Podcast

Questions and Answers

What annual interest rate is required to double an investment in 7 years with annual compounding?

What annual interest rate is required to double an investment in 7 years with annual compounding?

- 10.41% (correct)

- 12.34%

- 9.87%

- 8.51%

If an investment of 8,000 amounts to 8,820 at a 10% interest rate compounded half-yearly, how long does it take for the investment to mature?

If an investment of 8,000 amounts to 8,820 at a 10% interest rate compounded half-yearly, how long does it take for the investment to mature?

- 1 year (correct)

- 3 years

- 2 years

- 1.5 years

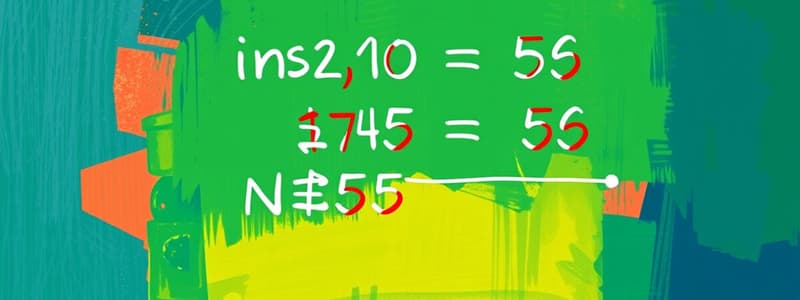

What is the total number of conversion periods if 200,000 amounts to 231,525 in 1½ years with interest compounded half-yearly?

What is the total number of conversion periods if 200,000 amounts to 231,525 in 1½ years with interest compounded half-yearly?

- 5

- 3 (correct)

- 2

- 4

If a principal of `78,030 amounts to what sum when invested at 4% per annum compounded semi-annually for one year?

If a principal of `78,030 amounts to what sum when invested at 4% per annum compounded semi-annually for one year?

In the calculation for doubling an investment, which equation is used?

In the calculation for doubling an investment, which equation is used?

What is the interest rate per conversion period if the annual rate is 10% compounded semi-annually?

What is the interest rate per conversion period if the annual rate is 10% compounded semi-annually?

What is the formula used to determine the amount after n periods with compounded interest?

What is the formula used to determine the amount after n periods with compounded interest?

What too long period must an investment earn interest to amount to 231,525 if starting from 200,000 at 5% compounded semi-annually?

What too long period must an investment earn interest to amount to 231,525 if starting from 200,000 at 5% compounded semi-annually?

What is the initial deposit amount if the total amount reaches `1,01,500 with interest applied at a rate of 2% for 6 years?

What is the initial deposit amount if the total amount reaches `1,01,500 with interest applied at a rate of 2% for 6 years?

If a sum of 46,875 lent out at simple interest results in a total amount of 50,000 after 1 year and 8 months, what is the interest rate per annum?

If a sum of 46,875 lent out at simple interest results in a total amount of 50,000 after 1 year and 8 months, what is the interest rate per annum?

What sum of money will produce `28,600 as interest in 3 years and 3 months at an interest rate of 2.5% per annum?

What sum of money will produce `28,600 as interest in 3 years and 3 months at an interest rate of 2.5% per annum?

In how many years will an investment of 85,000 amount to 1,57,675 at an interest rate of 4.5% per annum?

In how many years will an investment of 85,000 amount to 1,57,675 at an interest rate of 4.5% per annum?

What is the total interest earned from a principal of `70,000 after 6 years at a rate of 2% per annum?

What is the total interest earned from a principal of `70,000 after 6 years at a rate of 2% per annum?

Given that a principal of 46,875 earns an interest of 3,125 over one year, what is the effective rate of interest?

Given that a principal of 46,875 earns an interest of 3,125 over one year, what is the effective rate of interest?

If 1,00,000 is deposited and the total amount after 3 years is 1,20,000 at simple interest, what is the rate of interest per annum?

If 1,00,000 is deposited and the total amount after 3 years is 1,20,000 at simple interest, what is the rate of interest per annum?

What will be the total amount after 5 years if `50,000 is invested at an interest rate of 3% per annum?

What will be the total amount after 5 years if `50,000 is invested at an interest rate of 3% per annum?

What is the formula used to calculate the present value of a cash flow stream with growth?

What is the formula used to calculate the present value of a cash flow stream with growth?

If the discount rate is 7% and the growth rate is 5%, what is the discount factor for the cash flow of 50?

If the discount rate is 7% and the growth rate is 5%, what is the discount factor for the cash flow of 50?

What does calculating the rate of return enable an investor to do?

What does calculating the rate of return enable an investor to do?

Why is net present value (NPV) used in evaluating capital investments?

Why is net present value (NPV) used in evaluating capital investments?

Which attribute is important for successful investors when making investment decisions?

Which attribute is important for successful investors when making investment decisions?

What does the net present value method specifically take into account?

What does the net present value method specifically take into account?

What would be a consequence of continually making losing investments?

What would be a consequence of continually making losing investments?

If an investment generates cash flows at different times, what concept helps in comparing these cash flows?

If an investment generates cash flows at different times, what concept helps in comparing these cash flows?

What constitutes the principal in the context of investment?

What constitutes the principal in the context of investment?

Which formula is used to calculate compound interest?

Which formula is used to calculate compound interest?

How is the effective rate of interest computed?

How is the effective rate of interest computed?

In the context of annuities, what characterizes an annuity due?

In the context of annuities, what characterizes an annuity due?

What is the formula to calculate the future value of a single cash flow?

What is the formula to calculate the future value of a single cash flow?

What does the variable 'n' represent in the context of compound interest?

What does the variable 'n' represent in the context of compound interest?

Which of the following statements is true regarding annuity payments?

Which of the following statements is true regarding annuity payments?

If the annual interest rate is denoted by 'i', how is the interest 'I' calculated?

If the annual interest rate is denoted by 'i', how is the interest 'I' calculated?

What is the formula used to calculate the final value of an investment at simple interest?

What is the formula used to calculate the final value of an investment at simple interest?

If Rahul received 85,925 after investing 70,000 at a simple interest rate of 6.5% per annum for a certain period, what was the calculated period?

If Rahul received 85,925 after investing 70,000 at a simple interest rate of 6.5% per annum for a certain period, what was the calculated period?

How much interest would Sachin earn on a deposit of ` 1,00,000 at a 6% simple interest rate over 2 years?

How much interest would Sachin earn on a deposit of ` 1,00,000 at a 6% simple interest rate over 2 years?

What rate of interest corresponds to an amount owed of 1050 on a borrowed amount of 1000 after 6 months?

What rate of interest corresponds to an amount owed of 1050 on a borrowed amount of 1000 after 6 months?

What is the initial deposit made by Kapil if he received ` 1,01,500 after 7.5 years at a simple interest rate of 6%?

What is the initial deposit made by Kapil if he received ` 1,01,500 after 7.5 years at a simple interest rate of 6%?

Using the formula A = P(1 + it), if P = ` 50,000 and i = 5.5% for 2 years, what is the final amount, A?

Using the formula A = P(1 + it), if P = ` 50,000 and i = 5.5% for 2 years, what is the final amount, A?

What is the amount of interest generated if an amount of ` 70,000 is invested for 3.5 years at a simple interest rate of 6.5%?

What is the amount of interest generated if an amount of ` 70,000 is invested for 3.5 years at a simple interest rate of 6.5%?

What is the total final value of Sachin's bank deposit after earning interest?

What is the total final value of Sachin's bank deposit after earning interest?

Flashcards are hidden until you start studying

Study Notes

Investment and Interest Calculation

- The final value of investment can be calculated using the formula: ( A = P(1 + it) ).

- For an investment of ₹50,000 at a simple interest rate of 5.5% over 2 years, the final amount is ₹55,500.

Simple Interest Calculation

- Simple interest formula: ( I = P \times it ), where ( P ) is principal, ( i ) is rate, and ( t ) is time.

- Example: Sachin deposits ₹100,000 at a 6% interest rate for 2 years, earning ₹12,000 interest, leading to a total of ₹112,000.

Rate of Interest Determination

- Given an amount of ₹1,050 after 6 months from an initial loan of ₹1,000, the interest rate can be calculated as 10%.

Period Calculation from Amount

- When Rahul invested ₹70,000 at a 6.5% interest rate and received ₹85,925, the investment period calculated is 3.5 years.

Initial Deposit Calculation

- Kapil received ₹101,500 after 7.5 years at a 6% interest rate; his initial deposit was calculated to be ₹70,000.

Interest Rate Computation Over Time

- For ₹46,875 that grew to ₹50,000 over 1 year and 8 months, the interest rate found was 4%.

Principal Calculation from Interest Earned

- A sum needed to yield ₹28,600 interest over 3 years and 3 months at 2.5% p.a. was calculated to be ₹352,000.

Time Calculation for Investment

- The time required for ₹85,000 to double to ₹157,675 at 4.5% p.a. interest can be derived via ( A_n = P(1 + i)^n ).

Compounding Annual Interest

- An investment doubling in 7 years at a compounded annual rate can be calculated, leading to a required interest rate of 10.41%.

Semiannual Compounding Example

- ₹8,000 growing to ₹8,820 at a 10% per annum interest rate compounded semiannually takes 1 year.

Compound Interest Calculation

- Formula for compound interest: ( A_n = P(1 + i)^n ), where ( n ) is the total number of compounding periods.

Effective Rate of Interest

- The effective interest rate formula: ( E = (1 + i)^n - 1 ).

Annuities

- An annuity is a series of periodic payments; it can either be regular (payments at the end of periods) or due (payments at the beginning).

- To compute future value of a cash flow, use the formula ( F = C.F.(1 + i)^n ), where ( C.F. ) is the cash flow.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.