Podcast

Questions and Answers

If there is no agreement on profit and loss sharing, how should losses be distributed to capitalist partners?

If there is no agreement on profit and loss sharing, how should losses be distributed to capitalist partners?

- Divided proportionately according to the capital contribution ratio (correct)

- Equally divided

- Divided based on the profit agreement ratio

- Divided based on time spent working for the partnership

In the absence of agreement on loss sharing, how does a capitalist-industrial partner share in partnership losses?

In the absence of agreement on loss sharing, how does a capitalist-industrial partner share in partnership losses?

- Receive an equal share in losses

- Share based on profit agreement ratio

- Not share in losses as an industrial partner, but share based on profit ratio as a capitalist partner (correct)

- Receive the lowest share among capitalist partners

Which of the following stipulations in profit or loss sharing would be valid?

Which of the following stipulations in profit or loss sharing would be valid?

- Excluding a capitalist partner from profit sharing

- Excluding a capitalist partner from loss sharing (correct)

- Excluding an industrial partner from profit sharing

- Excluding an industrial partner from loss sharing

If C and I entered into a partnership for two years, with C as the capitalist partner and I as the industrial partner, what terms did they agree on for profit or loss sharing?

If C and I entered into a partnership for two years, with C as the capitalist partner and I as the industrial partner, what terms did they agree on for profit or loss sharing?

In a partnership, if there is no agreement on the distribution of profits, what determines how profits are shared among partners?

In a partnership, if there is no agreement on the distribution of profits, what determines how profits are shared among partners?

When a partnership agreement does not specify how profits are to be shared, what method is typically used for distributing profits?

When a partnership agreement does not specify how profits are to be shared, what method is typically used for distributing profits?

In the absence of an agreement on sharing profits, how shall a capitalist-industrial partner share in partnership profits?

In the absence of an agreement on sharing profits, how shall a capitalist-industrial partner share in partnership profits?

If there is no agreement on sharing losses, how shall an industrial partner share in the losses?

If there is no agreement on sharing losses, how shall an industrial partner share in the losses?

How should losses be distributed to capitalist partners in the absence of an agreement?

How should losses be distributed to capitalist partners in the absence of an agreement?

What happens if there is no explicit agreement on profit sharing terms in a partnership?

What happens if there is no explicit agreement on profit sharing terms in a partnership?

How does an industrial partner typically benefit from sharing profits in a partnership?

How does an industrial partner typically benefit from sharing profits in a partnership?

If a partnership agreement does not specify how cumulative profits should be handled, what is most likely to occur?

If a partnership agreement does not specify how cumulative profits should be handled, what is most likely to occur?

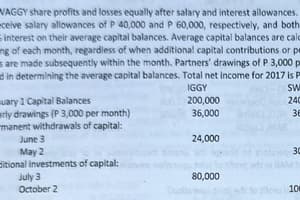

What is the total net income for the two years of partnership operation?

What is the total net income for the two years of partnership operation?

In this partnership, why is there no agreement as to losses?

In this partnership, why is there no agreement as to losses?

What would happen if a third party's designation of share in profits and losses is found to be manifestly inequitable?

What would happen if a third party's designation of share in profits and losses is found to be manifestly inequitable?

If a partnership agreement designates shares in both profit and loss to a third person, what is the impact on the partners?

If a partnership agreement designates shares in both profit and loss to a third person, what is the impact on the partners?

Why did the industrial partner receive P20,000 for the two years of partnership operation?

Why did the industrial partner receive P20,000 for the two years of partnership operation?

What is the implication of an industrial partner not sharing in losses according to the partnership agreement?

What is the implication of an industrial partner not sharing in losses according to the partnership agreement?

Flashcards are hidden until you start studying

Study Notes

Partnership Profit and Loss Sharing

- In the absence of an agreement, losses are distributed equally among partners.

- Without an agreement, profits are typically distributed equally among partners.

- If there is no agreement on profit sharing, the partners will share equally.

- In the absence of an agreement, an industrial partner shares equally in partnership profits.

- A capitalist partner shares equally in partnership losses if there is no agreement.

- If a partnership agreement does not specify how profits are to be shared, the partners share equally.

- If there is no agreement on sharing losses, the industrial partner shares equally in the losses.

- Without an agreement, losses are distributed equally among capitalist partners.

- If a partnership agreement does not specify how cumulative profits should be handled, the partners share equally.

- If a third party's designation of share in profits and losses is found to be manifestly inequitable, it may be reconsidered.

- If a partnership agreement designates shares in both profit and loss to a third person, the third person becomes a partner.

- If an industrial partner does not share in losses according to the partnership agreement, it implies they are not liable for losses.

- In the given partnership, the industrial partner received P20,000 for the two years of partnership operation, indicating they shared in profits but not in losses.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.