Podcast

Questions and Answers

What is the main reason why retail investors tend to overlook the bond market?

What is the main reason why retail investors tend to overlook the bond market?

Less liquid markets and less volatility in returns, making it less attractive to retail investors.

What is the relationship between interest rates and bond prices?

What is the relationship between interest rates and bond prices?

Inverse relationship

What happens to bond prices if the bond issuer is financially stressed?

What happens to bond prices if the bond issuer is financially stressed?

Bond prices lower

How can a bond fund achieve a return of 11% when the securities it comprises yield 2.75%?

How can a bond fund achieve a return of 11% when the securities it comprises yield 2.75%?

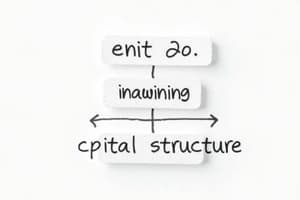

What is the purpose of a duration strategy in bond portfolio management?

What is the purpose of a duration strategy in bond portfolio management?

What is the yield curve, and what does it plot?

What is the yield curve, and what does it plot?

Why is the bond yield level important?

Why is the bond yield level important?

What are the three main strategies used to capture capital appreciation in bond markets?

What are the three main strategies used to capture capital appreciation in bond markets?

What is the short-term impact of Artificial Intelligence on the job market?

What is the short-term impact of Artificial Intelligence on the job market?

How does the Low Carbon Transition affect the traditional energy sector in the short term?

How does the Low Carbon Transition affect the traditional energy sector in the short term?

What is the long-term impact of the Aging Population on the economy?

What is the long-term impact of the Aging Population on the economy?

How does Geopolitical Fragmentation affect global markets in the short term?

How does Geopolitical Fragmentation affect global markets in the short term?

What is the role of Private Credit in the Future of Finance?

What is the role of Private Credit in the Future of Finance?

What is the long-term impact of Artificial Intelligence on the economy?

What is the long-term impact of Artificial Intelligence on the economy?

What is the impact of the Low Carbon Transition on energy costs in the long term?

What is the impact of the Low Carbon Transition on energy costs in the long term?

What is the role of a Venture Capitalist in the economy?

What is the role of a Venture Capitalist in the economy?

What is the economic cycle that occurs due to rapid escalation in price of an asset?

What is the economic cycle that occurs due to rapid escalation in price of an asset?

What is cheap money and how does it relate to bond yields?

What is cheap money and how does it relate to bond yields?

How does a low interest rate environment impact risk and return?

How does a low interest rate environment impact risk and return?

What happens to asset prices when bond yields rise?

What happens to asset prices when bond yields rise?

Why do investors seek higher returns in riskier assets in a low interest rate environment?

Why do investors seek higher returns in riskier assets in a low interest rate environment?

What is the importance of considering the risk of a shift in interest rates in investment decisions?

What is the importance of considering the risk of a shift in interest rates in investment decisions?

What is the relationship between bond yields and interest rates?

What is the relationship between bond yields and interest rates?

What factors influence asset prices in a low interest rate environment?

What factors influence asset prices in a low interest rate environment?

Flashcards are hidden until you start studying

Study Notes

Investment and Risk

- Significant profit-making opportunities often come with uncertainty and risk.

- Retail investors tend to invest small quantities with their own money and trade less frequently.

Bond Market

- Most bonds are sold on the Over-the-Counter (OTC) market, which is less liquid.

- Bond prices have an inverse relationship with interest rates and credit stress.

- If the bond issuer is financially stressed, it may vary borrowing terms, leading to lower bond prices.

Bond Funds

- A bond fund can achieve a higher return than the yield of its individual securities by capturing capital appreciation through trading.

Bond Strategies

- Duration strategy: managing bond portfolio duration to position expected movements in interest rates.

- Yield curve strategy: buying a long-term bond and selling it before maturity to profit from declining yields.

Bond Yield and Interest Rates

- Bond yield is the return on investment influenced by interest rates.

- Low bond yield leads to low interest rates, making borrowing cheap and increasing investment in new assets, which can drive up asset prices and create bubbles.

Megaforces

- Five key factors affecting managing risk and capitalizing on new opportunities:

- Artificial intelligence

- Low carbon transition

- Aging population

- Geopolitical fragmentation

- Future of finance

Venture Capital and Bubbles

- Venture capitalists provide capital to start-up companies with high growth potential.

- A bubble is an economic cycle where rapid price escalation leads to a quick decrease in value, often caused by cheap money and low interest rates.

Low Interest Rate Environment

- Low interest rates impact asset prices, making them look expensive, but reasonably priced due to lower interest rates.

- Risk and return are affected by low interest rates, leading to higher returns in riskier assets and increased risk of asset prices falling.

Bond Yield and Interest Rates

- Bond yield level is important because it affects interest rates and borrowing costs.

- A rise in bond yield can lead to a decrease in cheap money, causing bubbles to burst as asset prices realign with their intrinsic value.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.