligations. For instance, if Company Y generated $1.2M in cash flows from operating activities, invested $0.8M in property and equipment, and paid $0.4M in dividends, the overall change in cash was $(-0.4) M, indicating a decrease in cash reserves.

-

Notes to Financial Statements: These additional disclosures offer readers more contextualized data, explaining complex transactions and events not directly presented elsewhere in the financial reporting package. Notes may also address accounting choices, such as methods used for depreciating fixed assets or measuring inventory.

By analyzing these financial statements jointly, one can draw conclusions about several financial ratios related to liquidity, solvency, profitability, operational efficiency, and other critical aspects influencing a company's profit potential, creditworthiness, and risk profile. As an informed reader, you'll come away better apprised of market forces affecting businesses like yours and make wiser, more informed decisions based upon your newfound knowledge!

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.