Podcast

Questions and Answers

What is the primary purpose of financial statements?

What is the primary purpose of financial statements?

- To present a forecast of future earnings

- To comply with government regulations

- To summarize a business enterprise's financial information (correct)

- To provide a detailed list of all transactions

On what basis are financial statements primarily prepared?

On what basis are financial statements primarily prepared?

- Projected costs and future revenues

- Recorded facts expressed in monetary terms (correct)

- Managerial discretion and subjective judgment

- Estimates based on industry standards

How often are financial statements typically prepared?

How often are financial statements typically prepared?

- Annually (correct)

- Bi-annually

- Monthly

- Quarterly

What does a balance sheet primarily reflect?

What does a balance sheet primarily reflect?

According to the American Accounting Association, financial statements should be based on what?

According to the American Accounting Association, financial statements should be based on what?

What are the components required for a complete set of financial statements according to GAAP?

What are the components required for a complete set of financial statements according to GAAP?

What is the primary purpose of a balance sheet?

What is the primary purpose of a balance sheet?

What does an excess of revenues over expenditures indicate in the income statement?

What does an excess of revenues over expenditures indicate in the income statement?

When is the income statement typically prepared?

When is the income statement typically prepared?

How does the balance sheet categorize the right-hand side?

How does the balance sheet categorize the right-hand side?

Study Notes

Introduction

- Financial statements provide a summary of a business's financial position and performance

- They are the end result of financial accounting

- Multiple sources define financial statements as a structured representation of a business's financial condition, operational results, and allocation of earnings

Nature of Financial Statements

- Rely on recorded facts that can be expressed monetarily

- Cover a specific period, usually a year

- Transactions are recorded chronologically

- Based on historical costs

- Represent summaries of business activities

- Are created periodically, typically for accounting periods

- American Institute of Certified Public Accountants (AICPA) and American Accounting Association (AAA) highlight the importance of consistent accounting principles for accurate financial statement reporting

Anatomy/Types of Financial Statements

- Primarily composed of two statements:

- Balance Sheet: A snapshot of a company's assets (what it owns), liabilities (what it owes), and equity (ownership value) at a specific point in time

- Income Statement: A summary of a company's revenues and expenses over a specific period, resulting in a profit or loss

- GAAP requires a complete set of financial statements:

- Balance Sheet

- Income Statement

- Statement of Changes in Owners' Equity: Tracks changes in shareholder ownership over time

- Statement of Changes in Financial Position: Analyzes how a company's financial position has changed over time

Balance Sheet

- AICPA defines it as a tabular summary of account balances after closing the books

- Shows the company's resources (assets) and their sources (liabilities and equity)

- Indicates the company's financial strength

- Presents a balanced view: assets on one side, liabilities and equity on the other

- Prepared on a specific date

- The Companies Act 1956 prescribes a specific format for balance sheets of registered companies, requiring historical comparative data

Income Statement (Or Profit and Loss Account)

- Reports on a company's performance over a period

- Shows revenue earned and expenses incurred to generate that revenue

- Highlights profit (excess of revenue over expenses) or loss (excess of expenses over revenue)

- Covers a specific period, typically a year

- The liquidity form is suitable for financial institutions

- The Companies Act 1956 prescribes specific formatting for income statements

Revising Schedule VI of The Companies Act, 1956

- Revised Schedule VI emphasizes a vertical format for Balance Sheets

- Specifies a detailed structure for presenting balance sheet information, including:

- Equity and Liabilities: Separating equity, reserves, long-term borrowings, provisions, others, and short-term provisions

- Assets: Classifying current assets, fixed assets, and intangible assets

- Emphasizes clarity and transparency in financial reporting

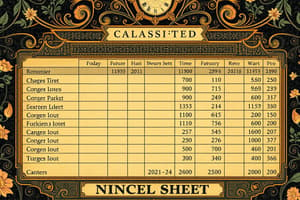

Balance Sheet Format

- Requires a specific format for balance sheet presentation, as outlined in Schedule VI Part I

- Includes columns for:

- Particulars (categories of assets, liabilities, and equity)

- Note No. (references to explanatory notes)

- Figures as at the end of the current reporting period

- Figures as at the end of the previous reporting period

- Provides a standardized structure for comparing financial information over time

Balance Sheet Headings

- Equity and Liabilities:

- Equities: Represents ownership interest in the company

- Reserves and Surplus: Accumulated profits or losses

- Long-Term Borrowings: Debt obligations with maturities of one year or more

- Short-term Provisions: Funds set aside for potential future obligations

- Assets:

- Current Assets: Resources that are expected to be converted into cash or used up within one year

- Non-current Assets (Fixed Assets): Resources that are expected to be used for more than one year

- Intangible assets: Assets that lack physical form, such as goodwill, trademarks, and patents

- Tangible assets: Assets that have physical form, such as land, buildings, and equipment

- Ensures that all sections of the balance sheet are thoroughly accounted for

Schedule VI Part I - Balance Sheet Details

- Equity and Liabilities:

- Equity:

- Share capital: Includes details of issued and paid-up capital, calls unpaid, and forfeited shares

- Reserves and Surplus:

- Details of various types of reserves, including capital reserves, capital redemption reserve, securities premium reserve, reserves relating to the redemption of preference shares and debentures

- Surplus: Profit or loss carried forward

- Long-Term borrowings: Detailed classification of borrowings based on their terms and nature, including bonds, debentures, term loans, loans from related parties, and deferred payment liabilities

- Provisions: Includes provisions for employee benefits and other potential liabilities

- Equity:

- Assets:

- Tangible assets: Detailed classification of tangible assets as per their nature, including land, buildings, plant and equipment, furniture and fixtures, vehicles, and office equipment

- Intangible assets: A thorough list of intangible assets including goodwill, brands, computer software, patents, copyrights, licenses, and franchises

- Promotes detailed and comprehensive reporting of financial information

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

This quiz covers the essentials of financial statements, including their nature, components, and significance in business accounting. You will learn about the balance sheet and how financial statements reflect a company's financial performance over a specific period.