Podcast

Questions and Answers

What is the primary purpose of the Capital Asset Pricing Model (CAPM)?

What is the primary purpose of the Capital Asset Pricing Model (CAPM)?

- To determine the volatility of a security in isolation.

- To measure the overall market performance over time.

- To calculate the required rate of return based on systematic risk. (correct)

- To evaluate historical returns of different investment portfolios.

What does a beta factor greater than 1 indicate about a security?

What does a beta factor greater than 1 indicate about a security?

- It is considered a risk-free investment.

- It has more systematic risk than the overall market. (correct)

- It has less systematic risk compared to the market as a whole.

- It guarantees a return greater than the risk-free rate.

In the CAPM formula, which component represents the risk-free rate of return?

In the CAPM formula, which component represents the risk-free rate of return?

- β

- R

- RF (correct)

- RM

How is systematic risk represented in the context of investments?

How is systematic risk represented in the context of investments?

What would a beta of 0 suggest about a security's risk profile?

What would a beta of 0 suggest about a security's risk profile?

Which of the following best describes business/operating risks?

Which of the following best describes business/operating risks?

What impact can changes in the cost of inputs have on a business's profitability?

What impact can changes in the cost of inputs have on a business's profitability?

Which of the following accurately represents financing risks?

Which of the following accurately represents financing risks?

What distinguishes systematic risk from unsystematic risk?

What distinguishes systematic risk from unsystematic risk?

Which type of risk is primarily influenced by market conditions and cannot be avoided through portfolio diversification?

Which type of risk is primarily influenced by market conditions and cannot be avoided through portfolio diversification?

How do changes in interest rates typically impact a business's debt payments?

How do changes in interest rates typically impact a business's debt payments?

What effect can changes in the competitive landscape have on a business?

What effect can changes in the competitive landscape have on a business?

Which of the following is a characteristic of unsystematic risk?

Which of the following is a characteristic of unsystematic risk?

Flashcards are hidden until you start studying

Study Notes

Risk and Leverage

- Business/operating risks are risks inherent to a business's day-to-day operations, including demand changes, input cost changes, and competitive landscapes.

- Financial risks are linked to a business's financing, covering interest rate changes, credit availability changes, and debt terms.

- Systematic risk (market risk) cannot be diversified and is measured by beta factors.

- Unsystematic risk only impacts a few assets, it is unique or asset-specific, and can be reduced through diversification.

Capital Asset Pricing Model (CAPM)

- CAPM predicts the required return for an investment based on its systematic risk compared to the market.

- The CAPM equation is: R = RF + β(RM – RF)

- R is the required return on a security

- RF is the risk-free rate of return

- RM is the market return.

- β is the beta factor of the individual security

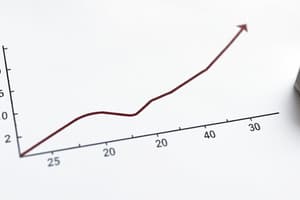

- The Security Market Line (SML) is the graphical representation of this equation.

Beta Factor

- The beta factor measures the systematic risk of a security relative to the market portfolio.

- The market's beta is 1.0.

- A beta of 0 indicates a risk-free investment.

- Beta interpretation:

- Beta of 1: Indicates the same level of systematic risk as the market, resulting in a required return equal to rm.

- Beta greater than 1: Indicates a higher systematic risk than the market, leading to a required return exceeding rm.

- Beta less than 1: Indicates a lower systematic risk than the market, resulting in a required return lower than rm.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.