Podcast

Questions and Answers

How does a business contribute to variety and efficient production?

How does a business contribute to variety and efficient production?

By offering a range of finished products when consumers go shopping.

What is the difference between revenue and profit for a business?

What is the difference between revenue and profit for a business?

Revenue is the money a business receives from sales, while profit is what remains after deducting all costs and expenses from the revenue.

How does innovation driven by competition benefit businesses?

How does innovation driven by competition benefit businesses?

It allows enterprises to gain a competitive advantage by introducing new and improved products or ways of doing things.

Outline two ways a business contributes to wealth creation in a society.

Outline two ways a business contributes to wealth creation in a society.

Name two qualitative measures that can be used to classify a business.

Name two qualitative measures that can be used to classify a business.

The owner of a sole trader dies, what happens to the business?

The owner of a sole trader dies, what happens to the business?

What are two advantages of a private company legal structure?

What are two advantages of a private company legal structure?

What are two disadvantages of a government enterprise?

What are two disadvantages of a government enterprise?

How does business expansion influence a business's financing needs?

How does business expansion influence a business's financing needs?

In terms of its outputs, what are three ways a change in the business environment can impact a business?

In terms of its outputs, what are three ways a change in the business environment can impact a business?

Explain how economic conditions during peaks or booms influence business decisions.

Explain how economic conditions during peaks or booms influence business decisions.

How has deregulation impacted the financial industry in Australia?

How has deregulation impacted the financial industry in Australia?

What are two demographic changes that impact business activity?

What are two demographic changes that impact business activity?

How do ethical influences impact business operations?

How do ethical influences impact business operations?

How do legal influences affect diverse business functions?

How do legal influences affect diverse business functions?

What are two ways the government can impact businesses through their stance?

What are two ways the government can impact businesses through their stance?

Give two examples of regulatory institutions that implement government policy.

Give two examples of regulatory institutions that implement government policy.

In what two ways, can technology benefit businesses?

In what two ways, can technology benefit businesses?

What challenge could arise from technological implementation in a company?

What challenge could arise from technological implementation in a company?

Give one benefit and one challenge of having foreign competitors as a business?

Give one benefit and one challenge of having foreign competitors as a business?

What are the four stages of the business life cycle?

What are the four stages of the business life cycle?

What are two difficulties a business can face during the decline stage?

What are two difficulties a business can face during the decline stage?

What impact can poor location have on a business?

What impact can poor location have on a business?

What process does a voluntary cessation follow?

What process does a voluntary cessation follow?

What reasons would require the company to deregister?

What reasons would require the company to deregister?

Flashcards

What is a business?

What is a business?

An organised effort to produce and sell goods and services for profit.

What is production?

What is production?

Activities undertaken by businesses that combine resources to create a product.

What are goods?

What are goods?

Items that are tangible (you can touch them).

What are services?

What are services?

Signup and view all the flashcards

What is revenue?

What is revenue?

Signup and view all the flashcards

What is Profit?

What is Profit?

Signup and view all the flashcards

What is Income?

What is Income?

Signup and view all the flashcards

What is innovation?

What is innovation?

Signup and view all the flashcards

Who is an entrepreneur?

Who is an entrepreneur?

Signup and view all the flashcards

Wealth Creation

Wealth Creation

Signup and view all the flashcards

What are SME's?

What are SME's?

Signup and view all the flashcards

What is a small business?

What is a small business?

Signup and view all the flashcards

What is a medium business?

What is a medium business?

Signup and view all the flashcards

What is a large business?

What is a large business?

Signup and view all the flashcards

What is a Local Business?

What is a Local Business?

Signup and view all the flashcards

What is a National Business?

What is a National Business?

Signup and view all the flashcards

What is a Global Business?

What is a Global Business?

Signup and view all the flashcards

What is the primary industry?

What is the primary industry?

Signup and view all the flashcards

What is the secondary industry?

What is the secondary industry?

Signup and view all the flashcards

What is the tertiary industry?

What is the tertiary industry?

Signup and view all the flashcards

What is the quaternary industry?

What is the quaternary industry?

Signup and view all the flashcards

What is the quinary industry?

What is the quinary industry?

Signup and view all the flashcards

What is an Unincorporated Business?

What is an Unincorporated Business?

Signup and view all the flashcards

What is a Sole Trader?

What is a Sole Trader?

Signup and view all the flashcards

What is a Partnership?

What is a Partnership?

Signup and view all the flashcards

Study Notes

The Nature of a Business

- The focus is on the role and nature of businesses in a changing environment.

- The student should be able to discuss the nature of business, its role in society, and types of business structures.

- The student should be able to explain the internal and external influences on businesses.

- The student should be able to analyse the responsibilities of businesses to internal and external stakeholders.

- The student should be able to plan and conduct investigations into contemporary business issues.

- The student should be able to evaluate information for actual and hypothetical business situations.

- Students learn by examining contemporary business issues to:

- Discuss the global expansion of Australian and international businesses.

- Explain how external influences have contributed to industry growth in Australia.

- Identify problems arising for stakeholders when companies liquidate.

- By Using hypothetical situations and case studies students learn to:

- Distinguish between types of businesses.

- Identify businesses at different life cycle stages.

- Outline appropriate business strategies for different life cycle stages.

Role of Business

- The nature of a business involves producing goods and services for profit.

- Businesses contribute both variety and efficient production to satisfy consumer needs.

- Production combines resources to create a product.

- Goods are tangible items, while services are performed for consumers.

- Businesses contribute to society by providing profit, employment, incomes, choice, innovation, entrepreneurship, and wealth creation.

Profit

- Profit is what remains after all business costs and expenses have been deducted from sales revenue.

- Revenue is the money a business receives as payment for its products.

Employment

- Businesses benefit their employees as well as their owners.

- Large businesses employ thousands of people.

- SMEs account for approximately 68% of all private (non-government) sector employment in Australia, employing approximately 8 million people.

- Employment levels are impacted by the size and type of business, industry, profitability, wages, legislation, and the economy.

Income

- Income is the money received for providing labor or from a return on investments.

- Businesses can provide income through salary, wages, commission, profit, dividends, and fringe benefits.

Innovation

- Innovation happens through a new and improved product or way of doing things.

- Competition drives innovation for a competitive advantage.

Entrepreneurship

- A person who starts, owns, and assumes the risk of a business in the hopes of generating a profit is an entrepreneur.

Wealth Creation

- Businesses allow an increase in wealth for individuals through investment opportunities like purchasing shares.

- Businesses increase society's wealth by paying tax on profits.

- The government uses this tax revenue to provide public goods like roads, schools, and hospitals, thereby improving society’s quality of life.

Types of Businesses

- The classification of business size can be small to medium enterprises (SMEs) or large.

Quantitative Measures

- Number of employees is a quantitative measure where:

- Small businesses have under 20 employees.

- Medium businesses have 20 - 199 employees.

- Large businesses have 200 or more employees.

- Other Quantitative Measures are number of owners, market share, revenue and profits.

Qualitative Measures

- Decision-making process is a qualitative measure.

- Small businesses have faster decision-making because the owner and manager are usually the same person.

- Large businesses have slower decision-making processes due to more people being involved and lots of paperwork.

- Source of finance:

- Small Businesses - Capital usually comes from owner/s.

- Large Businesses - Listed on the ASX.

- Influence on the industry:

- Large Businesses- Hold the power to set trends in the industry.

- Scope of business operation:

- Local, regional, national or global.

- Local businesses have a restricted geographical spread and serve only the surrounding area.

- National businesses operate across one country in multiple states.

- Global businesses operate in multiple countries.

- Industry classifications: primary, secondary, tertiary, quaternary, quinary

Primary

- Collection of natural resources like farming, mining, and fishing.

Secondary

- Processing materials into finished or semi-finished products like manufacturing and construction.

Tertiary

- Services such as retail and dentistry.

- Splits into quaternary and quinary.

Quaternary

- Services that generate, transfer, or process information like teaching, financial services, and journalism.

Quinary

- Services traditionally performed at home like hospitality, childcare, and tourism.

Legal Structure

- Sole trader, partnership, private company, public company or government enterprise.

Unincorporated Business

- Has no separate legal existence from its owner/s.

- It will be either a sole trader or a partnership, meaning the business entity and owners are the same.

- When the owner dies so does the business entity.

- The owner has unlimited liability.

Incorporated Business

- A separate legal entity from the owner/s and exists in its own right.

- Happens regardless of what happens to individual owners (shareholders) of the company, the business continues to operate.

Sole Trader

- A business that is owned and operated by one person.

- Advantages: taxed on personal income, one person makes all the decisions, low cost of entry, no partner disputes, less government regulation and the simplest form.

- Disadvantages: unlimited liability, provides all the finances, end of the business when the owner dies, difficult to operate if sick, burden of management and owner needs to provide a wide variety of tasks.

Partnership

- Owned and operated between 2 and 20 people.

- Advantages: low start-up costs, less costly to operate than a company, shared responsibility and work, pooled funds and talent, minimal government regulation, only personal income is taxed, can keep going on the death of a partner.

- Disadvantages: person unlimited liability, liability for all debts, the possibility of disputes, difficulty to find a suitable partner, and divided loyalty and authority.

Private Company

- Shares are not offered to the public for sale and operate under much less strict legal requirements trading as Pty Ltd.

- Advantages: limited liability, raising capital, perpetual succession, BOD must approve shares- more control and credibility.

- Disadvantages: increased legal restrictions and government regulation, higher taxes, and less ownership.

Public Company

- Sells a share of their stocks to the public by listing it on the ASX trading as Ltd.

- Advantages: limited liability, raising capital, unlimited number of owners, perpetual succession and credibility.

- Disadvantages: increased legal restrictions and government regulation, no say in who invests, higher taxes and less ownership.

Government Enterprise

- Government-owned and operated (GBEs) AKA public sector business.

- Advantages: direct subsidies, regulatory advantages, favourable taxation, borrowing arrangements and stability and safety.

- Disadvantages: political influence, bureaucratic influence, limited profit margin, public scrutiny and lack of agility and efficiency.

Factors Influencing Legal Structure

- Size, ownership, and finance considerations are factors to consider.

- Size: Small business often start as sole trader. Growth and expansion requires the protection of limited liability, requiring a private company legal structure.

- Ownership: Sole traders have complete control and ownership, whereas partnerships allow ownership sharing.

- Finance: Business expansion necessitates financial injections by injections for equipment, research, staff, market expansion, and new outlets. Venture capital, which invests in small businesses with potential for success, can be a potential source of finance

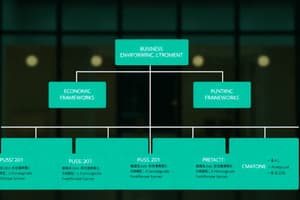

Influences in the Business Environment

- Businesses don't operate in isolation & operate within a context of influences and factors known as the business environment.

- Any change in these influences will impact businesses in terms of outputs, processes, and success of business goals.

- An influence is a factor either inside or outside of the business that will impact the way the business processes function and/or their outcomes.

Examples of Influences

- Legal, Economic, Government, Social, Ethical & Technological are all influences.

- Legal (laws that businesses must follow)

- Economic (changes in the level of economic activity i.e. stage of business cycle)

- Government (impact of policies & regulations of the government and their institutions)

- Social (changes in societal expectations & demographics)

- Ethical (applying moral standards to business activities & decisions)

- Technological (changes in the level of machinery, equipment etc. used by businesses and their competitors)

Impacts of Influences

- Cost, Variability & Risk, Interactions with shareholders & Expectations of shareholders are all impacts.

- Types of outputs, level of sales and profits earned, the way the work is conducted are all also impacts.

- Influences set the parameters of business functions & activities.

- Influences depend on what is permissible from a legal/government point of view and what is acceptable business conduct from an ethical point of view.

External Influences

- Economic, Financial, Geographic, Social, Legal, Political, Institutional, Technological, competitive situation, markets.

- Economic: Relate to the stage of the business cycle i.e. the cyclical movements in consumer and business spending

Economic Stages

- Peaks/ Booms: Represent periods of high employment, confidence and spending.

- Businesses increase production and have higher sales and profits, but face stock shortages and rising wage costs.

- Troughs/ Recessions: Periods of low employment, confidence, and spending.

- Businesses reduce production and have lower sales, profits and stock surpluses, but may benefit from reduced labour costs.

- Economic Influences impact:

- Production levels

- Stock levels

- Employment levels and their level of remuneration

- Sales and profit levels

Financial Influence

- Global Financial Market Changes and Australia's Deregulation have made financial markets more global. Australia's financial system deregulation began in 1983, leading to a flexible, market-oriented approach.

- Debt Finance and Interest Rates influence business decisions. Interest rates in Australia fell to record lows in 2019-20.

Geographic Influences

- Geographic influences refer to the effects the climate, natural resources, topography, physical infrastructure and location have on a business.

- Australia's geographical location impacts business significantly. These factors present opportunities for business expansion, sales, and profit.

Demographic Factors

- Influences include changes in population size, age, sex, income, cultural background, and family size.

- The ageing Australian population causes skill shortages and increased demand for age-related services.

Social Influences

- Relate to changes in the culture, demographics, values, and ideals applicable to Australian society

- These influences may relate to changes in the age, gender, education levels, and ethnic background of the population.

- This will impact businesses in relation to The products they demand and are willing to buy , the price they are willing to pay for products and how they buy products, and the level of service expected

Ethical Influences

- Ethical points are Ethics relate to the standards of behaviour or a moral composition.

- They involve more than legal compliance

- Stakeholders expect businesses to consider the Environmental, Social, and financial impacts of their decisions.

Regulations for stakeholders

- Treat all people fairly, be transparent in decision-making and be open, honest and timely communication with stakeholders.

Legal Influences

- Laws regulate behaviour to protect the interests of stakeholders and define what is permissible and set the MINIMUM standards with which the business must comply.

Examples of Legal Influence

- Employees are required to ensure a safe working environment and prevent exploitation

- Consumers i.e. full disclosure of terms and conditions, inputs and costs and protection from unsafe products

- Society i.e. protection of the environment through sustainable business practices

Legal Impact

- Workplace Health and Safety Act (2011), Competition and Consumer Act (2010), Corporations Act (2001), Environment Protection and Biodiversity Conservation Act (1999) and Local Government Act (1993) influence all key business functions Businesses must comply with legal influences or face: Prosecution and fines lawsuits and Loss of Reputation

Political/ Government Influence

- Government policies often depend on the political party in favour and their beliefs and agendas Therefore, Fiscal and Monetary Policy are impacted:

Fiscal Policy (macro)

- The spending and taxation decisions in the annual federal budget have an impact on spending in the economy.

- Potential tax incentives from nominated courses of action.

Monetary Policy (macro)

- Government-Altering of the official cash rate by the RBA has impacted spending in the economy.

- Government Impact on the cost of borrowing/ the type of finance used

Government Stance

- Environmental issues and Labour market regulations depend on the government’s stance.

- Deregulation and competition

- Free trade and protection

- These policies give an incentive to act in a certain way by impacting costs

Government Policies Can Imapct

- Demand for their products, the relative cost of finance (via interest rates), employee rights and entitlements and levels of competition in markets Regulations they must comply with

Key Regulatory Institutions That Implement Government Policy

- The Australian Tax Office (ATO)

- The Australian Competition and Consumer Commission (ACCC)

- Australian Securities and Investment Commission (ASIC)

- The Environment Protection Agency (ΕΡΑ)

- The Fair Work Commission (FWC) These bodies enforce legislation to protect stakeholders such as investors, consumers & employees

Institutional Influences

- Local Government Obligations: Control over business activities such as new development, fire regulations, parking regulations, and size, location, and shape of business signs.

- State Government Obligations: Provide employee entitlements, Pay payroll taxes, Adhere to relevant state legislation for pollution controls.

- Federal Government Obligations: Pay taxes for employees and businesses with company tax and GST & provide superannuation.

- All level os Government has regulatory bodies that monitor and review the actions of businesses and consumers

Regulation Example

- NSW Environment Protection Authority (EPA)- Primary environmental regulator for NSW.

- NSW Fair Trading: Consumer protection agency.

- Australian Securities and Investments Commission (ASIC): Monitors market integrity and provides consumer protection.

- Australian Competition and Consumer Commission (ACCC): An independent statutory authority that administers the Competition and Consumer Act 2010. Other Institutional Influences:

Technical Influence

- Relate to the changes in the level of machinery, equipment and processes used to manage the business or produce their outputs such as the type of inputs, the production methods or How goods are sold and delivered to consumers

- Technology influence Can Increase efficiency and productivity

- Technology influence Has a High cost of implementation and can cause staffing issues Business and management A competitive advantage is a point of difference from competitors that attracts customers

Market Influence

- Refers to the number and size of businesses in an industry and the market of concentration is the four main types such as perfect competition, monopolistic competition, oligopoly, and monopoly.

Local influence

- Local competitors Face similar costs and economic conditions, whereas Foreign competitors Compete in local markets but face additional challenges.

Market Influence

- Changes in Financial/Capital Markets: Capital is now highly mobile across countries, especially since the 1970s when foreign exchange controls were eased. investment now flows to countries with favourable opportunities and returns.

- Changes in Labour Markets: The labour market has become less global over the past 60 years due to political barriers and restrictions

- Changes in Consumer Markets: New consumer markets are emerging in developing countries like China and India.

Internal Influence

- Products, location, resources, management and business culture are internal influence factors inside of the business that will impact how the business operates and the likelihood of success and the accessibility, quality and quantity of the financial input and staff resources available to the business.

Stakeholder

- A stakeholder is any group or individual who has an interest in or is affected by the activities of a business.

Business Performance

- Include Owners/shareholders, society/general public, employees, customers, environment and managers and is important because business performance and conduct will affect the reputation of all stakeholders

Responsibilities

- Companies have a duty to hold an annual general meeting (AGM), where shareholders ask questions of the BOD. Companies need to ensure that they maximise returns on their shareholder's investments.

Environment

- Brands working together to increase customer reach and new markets Companies have environmental, social, and governance (ESG) are essential factors in measuring the sustainability, ethics, and social impact of a business/company

Growth

- Requires long-term planning where advertising is important during both establishment and growth

Failure

Establishment

- Limited customer awareness and response through marketing through personal selling. High costs and develop a financial plan.

Growth

- Providing the quantity and quality of products required, shortage of skilled labour and response.

Maturity

Renewal Factors that can contribute to business decline are:

- Failure to meet business needs and a lack of demand for the product

- Failure to plan

- Lack of management skills Poor location

- III-conceived business ideas

Financial Situation

- Poor location and a lack of adequate cash flow

Voluntary and Involuntary Cessation

- Voluntary Cessation is when the owner ceases to operate the business of their own accord with Debts increasing and negative cashflow

Voluntary Administration

- When an independent administrator is appointed to operate the business in the hope of trading out of present financial problems if they are a SME.

Requirements To Deregister

- All members (shareholders) of the company agree to deregister the company if the company is not carrying on business has less than $1000 and no outstanding liabilities.

Management

- In the business environment this includes responsibility to assess the processes and interdependence of key business functions and applying management theories and strategies.

Management Strategies

- Stakeholder strategy requires reconciling the conflicting interests of stakeholders

Management Styles

Effective management factors:

- Interpersonal

- Communication.

- Strategic thinking

- Vision

- Problem-solving

- Decision-making

Management Requirements

- Flexibility

- Adaptability to change.

- Achieving business goals such as profits, market share, growth, share price, social, environmental

Management Approaches

- Classical approach as managing, planning, organising and controlling

- Hierarchical organisational structure and autocratic leadership style.

- Behavioural Approach as managing, leading, motivating, communicating

- Team involvement

Managing Objectives.

- Achieve objectives through - Staff involvement innovation, motivation, mentoring, training

Management Process

Coordinating key business functions and resources like

- Operations- includes goods and/or services, the production process and quality management

- Marketing-includes identification of the target market and marketing mix

- Finance- includes cash flow statement, income statement and balance sheet

- Human resources includes recruitment, training and labour contracts.

Business Planning

- Is the processes of establishing and planning a small to medium enterprise and assessing the effect of two changes in the business environment on SMEs

Business Creation

Factors that can influence Small to medium enterprise creation

- personal qualities – qualifications, skills, motivation, entrepreneurship, cultural background, gender

- Sources of information: sources, the business idea – competition, establishment options – new, existing, franchise, market – goods and/or services, price, location

- Finance – source, cost, legal - business name, zoning, health and other regulations, human resources skills/costs and taxation – federal and state taxes, local rates and charges

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.