Podcast

Questions and Answers

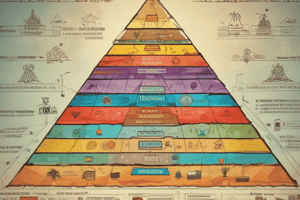

What is the first phase of the risk pyramid in transaction monitoring?

What is the first phase of the risk pyramid in transaction monitoring?

- Mitigation

- Customer Selection

- Assessment

- Identification (correct)

In transaction monitoring, what does 'identification' primarily refer to?

In transaction monitoring, what does 'identification' primarily refer to?

- Identifying unusual or suspicious transactions (correct)

- Setting up business rules

- Researching and testing framework

- Selecting customers for investigation

What triggers the system to signal that a cash transaction is above a certain threshold value?

What triggers the system to signal that a cash transaction is above a certain threshold value?

- Cash withdrawal or deposit (correct)

- Tax havens transfer

- Currency exchange

- High-risk countries transaction

How does the system recognize when to trigger an investigation in transaction monitoring?

How does the system recognize when to trigger an investigation in transaction monitoring?

What is the purpose of the assessment phase in the risk pyramid of transaction monitoring?

What is the purpose of the assessment phase in the risk pyramid of transaction monitoring?

How are investigations for unusual or suspicious transactions typically assessed in transaction monitoring?

How are investigations for unusual or suspicious transactions typically assessed in transaction monitoring?

What is the role of the Financial Intelligence Unit?

What is the role of the Financial Intelligence Unit?

What happens if there is a delay in reporting an unusual transaction?

What happens if there is a delay in reporting an unusual transaction?

Who must be informed about a suspicious transaction before it is reported to the Financial Intelligence Unit?

Who must be informed about a suspicious transaction before it is reported to the Financial Intelligence Unit?

What action can the central bank of a country take if financial institutions do not comply with regulations?

What action can the central bank of a country take if financial institutions do not comply with regulations?

What is the consequence of reporting an unusual transaction to the Financial Intelligence Unit?

What is the consequence of reporting an unusual transaction to the Financial Intelligence Unit?

Why does the Financial Intelligence Unit share reported unusual transactions with other parties?

Why does the Financial Intelligence Unit share reported unusual transactions with other parties?

What is the first step in conducting a customer survey?

What is the first step in conducting a customer survey?

What is the purpose of reviewing transactions in the customer survey?

What is the purpose of reviewing transactions in the customer survey?

What is the role of a Compliance professional in the survey process?

What is the role of a Compliance professional in the survey process?

What is the purpose of the four-eye principle in the survey process?

What is the purpose of the four-eye principle in the survey process?

What are subjective indicators in the survey process?

What are subjective indicators in the survey process?

Which management measures can be taken in the mitigation phase?

Which management measures can be taken in the mitigation phase?

What is the purpose of internal escalation in the survey process?

What is the purpose of internal escalation in the survey process?

What is the role of the Quality Checker in the survey process?

What is the role of the Quality Checker in the survey process?

What is the purpose of blocking transactions in the survey process?

What is the purpose of blocking transactions in the survey process?

What is the purpose of external reporting to the Financial Intelligence Unit?

What is the purpose of external reporting to the Financial Intelligence Unit?

Flashcards are hidden until you start studying