Podcast

Questions and Answers

Which individual presented the first budget of independent India?

Which individual presented the first budget of independent India?

R.K. Shanmukham Chetty presented the first budget of independent India.

What is the main purpose of the 'annual financial statement' or budget?

What is the main purpose of the 'annual financial statement' or budget?

The budget is an 'annual financial statement' which outlines the estimated receipts and expenditures of the government for the upcoming financial year.

What significant change occurred in 1999 regarding budget presentation time?

What significant change occurred in 1999 regarding budget presentation time?

In 1999, the budget presentation time was changed from 5:00 PM to 11:00 AM to align with the working hours of the government and financial markets.

What does the 'Economic Survey' document that is prepared by the Economic Division of the Department of Economic Affairs focus on?

What does the 'Economic Survey' document that is prepared by the Economic Division of the Department of Economic Affairs focus on?

How has the budget presentation date been adjusted in recent years?

How has the budget presentation date been adjusted in recent years?

What is the purpose of the Demands for Grants?

What is the purpose of the Demands for Grants?

What is the difference between 'charged' expenditure and expenditure 'made' from the Consolidated Fund of India?

What is the difference between 'charged' expenditure and expenditure 'made' from the Consolidated Fund of India?

Give three examples of items that fall under 'charged' expenditure.

Give three examples of items that fall under 'charged' expenditure.

What is the role of the Appropriation Bill in the budget process?

What is the role of the Appropriation Bill in the budget process?

What is the purpose of the Finance Bill?

What is the purpose of the Finance Bill?

What is the role of the Rajya Sabha in the passage of Appropriation and Finance Bills?

What is the role of the Rajya Sabha in the passage of Appropriation and Finance Bills?

What is the significance of the Finance Bill being a Money Bill?

What is the significance of the Finance Bill being a Money Bill?

What is the purpose of the Macro-Economic Framework Statement (MEFS)?

What is the purpose of the Macro-Economic Framework Statement (MEFS)?

What are three economic indicators assessed in MEFS?

What are three economic indicators assessed in MEFS?

What are the three-year rolling targets set by the Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement?

What are the three-year rolling targets set by the Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement?

What are the two broad categories under which expenditures are categorized in the Expenditure Budget?

What are the two broad categories under which expenditures are categorized in the Expenditure Budget?

What is the purpose of the "Output Outcome Monitoring Framework"?

What is the purpose of the "Output Outcome Monitoring Framework"?

What is the largest source of revenue for the government, based on the provided information?

What is the largest source of revenue for the government, based on the provided information?

What is the second-largest expenditure category in the government's budget?

What is the second-largest expenditure category in the government's budget?

What is the largest contributor to government revenue after borrowing and other liabilities?

What is the largest contributor to government revenue after borrowing and other liabilities?

What is the largest expenditure category in the government's budget?

What is the largest expenditure category in the government's budget?

What are the key fiscal indicators related to GDP that the Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement sets targets for?

What are the key fiscal indicators related to GDP that the Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement sets targets for?

What is the FRBM Act and what is its role in the government's fiscal policy?

What is the FRBM Act and what is its role in the government's fiscal policy?

When is the budget presented in Parliament?

When is the budget presented in Parliament?

Who introduces the budget in the Lok Sabha?

Who introduces the budget in the Lok Sabha?

What happens on the day the budget is presented?

What happens on the day the budget is presented?

What are the two main stages of the budget discussion?

What are the two main stages of the budget discussion?

Which articles of the constitution pertain to the budget process?

Which articles of the constitution pertain to the budget process?

What follows the detailed discussion of the budget?

What follows the detailed discussion of the budget?

Flashcards

First Budget of India

First Budget of India

Introduced on April 7, 1860, by the East India Company.

First Budget of Independent India

First Budget of Independent India

Presented by R.K. Shanmukham Chetty on November 26, 1947.

Budget Presentation Time

Budget Presentation Time

Changed to 11:00 AM in 1999 for market alignment.

Budget Date Advance

Budget Date Advance

Signup and view all the flashcards

Budget Definition

Budget Definition

Signup and view all the flashcards

Budget Introduction

Budget Introduction

Signup and view all the flashcards

Lok Sabha Speech

Lok Sabha Speech

Signup and view all the flashcards

Budget Discussion

Budget Discussion

Signup and view all the flashcards

Budget Stages

Budget Stages

Signup and view all the flashcards

Appropriation Bill

Appropriation Bill

Signup and view all the flashcards

Finance Bill

Finance Bill

Signup and view all the flashcards

Examination by DRSC

Examination by DRSC

Signup and view all the flashcards

Demand for Grants

Demand for Grants

Signup and view all the flashcards

Charged Expenditure

Charged Expenditure

Signup and view all the flashcards

Examples of Charged Expenditure

Examples of Charged Expenditure

Signup and view all the flashcards

Finance Bill Timeline

Finance Bill Timeline

Signup and view all the flashcards

Money Bills

Money Bills

Signup and view all the flashcards

Rajya Sabha's Role

Rajya Sabha's Role

Signup and view all the flashcards

Macro-Economic Framework Statement (MEFS)

Macro-Economic Framework Statement (MEFS)

Signup and view all the flashcards

FRBM Act, 2003

FRBM Act, 2003

Signup and view all the flashcards

Fiscal Policy Strategy Statement

Fiscal Policy Strategy Statement

Signup and view all the flashcards

Fiscal Deficit

Fiscal Deficit

Signup and view all the flashcards

Revenue Deficit

Revenue Deficit

Signup and view all the flashcards

Primary Deficit

Primary Deficit

Signup and view all the flashcards

Output Outcome Monitoring Framework

Output Outcome Monitoring Framework

Signup and view all the flashcards

Central Sector Schemes

Central Sector Schemes

Signup and view all the flashcards

Revenue Sources

Revenue Sources

Signup and view all the flashcards

Expenditure Classification

Expenditure Classification

Signup and view all the flashcards

Study Notes

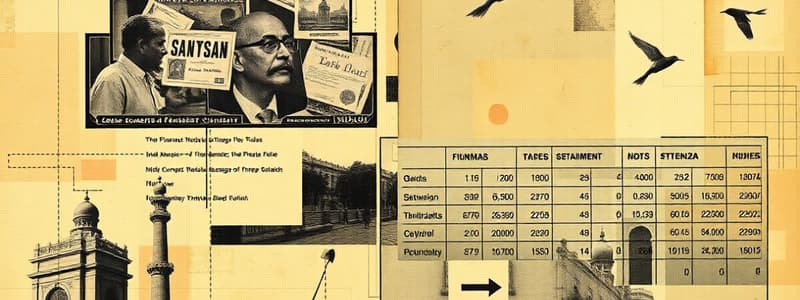

Indian Budget 2025

- The Union Budget 2025 is presented by the Finance Minister, Nirmala Sitharaman.

- This will be her 8th consecutive presentation.

- Previous finance ministers Chidambaram and Mukherjee had presented nine and eight budgets, respectively, under different Prime Ministers.

- The budget is an annual financial statement of the estimated government receipts and expenditures for the forthcoming financial year.

- The Indian Constitution does not mention the word "budget."

- Article 112 of the constitution mandates the President to ensure a statement of estimated receipts and expenditure is presented to Parliament before the financial year commences.

- This is referred to as the Annual Financial Statement.

- The Budget Division of the Department of Economic Affairs, under the Ministry of Finance, prepares the Union budget.

- The Economic Survey is prepared under the guidance of the Chief Economic Adviser.

- The Budget is compulsory for all states. (Article 202)

- The budget is a tool of fiscal policy for the government.

Pre-Independence

- The first budget of India was introduced on April 7, 1860 by James Wilson, for the East India Company to the British Crown.

Post-Independence

- The first budget of independent India was presented on November 26, 1947 by R.K. Shanmukham Chetty.

- The budget covered the period from August 15, 1947 to March 31, 1948.

Budget Changes

- The budget was originally presented at 5:00 PM. This practice changed in 1999 when Yashwant Sinha presented the budget at 11:00 AM, to align with the government's and financial markets' working hours.

- In 2017, the government advanced the budget presentation date from the last day of February to the first day of February to allow for better expenditure planning and utilization of funds from the beginning of the financial year.

- Budget for Railways was presented separately until 2017. The practice was discontinued, and the Railway Budget merged with the General Budget.

Budget Procedure

- The budget is presented in Parliament on the first working day of February, at 11:00 AM.

- Introduced in Lok Sabha by the Finance Minister by means of a speech.

- Then, the presented budget moves to Rajya Sabha.

- No discussion on the budget takes place on the day of the presentation.

- Budget discussion occurs in two stages.

- General discussion and

- Detailed discussion

- Demands for Grants are examined by the Department of Revenue and the related reports are presented to the Lok Sabha.

Budget Documents

- Besides the Finance Minister's Budget Speech, the following other documents are presented to Parliament. Some are mandated by law.

- Annual Financial Statement (AFS)

- Demands for Grants (DGs)

- Finance Bill

- Fiscal Policy Statements mandated by the Fiscal Responsibility and Budget Management (FRBM) Act, 2003

- Macro-Economic Framework Statement

- Expenditure Budget

- Receipt Budget

- Expenditure Profile

- Budget at a Glance

- Memorandum Explaining the Provisions in the Finance Bill

- Output Outcome Monitoring Framework

- Key Features of Budget 2025-26

- Implementation of Budget Announcements 2024-25

Government Accounts

- Government accounts are maintained in three parts:

- Consolidated Fund of India,

- Contingency Fund of India, and

- Public Account of India

Consolidated Fund of India (CFI)

- The CFI operates under Article 266 of the Constitution.

- It holds all government revenues.

- All government expenditures are incurred from the CFI.

- No amounts can be withdrawn without the prior approval of the Parliament.

Contingency Fund of India (CFI)

- The CFI is based on Article 267.

- It is used to meet urgent and unforeseen expenses before the Parliament can authorize them.

- The fund is controlled by the President of India.

- The government can immediately use funds for emergencies.

- The Parliament's approval for the expenditures is sought later.

- Funds are allocated from the Consolidated Fund of India to replenish the Contingency Fund once the Parliament approves the emergency expenditures.

- The authorized corpus of the fund is ₹30,000 crore.

Public Account of India

- The Public Account is operated under Article 266 of the Constitution.

- Government holds the funds in trust for specific purposes or on behalf of others.

- Types of funds held:

- Provident Funds

- Small savings collections

- Receipts for specific purposes (e.g., road development, primary education)

- Other Reserve funds

- Funds in the Public Account do not belong to the government; they belong to depositors (individuals/authorities), and are meant to be returned.

- Funds can be used only through the approval of the President.

Capital Receipts

- Capital receipts reduce assets or increase government liabilities.

- These receipts are not recurring in nature.

- Examples: Recovery of loans, disinvestment, borrowing from the market/RBI, Provident Funds, etc.

Revenue Receipts

- Revenue receipts do not create any liability or reduce assets.

- Revenue receipts are regular and recurring sources of income for the government.

- Examples: Income Tax, GST, Corporation Tax, Union Excise Duties, Customs, etc.

Revenue Expenditure

- Revenue expenditures support the daily functioning of government.

- These expenditures pertain to various schemes.

- These expenditures are ongoing and recurring.

- Examples: Salaries, wages, pensions, subsidies, interest payments, and welfare payments.

Capital Expenditure

- Capital expenditures create assets or reduce government liabilities.

- These expenditures are non-recurring.

- Examples: Repayment of loans, expenditure on acquiring capital assets, and nationalization.

Budget Procedure:

- The Budget is presented to Parliament by the Finance Minister.

- The Finance Bill is submitted after discussion in the Lok Sabha, but reviewed later in the Rajya Sabha.

- Parliament needs to approve both the Appropriation and Finance Bills within 75 days.

Important Related Concepts

- Macro-Economic Framework Statement (MEFS): - Includes an assessment that overviews the economy, including the GDP growth rate, fiscal balance of the central government, and the external sector balance.

- Fiscal Deficit: The excess of government expenditure over government receipts.

- Revenue Deficit: The excess of government revenue expenditure over government revenue receipts.

- Effective Revenue Deficit: Takes into consideration the grants in aid made for capital assets.

- Ways and Means Advances (WMA): Introduced to replace Ad-hoc treasury bills. A short-term loan from the RBI to cover temporary differences between government receipts and expenditures.

Budget Deficits

- Budgetary Deficit: The excess of government expenditure over total receipts.

- Primary Deficit: Fiscal Deficit - Current Interest Borrowings

Methods of Parliamentary Control Over Public Finance

- Placing Annual Financial Statement before Parliament

- Withdrawing money from the Consolidated Fund of India (after approval).

- Supplementary Grants and Vote on Account

- Periodic/Mid-year review of programs, using macroeconomic forecasts from a Parliamentary Budget Office

- Introducing the Finance Bill

Other Important Notes

- The Finance Minister presents the budget followed by related documents.

- The Macro Economic Framework Statement is mandated by long-standing convention.

- The budget document shows how tax and revenue expenditures are planned.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.