Podcast

Questions and Answers

According to the IS curve framework, what component of aggregate expenditure is typically MOST sensitive to changes in the interest rate?

According to the IS curve framework, what component of aggregate expenditure is typically MOST sensitive to changes in the interest rate?

- Consumption

- Government purchases

- Net exports

- Investment (correct)

How does an increase in the interest rate typically affect net exports, according to the IS curve model?

How does an increase in the interest rate typically affect net exports, according to the IS curve model?

- Increases due to cheaper domestic goods.

- Remains unchanged as net exports are independent of interest rates.

- Decreases due to a stronger domestic currency. (correct)

- Increases due to a weaker domestic currency.

In the context of the IS curve, what is the primary effect of decreased consumer confidence on aggregate expenditure and the IS curve?

In the context of the IS curve, what is the primary effect of decreased consumer confidence on aggregate expenditure and the IS curve?

- Shift to the right, increasing aggregate expenditure.

- Movement along the curve, decreasing aggregate expenditure.

- Shift to the left, decreasing aggregate expenditure. (correct)

- No effect, as consumer confidence is not a component of the IS curve.

What does a movement along the IS curve represent?

What does a movement along the IS curve represent?

What factor would cause the IS curve to shift to the right?

What factor would cause the IS curve to shift to the right?

According to the content, what is the central bank able to directly influence by adjusting the money supply?

According to the content, what is the central bank able to directly influence by adjusting the money supply?

If the central bank's inflation target is 2% and current inflation is 3%, what monetary policy action is MOST likely, according to the monetary policy rule?

If the central bank's inflation target is 2% and current inflation is 3%, what monetary policy action is MOST likely, according to the monetary policy rule?

What does the 'risk premium' primarily compensate lenders for in bond markets?

What does the 'risk premium' primarily compensate lenders for in bond markets?

What economic factor does the 'term spread' measure?

What economic factor does the 'term spread' measure?

How would an increase in global GDP growth typically affect a country's net exports, assuming other factors remain constant?

How would an increase in global GDP growth typically affect a country's net exports, assuming other factors remain constant?

In the IS-MP model, what is the effect of discretionary fiscal policy stimulus?

In the IS-MP model, what is the effect of discretionary fiscal policy stimulus?

According to the IS-MP model framework, what is the MOST likely initial effect of expansionary monetary policy?

According to the IS-MP model framework, what is the MOST likely initial effect of expansionary monetary policy?

What is the MOST likely effect of a credit crunch on the liquidity premium?

What is the MOST likely effect of a credit crunch on the liquidity premium?

What signifies a situation where the central bank decreases the interest rate below the neutral rate?

What signifies a situation where the central bank decreases the interest rate below the neutral rate?

How might decreased business confidence impact the IS curve?

How might decreased business confidence impact the IS curve?

If investors expect interest rates to be higher in the future, how will that impact longer-term rates?

If investors expect interest rates to be higher in the future, how will that impact longer-term rates?

Which action would MOST directly counteract the effects of a financial shock that decreases aggregate demand?

Which action would MOST directly counteract the effects of a financial shock that decreases aggregate demand?

How does an increase in government assistance typically affect the IS curve?

How does an increase in government assistance typically affect the IS curve?

What effect do automatic stabilizers primarily have on the economy?

What effect do automatic stabilizers primarily have on the economy?

What name is used to describe the effect, where increased saving leads to a fall in aggregate demand and output?

What name is used to describe the effect, where increased saving leads to a fall in aggregate demand and output?

In the IS curve framework, which component of aggregate expenditure is generally considered to have the LEAST sensitivity to changes in the interest rate?

In the IS curve framework, which component of aggregate expenditure is generally considered to have the LEAST sensitivity to changes in the interest rate?

If the central bank sets the nominal policy rate ($i^{PR}$), and expected inflation ($\pi^e$) rises, what happens to the real interest rate (r), assuming the nominal rate remains unchanged?

If the central bank sets the nominal policy rate ($i^{PR}$), and expected inflation ($\pi^e$) rises, what happens to the real interest rate (r), assuming the nominal rate remains unchanged?

What is the likely impact of increased risk aversion among lenders on the risk premium?

What is the likely impact of increased risk aversion among lenders on the risk premium?

How is the 'term spread' calculated?

How is the 'term spread' calculated?

What is the effect on the IS curve of changes in consumer confidence?

What is the effect on the IS curve of changes in consumer confidence?

What does the central bank directly control when fine-tuning the money supply within overnight money markets?

What does the central bank directly control when fine-tuning the money supply within overnight money markets?

According to monetary policy rules, if current inflation is below the central bank's target, what action is the central bank MOST likely to take?

According to monetary policy rules, if current inflation is below the central bank's target, what action is the central bank MOST likely to take?

What is the primary factor that the 'risk premium' compensates lenders for in bond markets?

What is the primary factor that the 'risk premium' compensates lenders for in bond markets?

Assuming other factors remain constant, how does increased global GDP growth typically impact a country's net exports?

Assuming other factors remain constant, how does increased global GDP growth typically impact a country's net exports?

What is the direct impact on aggregate expenditure from discretionary fiscal policy stimulus, based on the IS-MP model?

What is the direct impact on aggregate expenditure from discretionary fiscal policy stimulus, based on the IS-MP model?

What is the MOST likely immediate impact of expansionary monetary policy, within the IS-MP model framework?

What is the MOST likely immediate impact of expansionary monetary policy, within the IS-MP model framework?

How would you expect a credit crunch to affect the liquidity premium?

How would you expect a credit crunch to affect the liquidity premium?

What condition is present when a central bank decreases the interest rate below the neutral rate?

What condition is present when a central bank decreases the interest rate below the neutral rate?

How would diminished business confidence likely influence the IS curve?

How would diminished business confidence likely influence the IS curve?

If investors anticipate higher interest rates in the future, how will this expectation affect longer-term rates currently?

If investors anticipate higher interest rates in the future, how will this expectation affect longer-term rates currently?

Following a drop in aggregate demand caused by a financial shock, which policy response would provide the MOST direct counteraction?

Following a drop in aggregate demand caused by a financial shock, which policy response would provide the MOST direct counteraction?

What effect does increased government assistance typically have on the IS curve?

What effect does increased government assistance typically have on the IS curve?

What role do automatic stabilizers primarily play within an economy?

What role do automatic stabilizers primarily play within an economy?

The 'paradox of thrift' describes a situation where increased saving leads to what?

The 'paradox of thrift' describes a situation where increased saving leads to what?

Consider the effect of very high inflation expectations ($\pi^e$) that become unanchored. Even when the central bank sets a high nominal policy rate ($i^{PR}$), the real interest rate (r) remains exceptionally low or negative. According to the IS-MP model, what is the MOST likely economic outcome?

Consider the effect of very high inflation expectations ($\pi^e$) that become unanchored. Even when the central bank sets a high nominal policy rate ($i^{PR}$), the real interest rate (r) remains exceptionally low or negative. According to the IS-MP model, what is the MOST likely economic outcome?

According to the IS curve framework, which of the following is the MOST direct effect of an increase in the cost of consumption loans?

According to the IS curve framework, which of the following is the MOST direct effect of an increase in the cost of consumption loans?

In the IS-MP model, what would be the effect of increased global demand for a country's exports?

In the IS-MP model, what would be the effect of increased global demand for a country's exports?

Which of the following fiscal policies would MOST likely shift the IS curve to the right?

Which of the following fiscal policies would MOST likely shift the IS curve to the right?

If the central bank aims to maintain a specific nominal policy rate ($i^{PR}$) and inflation expectations ($\pi^e$) suddenly decrease, what will happen to the real interest rate (r)?

If the central bank aims to maintain a specific nominal policy rate ($i^{PR}$) and inflation expectations ($\pi^e$) suddenly decrease, what will happen to the real interest rate (r)?

What is the MOST direct impact of increased risk aversion among lenders on the broader economy?

What is the MOST direct impact of increased risk aversion among lenders on the broader economy?

What characterizes the 'term spread' in financial markets?

What characterizes the 'term spread' in financial markets?

What is the effect on real interest rates when a central bank lowers the nominal policy rate below the neutral rate?

What is the effect on real interest rates when a central bank lowers the nominal policy rate below the neutral rate?

How would decreased business confidence MOST likely impact the IS curve?

How would decreased business confidence MOST likely impact the IS curve?

Following a financial shock that reduces aggregate demand, which policy response would be MOST effective in directly counteracting the shock, assuming timely implementation?

Following a financial shock that reduces aggregate demand, which policy response would be MOST effective in directly counteracting the shock, assuming timely implementation?

What is the primary function of automatic stabilizers in an economy?

What is the primary function of automatic stabilizers in an economy?

In the loanable funds market, what economic factor is MOST closely associated with the risk premium?

In the loanable funds market, what economic factor is MOST closely associated with the risk premium?

If the central bank decreases the money supply in the overnight money market, what is the MOST likely immediate effect?

If the central bank decreases the money supply in the overnight money market, what is the MOST likely immediate effect?

Imagine a scenario where investors suddenly anticipate significantly higher inflation in the future. If the central bank keeps the nominal interest rate unchanged, what is the MOST likely consequence?

Imagine a scenario where investors suddenly anticipate significantly higher inflation in the future. If the central bank keeps the nominal interest rate unchanged, what is the MOST likely consequence?

How does an increase in the perceived riskiness of corporate bonds, relative to government bonds, MOST directly impact the risk spread?

How does an increase in the perceived riskiness of corporate bonds, relative to government bonds, MOST directly impact the risk spread?

Consider an economy where consumer confidence plummets due to fears of a potential recession. What is the MOST likely initial impact on the IS curve, assuming no immediate policy intervention?

Consider an economy where consumer confidence plummets due to fears of a potential recession. What is the MOST likely initial impact on the IS curve, assuming no immediate policy intervention?

An economy is operating at its potential output. If a large, unexpected increase in global demand for domestically produced goods occurs, what is the MOST likely sequence of events, assuming the central bank maintains its inflation target?

An economy is operating at its potential output. If a large, unexpected increase in global demand for domestically produced goods occurs, what is the MOST likely sequence of events, assuming the central bank maintains its inflation target?

Imagine an economy where the central bank is committed to a strict inflation target. A significant supply-side shock increases production costs, leading to both higher inflation and lower output. According to the IS-MP framework, what is the MOST appropriate policy response for the central bank?

Imagine an economy where the central bank is committed to a strict inflation target. A significant supply-side shock increases production costs, leading to both higher inflation and lower output. According to the IS-MP framework, what is the MOST appropriate policy response for the central bank?

Consider an economy where a sudden increase in global risk aversion leads to a 'flight to safety,' causing a large inflow of capital into government bonds. How would this MOST likely affect the 'term spread' and the 'risk spread'?

Consider an economy where a sudden increase in global risk aversion leads to a 'flight to safety,' causing a large inflow of capital into government bonds. How would this MOST likely affect the 'term spread' and the 'risk spread'?

In a deep recession, even with the nominal interest rate at the zero lower bound, the real interest rate may still be too high due to deflation expectations (expected negative inflation). How does this situation affect aggregate expenditure, according to the IS-MP model?

In a deep recession, even with the nominal interest rate at the zero lower bound, the real interest rate may still be too high due to deflation expectations (expected negative inflation). How does this situation affect aggregate expenditure, according to the IS-MP model?

An economy is initially in equilibrium. A new technological innovation significantly increases the expected future profitability of investment for firms. What is the MOST likely combined effect on the IS curve and the MP curve, assuming the central bank does not initially react?

An economy is initially in equilibrium. A new technological innovation significantly increases the expected future profitability of investment for firms. What is the MOST likely combined effect on the IS curve and the MP curve, assuming the central bank does not initially react?

According to the Phillips Curve, what is the typical effect of an output gap (where actual output exceeds potential output) on inflation?

According to the Phillips Curve, what is the typical effect of an output gap (where actual output exceeds potential output) on inflation?

In the Phillips Curve equation, which factor represents inflation expectations?

In the Phillips Curve equation, which factor represents inflation expectations?

What is the effect of predetermined labor contracts on the price-setting behavior of firms?

What is the effect of predetermined labor contracts on the price-setting behavior of firms?

Which of the following factors would NOT cause a movement along the Phillips Curve?

Which of the following factors would NOT cause a movement along the Phillips Curve?

What is the consequence of firms setting nominal prices with a markup over marginal cost?

What is the consequence of firms setting nominal prices with a markup over marginal cost?

How does high productivity growth typically affect the Phillips Curve?

How does high productivity growth typically affect the Phillips Curve?

According to the IS-MP-PC model, what is the initial impact of an increase in financial frictions ($\gamma$) on the economy, assuming the central bank does not immediately adjust the policy rate?

According to the IS-MP-PC model, what is the initial impact of an increase in financial frictions ($\gamma$) on the economy, assuming the central bank does not immediately adjust the policy rate?

What is the implication of Cost-Push Inflation for the central bank's policy decisions?

What is the implication of Cost-Push Inflation for the central bank's policy decisions?

What is the most direct consequence of a central bank losing credibility in its inflation target?

What is the most direct consequence of a central bank losing credibility in its inflation target?

When an economy experiences 'stagflation', what challenge does this present for policymakers?

When an economy experiences 'stagflation', what challenge does this present for policymakers?

What is the primary reason wages are assumed to increase faster when unemployment is low?

What is the primary reason wages are assumed to increase faster when unemployment is low?

According to the IS-MP-PC model, how does monetary policy feedback influence business cycle fluctuations?

According to the IS-MP-PC model, how does monetary policy feedback influence business cycle fluctuations?

Within the Phillips Curve framework, what is the effect of a negative supply shock ($\epsilon < 0$) on the short-run trade-off between inflation and output?

Within the Phillips Curve framework, what is the effect of a negative supply shock ($\epsilon < 0$) on the short-run trade-off between inflation and output?

What is the implication of an upward-sloping Monetary Policy Rule (MPR) curve in the AS-AD model?

What is the implication of an upward-sloping Monetary Policy Rule (MPR) curve in the AS-AD model?

In the context of the Phillips Curve, what does 'menu cost' refer to?

In the context of the Phillips Curve, what does 'menu cost' refer to?

Which scenario BEST describes a situation where the economy would experience 'demand-pull' inflation?

Which scenario BEST describes a situation where the economy would experience 'demand-pull' inflation?

What is the effect of currency depreciation on the Phillips Curve?

What is the effect of currency depreciation on the Phillips Curve?

According to the Phillips Curve, and assuming adaptive expectations, what would one expect to happen to inflation if unemployment falls below the natural rate?

According to the Phillips Curve, and assuming adaptive expectations, what would one expect to happen to inflation if unemployment falls below the natural rate?

Consider an economy described by the IS-MP-PC model. A financial crisis leads to a significant increase in the risk premium. The central bank, committed to its inflation target, responds by lowering the policy rate. However, the increased risk premium severely restricts the flow of credit, muting the impact of the central bank’s policy. What is the MOST likely outcome?

Consider an economy described by the IS-MP-PC model. A financial crisis leads to a significant increase in the risk premium. The central bank, committed to its inflation target, responds by lowering the policy rate. However, the increased risk premium severely restricts the flow of credit, muting the impact of the central bank’s policy. What is the MOST likely outcome?

There is a new technology that increases productivity in the manufacturing sector, but simultaneously requires significant worker retraining. In the short run, some workers become unemployed due to their skills not matching the new requirements, while firms that have adopted the technology experience increased profits. How would this situation likely affect the Phillips Curve?

There is a new technology that increases productivity in the manufacturing sector, but simultaneously requires significant worker retraining. In the short run, some workers become unemployed due to their skills not matching the new requirements, while firms that have adopted the technology experience increased profits. How would this situation likely affect the Phillips Curve?

According to the Phillips Curve, how do firms typically set nominal prices?

According to the Phillips Curve, how do firms typically set nominal prices?

In the Phillips Curve equation, what does the term $\alpha$ (alpha) represent?

In the Phillips Curve equation, what does the term $\alpha$ (alpha) represent?

According to the Phillips Curve, what condition is MOST likely to lead to increasing inflation?

According to the Phillips Curve, what condition is MOST likely to lead to increasing inflation?

In the context of the Phillips Curve, what does a movement along the curve typically indicate?

In the context of the Phillips Curve, what does a movement along the curve typically indicate?

Which of the following would MOST likely cause a shift in the Phillips Curve?

Which of the following would MOST likely cause a shift in the Phillips Curve?

What is the MOST likely effect of predetermined labor contracts on firms' price-setting behavior?

What is the MOST likely effect of predetermined labor contracts on firms' price-setting behavior?

How does an increase in productivity growth typically affect the Phillips Curve?

How does an increase in productivity growth typically affect the Phillips Curve?

How does a currency depreciation affect the Phillips Curve?

How does a currency depreciation affect the Phillips Curve?

In the Phillips Curve equation, $\pi = \pi^e + \alpha \hat{y}$, what does the parameter $\alpha$ (alpha) represent?

In the Phillips Curve equation, $\pi = \pi^e + \alpha \hat{y}$, what does the parameter $\alpha$ (alpha) represent?

According to the Phillips Curve, how do firms typically determine their nominal prices?

According to the Phillips Curve, how do firms typically determine their nominal prices?

According to the Phillips Curve, how do firms primarily determine nominal prices?

According to the Phillips Curve, how do firms primarily determine nominal prices?

What factor is least likely to influence the position of Aggregate Supply (AS) or Phillips Curve (PC) in the short run?

What factor is least likely to influence the position of Aggregate Supply (AS) or Phillips Curve (PC) in the short run?

What is the MOST likely consequence of increased nominal wages throughout the economy, assuming no change in productivity or firms' markups?

What is the MOST likely consequence of increased nominal wages throughout the economy, assuming no change in productivity or firms' markups?

If an economy experiences a combination of rising inflation expectations and an adverse supply shock (e.g., rising oil prices), what is the most likely short-run outcome according to the IS-MP-PC model?

If an economy experiences a combination of rising inflation expectations and an adverse supply shock (e.g., rising oil prices), what is the most likely short-run outcome according to the IS-MP-PC model?

In the context of the Phillips Curve, what is the MOST likely impact of a central bank successfully anchoring inflation expectations at a low and stable level?

In the context of the Phillips Curve, what is the MOST likely impact of a central bank successfully anchoring inflation expectations at a low and stable level?

An economy is experiencing low inflation and high unemployment. The central bank decides to increase the money supply to stimulate demand. However, businesses and consumers believe this policy will be reversed quickly. What is the likely effect on the Phillips Curve?

An economy is experiencing low inflation and high unemployment. The central bank decides to increase the money supply to stimulate demand. However, businesses and consumers believe this policy will be reversed quickly. What is the likely effect on the Phillips Curve?

Suppose an economy is in long-run equilibrium with stable inflation. A new technology significantly boosts potential output, but also leads to a temporary surge in unemployment due to the need for worker retraining. Initially, how will both the short-run and long-run Phillips Curves likely be affected?

Suppose an economy is in long-run equilibrium with stable inflation. A new technology significantly boosts potential output, but also leads to a temporary surge in unemployment due to the need for worker retraining. Initially, how will both the short-run and long-run Phillips Curves likely be affected?

The central bank announces a new, more flexible inflation-targeting regime that explicitly allows for some short-run deviation from its target to stabilize output. How will this change MOST likely impact the slope of the short-run Phillips Curve (SRPC) and the credibility of the central bank?

The central bank announces a new, more flexible inflation-targeting regime that explicitly allows for some short-run deviation from its target to stabilize output. How will this change MOST likely impact the slope of the short-run Phillips Curve (SRPC) and the credibility of the central bank?

A country's central bank has been consistently missing its inflation target, leading to increased uncertainty about future price levels. How would you expect increased uncertainty regarding future inflation to directly affect the wage-setting behavior of firms and workers?

A country's central bank has been consistently missing its inflation target, leading to increased uncertainty about future price levels. How would you expect increased uncertainty regarding future inflation to directly affect the wage-setting behavior of firms and workers?

In a country heavily reliant on imported intermediate goods priced in a foreign currency, a sharp and unexpected depreciation of the domestic currency occurs. The central bank is committed to maintaining its existing inflation target. What would the IS-MP-PC model predict as the MOST immediate challenge for monetary policy?

In a country heavily reliant on imported intermediate goods priced in a foreign currency, a sharp and unexpected depreciation of the domestic currency occurs. The central bank is committed to maintaining its existing inflation target. What would the IS-MP-PC model predict as the MOST immediate challenge for monetary policy?

Consider an economy where a sustained period of low interest rates has led to excessive risk-taking in financial markets and a buildup of asset bubbles. If the Central Bank decides to ‘lean against the wind’ and raise interest rates to curb speculative activity, how is the Phillips Curve likely to be impacted in the short-run and medium-run?

Consider an economy where a sustained period of low interest rates has led to excessive risk-taking in financial markets and a buildup of asset bubbles. If the Central Bank decides to ‘lean against the wind’ and raise interest rates to curb speculative activity, how is the Phillips Curve likely to be impacted in the short-run and medium-run?

Flashcards

Aggregate Demand

Aggregate Demand

Total demand for goods and services in an economy at a given price level.

The IS Curve

The IS Curve

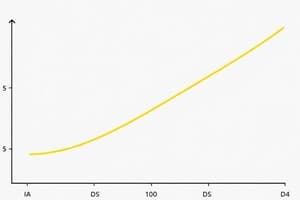

Graphical representation showing the relationship between real interest rates and aggregate output (income) in the goods market.

Interest Rate Sensitivity of Demand

Interest Rate Sensitivity of Demand

The sensitivity of aggregate expenditures (demand) to changes in the interest rate.

Consumption (C)

Consumption (C)

Signup and view all the flashcards

Investment (I)

Investment (I)

Signup and view all the flashcards

Government Purchases (G)

Government Purchases (G)

Signup and view all the flashcards

Net Exports (NX)

Net Exports (NX)

Signup and view all the flashcards

The MP Curve

The MP Curve

Signup and view all the flashcards

Nominal Policy Rate

Nominal Policy Rate

Signup and view all the flashcards

Real Interest Rate

Real Interest Rate

Signup and view all the flashcards

Monetary Policy Rule

Monetary Policy Rule

Signup and view all the flashcards

Demand Shocks

Demand Shocks

Signup and view all the flashcards

Financial Shocks

Financial Shocks

Signup and view all the flashcards

Default risk premium

Default risk premium

Signup and view all the flashcards

Liquidity premium

Liquidity premium

Signup and view all the flashcards

Term premium

Term premium

Signup and view all the flashcards

Fiscal Policy

Fiscal Policy

Signup and view all the flashcards

Monetary Policy

Monetary Policy

Signup and view all the flashcards

Y (Production)

Y (Production)

Signup and view all the flashcards

Government Purchases Examples

Government Purchases Examples

Signup and view all the flashcards

Risk Spread

Risk Spread

Signup and view all the flashcards

Movements along the IS curve

Movements along the IS curve

Signup and view all the flashcards

Shifts of the IS Curve

Shifts of the IS Curve

Signup and view all the flashcards

Paradox of Thrift

Paradox of Thrift

Signup and view all the flashcards

Multiplier Effects

Multiplier Effects

Signup and view all the flashcards

Self-Fulfilling Prophecies

Self-Fulfilling Prophecies

Signup and view all the flashcards

Aggregate Expenditures

Aggregate Expenditures

Signup and view all the flashcards

Interest Rate Sensitive Investment

Interest Rate Sensitive Investment

Signup and view all the flashcards

Impact of Lower Interest Rates

Impact of Lower Interest Rates

Signup and view all the flashcards

π*

π*

Signup and view all the flashcards

r*

r*

Signup and view all the flashcards

Phillips Curve

Phillips Curve

Signup and view all the flashcards

Price Markup (μ)

Price Markup (μ)

Signup and view all the flashcards

Menu costs

Menu costs

Signup and view all the flashcards

Output gap (ŷ)

Output gap (ŷ)

Signup and view all the flashcards

Demand-Pull Inflation

Demand-Pull Inflation

Signup and view all the flashcards

Supply shock (ε)

Supply shock (ε)

Signup and view all the flashcards

Cost-Push Inflation

Cost-Push Inflation

Signup and view all the flashcards

Stagflation

Stagflation

Signup and view all the flashcards

AS-AD Model

AS-AD Model

Signup and view all the flashcards

PC as AS

PC as AS

Signup and view all the flashcards

Price Setting by Firms

Price Setting by Firms

Signup and view all the flashcards

Phillips Curve Equation

Phillips Curve Equation

Signup and view all the flashcards

Movements Along the Phillips Curve

Movements Along the Phillips Curve

Signup and view all the flashcards

Phillips Curve Shifts

Phillips Curve Shifts

Signup and view all the flashcards

Higher Than Expected Inflation Effects

Higher Than Expected Inflation Effects

Signup and view all the flashcards

Lower Than Expected Inflation

Lower Than Expected Inflation

Signup and view all the flashcards

Phillips Curve Origin

Phillips Curve Origin

Signup and view all the flashcards

CB policy adjustment rationale

CB policy adjustment rationale

Signup and view all the flashcards

IS Curve Shift

IS Curve Shift

Signup and view all the flashcards

Supply shock cause

Supply shock cause

Signup and view all the flashcards

Monetary Policy Impact

Monetary Policy Impact

Signup and view all the flashcards

Stagflation Policy Dilemma

Stagflation Policy Dilemma

Signup and view all the flashcards

Labour Market Phillips Curve

Labour Market Phillips Curve

Signup and view all the flashcards

Phillips Curve in the Book Model

Phillips Curve in the Book Model

Signup and view all the flashcards

Financial Shocks Effect

Financial Shocks Effect

Signup and view all the flashcards

Stagflation Definition

Stagflation Definition

Signup and view all the flashcards

Output Gap Formula

Output Gap Formula

Signup and view all the flashcards

Nominal prices

Nominal prices

Signup and view all the flashcards

The Phillips Curve

The Phillips Curve

Signup and view all the flashcards

Inflation Expectations

Inflation Expectations

Signup and view all the flashcards

Shifts of the Phillips Curve

Shifts of the Phillips Curve

Signup and view all the flashcards

CB Policy Adjustment

CB Policy Adjustment

Signup and view all the flashcards

Phillips Curve Becomes Aggregate Supply

Phillips Curve Becomes Aggregate Supply

Signup and view all the flashcards

Monetary Policy Dampens Cycles

Monetary Policy Dampens Cycles

Signup and view all the flashcards

Study Notes

Aggregate Demand

- Aggregate expenditures are a function of the interest rate

- Formula for Aggregate Demand is Y = C + I + G + NX

- Each component of aggregate demand (C, I, G, NX) is influenced by the interest rate (r)

IS Curve

- Movements along the IS curve occur because of changes in r

- Shifts of the IS curve occur because of changes in C, I, G, or NX independent of changes in r

- Multiplier effects amplify the impact of these changes

Interest Rate Impact

- Consumption decreases as the cost of consumption loans increases

- Consumption increases as return on savings increases (opportunity cost)

- Investment decreases as return on saving increases (opportunity cost)

- Investment is most interest rate sensitive because future returns are discounted at a higher rate

- Government purchases are least interest rate sensitive because interest payments on debt increase

- Net exports decrease as demand for currency increases, leading to exchange rate increases

MP Curve

- The central bank sets a nominal policy rate by managing the money supply

- The central bank influences the overnight money market

Monetary Policy

- The real interest rate (r) is equal to the nominal policy rate (i) minus expected inflation

Monetary Policy Rule

- Central bank determines a set point to target inflation

- If inflation is above the target, the central bank increases the interest rate above neutral

- If inflation is below the target, the central bank decreases the interest rate below neutral

Risk Premium

- Nominal interest rate is the sum of the real interest rate, expected inflation, a default risk premium, a liquidity premium, and a term/interest rate risk premium

- Overnight money market includes shortest term and very low risk

- Bond/consumer loan markets include terms of 3 months to 10 years and significant risk

- The rate in the bond/consumer loan market is a function of the risk free rate plus a risk premium

Risk Spread

- Risk spread is the difference between corporate and government bond interest rates

- Term spread is the difference between interest rates on 10-year and 3-month government bonds

IS-MP Model

- Describes macroeconomic equilibrium

- Y = C + I + G + NX

Demand Shocks

- Changes in aggregate demand that shift the IS curve

IS Curve Shifters and examples

- Consumption: Increased Consumption results from increased wealth, consumer confidence and Government assistance. Decreased consumption results form increased taxes and inequality

- Investment: Increased Investment results from GDP growth, business confidence, and investment tax credits. Decreased Investment results from corporate taxes, difficult lending standards and low cast reserves, uncertainty

- Government Purchases: Rise in Spending bills and automatic stabilizers

- Net exports: rise in global GDP growth, weak Canadian dollar, trade barriers in foreign markets

Notes on IS-MP Model

- The model contains paradox of thrift, multiplier effects, and self-fulfilling prophecies

Financial Shocks

- Default risk premium increases when lenders believe firms will default on paying back their debt

- Liquidity premium increases when there is a credit crunch which increases the demand for liquid funds from banks

- The term/interest rate risk premium increases as interest rates are expected to be higher in the near future (increased defaults) thus longer-term rates increase

Monetary and Fiscal Policy

- Discretionary fiscal policy stimulus shifts the IS curve

- Expansionary monetary policy shifts the MP curve

The Phillips Curve

- Firms set nominal prices with a markup over marginal cost, shown as the equation P = Pe * μ * MC, where P is the nominal price, Pe is the expected price level, μ is the markup, and MC is the marginal cost.

- Production costs are often predetermined, so the price is set according to the expected price level.

- Predetermined labor contracts and menu costs are factors.

- The Phillips Curve/Aggregate Supply equation is π = πe + αŷ, where π is inflation, πe is inflation expectations, α is a constant, and ŷ is the output gap.

Factors that Impact the Phillips Curve

- Movements along the Phillips Curve are business cycle fluctuations.

- Low demand (y < ỳ) leads to low production, low labor demand, low (real) wage pressure, slack in production, low cost pressure, and low inflation/deflation.

- High demand (y > ỳ) leads to high production, high labor demand, high (real) wage pressure, hitting capacity constraints, high cost pressure, and high inflation (Demand-Pull Inflation).

Movements of the Philips Curve

- Supply shocks can cause shifts of the Philips Curve with the formula π = πe + α(y – ӯ) + ε, where ε is the supply shock.

- Higher than expected inflation (ε): Input price increases such as droughts, supply chain interruptions, increases in oil prices, wages, and currency depreciation (foreign inputs become more expensive). Higher expected inflation (πe) and a central bank that loses credibility. All leads to Cost-Push Inflation.

- Lower than expected inflation (ε): Input prices fall, high productivity growth, and currency appreciation (foreign inputs become cheaper).

Phillips Curve in the Book

- Unexpected inflation = π − πe = α(y − ỹ)

- When the output gap is closed the best expectation for inflation is the CB's inflation target π* (if the CB is credible)

- If y = ӯ (ŷ = 0) then πe = π*

The Classic Phillips Curve

- The labor market Phillips curve shows that higher unemployment leads to lower unexpected inflation, and lower unemployment leads to higher unexpected inflation.

- At the equilibrium unemployment rate, unexpected inflation is zero, so inflation is equal to inflation expectations.

- Phillips Curve: π = πe + αŷ

- Okun's Rule of Thumb: ŷ = −γ (u – un)

- π = πe – β(u – un) and β = α/γ

The AS-AD Model

- CB needs to adjust policy rate for financial frictions

- CB indirectly controls demand

- The PC becomes Aggregate Supply (AS)

Demand Shocks and Monetary Policy

- Monetary Policy feedback dampens business cycle fluctuations

Supply Shocks

- Stagflation occurs when CB can't fight inflation without making recession worse

Aggregate Supply Function Derivation

- P = Pe * μ * MC

- Pt = Pe * μ * MCt

- Taking logs gives pt = pe + μ + mct

- In the previous period pt-1 = pe-1 + μ + mct-1

- πt = pt - pt-1 = πet + mct - mct-1 = πet + Δmct

- The change in marginal cost is proportional to the output gap: Δmct = αŷt

- The equation 𝜋 = πe + αŷ is derived from increasing marginal cost and wage pressures in the labor market; wages increase faster when unemployment is low and increase slower/stagnate when unemployment is high

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.