Podcast

Questions and Answers

What is the Gross Profit in the HNI P&L statement?

What is the Gross Profit in the HNI P&L statement?

- $600 million (correct)

- $185 million

- $250 million

- $1,500 million

What percentage does the SG&A represent of the Net Sales?

What percentage does the SG&A represent of the Net Sales?

- 11.0%

- 12.3%

- 40.0%

- 16.7% (correct)

What is the calculation for EBIT as outlined in the P&L statement?

What is the calculation for EBIT as outlined in the P&L statement?

- Gross Profit - SG&A (correct)

- Gross Profit - SG&A + Cost of Goods Sold

- Net Sales - Cost of Goods Sold - SG&A

- Gross Profit - Cost of Goods Sold

If the Cost of Goods Sold is $165 million, what is the value of Gross Profit?

If the Cost of Goods Sold is $165 million, what is the value of Gross Profit?

What is the Cost of Goods Sold as a percentage of Net Sales?

What is the Cost of Goods Sold as a percentage of Net Sales?

What is the formula used to calculate Net Sales in the given P&L statement?

What is the formula used to calculate Net Sales in the given P&L statement?

What percentage of Net Sales does Gross Profit represent according to the P&L statement?

What percentage of Net Sales does Gross Profit represent according to the P&L statement?

Which line item has the highest dollar amount in the provided P&L statement?

Which line item has the highest dollar amount in the provided P&L statement?

What is the percentage of SG&A as a portion of Net Sales?

What is the percentage of SG&A as a portion of Net Sales?

Which of the following figures represents EBIT in the P&L statement?

Which of the following figures represents EBIT in the P&L statement?

What is the Gross Profit margin as a percentage of Net Sales?

What is the Gross Profit margin as a percentage of Net Sales?

What is the total amount designated for Selling, General and Administrative expenses (SG&A)?

What is the total amount designated for Selling, General and Administrative expenses (SG&A)?

What does EBIT represent in the context of the P&L statement?

What does EBIT represent in the context of the P&L statement?

If Net Sales amount to $1,500 million, what is the value of total discounts and programs combined?

If Net Sales amount to $1,500 million, what is the value of total discounts and programs combined?

What is the percentage of Net Sales attributable to the cost of F&D?

What is the percentage of Net Sales attributable to the cost of F&D?

What is the relationship between Gross Profit and Cost of Goods Sold as indicated in the P&L statement?

What is the relationship between Gross Profit and Cost of Goods Sold as indicated in the P&L statement?

What does the percentage of Net Sales for SG&A expenses represent?

What does the percentage of Net Sales for SG&A expenses represent?

Which of the following best describes EBIT in the context of the P&L statement?

Which of the following best describes EBIT in the context of the P&L statement?

What can be inferred about the relationship between Gross Profit and EBIT in terms of their relevance in the P&L statement?

What can be inferred about the relationship between Gross Profit and EBIT in terms of their relevance in the P&L statement?

If the Cost of Goods Sold is 11% of Net Sales, what does this imply about the remaining percentage?

If the Cost of Goods Sold is 11% of Net Sales, what does this imply about the remaining percentage?

What is a critical consideration for effective procurement and production planning?

What is a critical consideration for effective procurement and production planning?

Which aspect is important for managing inventory turnover?

Which aspect is important for managing inventory turnover?

What is one of the impacts of damaged raw materials on the supply chain?

What is one of the impacts of damaged raw materials on the supply chain?

What factor helps establish baseline operations in supply chain management?

What factor helps establish baseline operations in supply chain management?

Why is maintaining flexibility important in demand surges?

Why is maintaining flexibility important in demand surges?

Which of the following is a consideration for labor in production planning?

Which of the following is a consideration for labor in production planning?

What can strategic partnerships in supply chain lead to?

What can strategic partnerships in supply chain lead to?

What is the total Gross Profit for Workstations?

What is the total Gross Profit for Workstations?

What is the percentage of Net Sales for Task Chairs?

What is the percentage of Net Sales for Task Chairs?

How much is the total SG&A expense in the provided P&L statement?

How much is the total SG&A expense in the provided P&L statement?

What is the total Net Sales amount for the company?

What is the total Net Sales amount for the company?

Which item has the highest percentage of Net Sales as reported in the P&L statement?

Which item has the highest percentage of Net Sales as reported in the P&L statement?

What amount is designated for Marketing in the P&L statement?

What amount is designated for Marketing in the P&L statement?

What is the percentage of Gross Profit for Task Chairs relative to its Net Sales?

What is the percentage of Gross Profit for Task Chairs relative to its Net Sales?

How is the Collected EBIT for the overall company represented in percentage terms?

How is the Collected EBIT for the overall company represented in percentage terms?

What does the P&L statement help managers and investors distinguish?

What does the P&L statement help managers and investors distinguish?

Which equation represents the calculation of Net Profit?

Which equation represents the calculation of Net Profit?

What is the primary purpose of analyzing trends through P&L statements?

What is the primary purpose of analyzing trends through P&L statements?

How can revenue at HNI be influenced according to financial practices?

How can revenue at HNI be influenced according to financial practices?

What does the P&L formula $Revenue - Expenses = Profit/(Loss)$ signify?

What does the P&L formula $Revenue - Expenses = Profit/(Loss)$ signify?

What are the components used to calculate Total Revenue?

What are the components used to calculate Total Revenue?

Why is the P&L statement crucial for performance measurement?

Why is the P&L statement crucial for performance measurement?

Which of the following best describes the significance of P&L statements in decision-making?

Which of the following best describes the significance of P&L statements in decision-making?

In what way do P&L statements assist in trend analysis?

In what way do P&L statements assist in trend analysis?

What is the total of Revenue and Cash Discounts represented in the P&L statement?

What is the total of Revenue and Cash Discounts represented in the P&L statement?

How does the percentage of F&D compare to Gross Profit as a portion of Net Sales?

How does the percentage of F&D compare to Gross Profit as a portion of Net Sales?

Which line item reflects the highest percentage relative to Net Sales?

Which line item reflects the highest percentage relative to Net Sales?

In the context of the P&L statement, what is the significance of EBIT as expressed in percentage of Net Sales?

In the context of the P&L statement, what is the significance of EBIT as expressed in percentage of Net Sales?

What can be inferred about the cost structure when comparing EBIT to SG&A in the P&L statement?

What can be inferred about the cost structure when comparing EBIT to SG&A in the P&L statement?

What percentage of the Net Sales is represented by the Gross Profit?

What percentage of the Net Sales is represented by the Gross Profit?

How much is the total of F&D and SG&A expenses as a percentage of Net Sales?

How much is the total of F&D and SG&A expenses as a percentage of Net Sales?

What is the effect of having a high EBIT margin in relation to Net Sales?

What is the effect of having a high EBIT margin in relation to Net Sales?

If the Gross Profit is $600 million, what could be inferred about the Cost of Goods Sold?

If the Gross Profit is $600 million, what could be inferred about the Cost of Goods Sold?

What does the EBIT value indicate about the company's operational performance?

What does the EBIT value indicate about the company's operational performance?

What could be a potential consequence of high SG&A expenses relative to Net Sales?

What could be a potential consequence of high SG&A expenses relative to Net Sales?

In the context of the P&L statement, what does a decrease in EBIT over time typically suggest?

In the context of the P&L statement, what does a decrease in EBIT over time typically suggest?

What percentage of Net Sales does F&D represent?

What percentage of Net Sales does F&D represent?

What is the dollar amount for EBIT as shown in the P&L statement?

What is the dollar amount for EBIT as shown in the P&L statement?

Which of the following is the correct equation to calculate EBIT based on the P&L statement?

Which of the following is the correct equation to calculate EBIT based on the P&L statement?

What is the total dollar amount for SG&A expenses as per the P&L statement?

What is the total dollar amount for SG&A expenses as per the P&L statement?

What is the percentage of Net Sales attributed to Gross Profit?

What is the percentage of Net Sales attributed to Gross Profit?

Which of the following figures indicates the value of Net Sales reported in the P&L statement?

Which of the following figures indicates the value of Net Sales reported in the P&L statement?

Which line item contributes the least to Net Sales as a percentage in the P&L statement?

Which line item contributes the least to Net Sales as a percentage in the P&L statement?

What is the dollar amount of Net Sales if Gross Profit accounts for 40.0%?

What is the dollar amount of Net Sales if Gross Profit accounts for 40.0%?

Which of the following percentages indicates the relationship between EBIT and Net Sales?

Which of the following percentages indicates the relationship between EBIT and Net Sales?

What does the P&L formula $Revenue - Expenses = Profit/(Loss)$ represent?

What does the P&L formula $Revenue - Expenses = Profit/(Loss)$ represent?

Which of the following is NOT a purpose of the P&L statement?

Which of the following is NOT a purpose of the P&L statement?

How is Total Revenue calculated according to the P&L overview?

How is Total Revenue calculated according to the P&L overview?

What is a primary advantage of conducting trend analysis using the P&L statement?

What is a primary advantage of conducting trend analysis using the P&L statement?

Which of the following best describes the importance of the P&L statement in decision-making?

Which of the following best describes the importance of the P&L statement in decision-making?

What key financial terminology is essential for interpreting a P&L statement?

What key financial terminology is essential for interpreting a P&L statement?

In the context of a P&L statement, what does performance measurement entail?

In the context of a P&L statement, what does performance measurement entail?

Which statement best captures the essence of the P&L statement’s role in financial analysis?

Which statement best captures the essence of the P&L statement’s role in financial analysis?

What element is critical for assessing how well a company is financially performing according to the P&L statement?

What element is critical for assessing how well a company is financially performing according to the P&L statement?

Flashcards

Net Sales

Net Sales

Net Sales is revenue after considering discounts, programs, and other deductions from the list price.

Gross Profit

Gross Profit

Gross Profit is the difference between Net Sales and the cost of goods sold.

F&D

F&D

F&D represents Fees and Discounts, part of the company's revenue.

% of Net Sales

% of Net Sales

Signup and view all the flashcards

EBIT

EBIT

Signup and view all the flashcards

Gross Profit

Gross Profit

Signup and view all the flashcards

Cost of Goods Sold

Cost of Goods Sold

Signup and view all the flashcards

SG&A

SG&A

Signup and view all the flashcards

EBIT

EBIT

Signup and view all the flashcards

Net Sales Percentage

Net Sales Percentage

Signup and view all the flashcards

Net Sales (WPF)

Net Sales (WPF)

Signup and view all the flashcards

Gross Profit %

Gross Profit %

Signup and view all the flashcards

F&D (Fees & Discounts)

F&D (Fees & Discounts)

Signup and view all the flashcards

SG&A %

SG&A %

Signup and view all the flashcards

EBIT %

EBIT %

Signup and view all the flashcards

Gross Profit

Gross Profit

Signup and view all the flashcards

Cost of Goods Sold

Cost of Goods Sold

Signup and view all the flashcards

SG&A

SG&A

Signup and view all the flashcards

EBIT

EBIT

Signup and view all the flashcards

Net Sales (in $Millions)

Net Sales (in $Millions)

Signup and view all the flashcards

Ideal Flow

Ideal Flow

Signup and view all the flashcards

Demand Forecasting

Demand Forecasting

Signup and view all the flashcards

Supply Chain

Supply Chain

Signup and view all the flashcards

Production Planning

Production Planning

Signup and view all the flashcards

Inventory Management

Inventory Management

Signup and view all the flashcards

Critical Foundation

Critical Foundation

Signup and view all the flashcards

Strategic Partnerships

Strategic Partnerships

Signup and view all the flashcards

Net Sales

Net Sales

Signup and view all the flashcards

Gross Profit

Gross Profit

Signup and view all the flashcards

COGS

COGS

Signup and view all the flashcards

SG&A

SG&A

Signup and view all the flashcards

EBIT

EBIT

Signup and view all the flashcards

How to estimate total profit

How to estimate total profit

Signup and view all the flashcards

P&L Statement

P&L Statement

Signup and view all the flashcards

Financial Health

Financial Health

Signup and view all the flashcards

Profitability Impact

Profitability Impact

Signup and view all the flashcards

P&L Statement

P&L Statement

Signup and view all the flashcards

Revenue Overview

Revenue Overview

Signup and view all the flashcards

Revenue Impact

Revenue Impact

Signup and view all the flashcards

Profit and Loss

Profit and Loss

Signup and view all the flashcards

P&L Importance

P&L Importance

Signup and view all the flashcards

P&L Calculation

P&L Calculation

Signup and view all the flashcards

Financial Statement

Financial Statement

Signup and view all the flashcards

Performance Measurement

Performance Measurement

Signup and view all the flashcards

Decision Making

Decision Making

Signup and view all the flashcards

Net Sales (WPF)

Net Sales (WPF)

Signup and view all the flashcards

Gross Profit

Gross Profit

Signup and view all the flashcards

F&D (in $ Millions)

F&D (in $ Millions)

Signup and view all the flashcards

SG&A (in $ Millions)

SG&A (in $ Millions)

Signup and view all the flashcards

EBIT (in $Millions)

EBIT (in $Millions)

Signup and view all the flashcards

Net Sales (in $ Millions)

Net Sales (in $ Millions)

Signup and view all the flashcards

Gross Profit (in $ Millions)

Gross Profit (in $ Millions)

Signup and view all the flashcards

F&D (in $ Millions)

F&D (in $ Millions)

Signup and view all the flashcards

SG&A (in $ Millions)

SG&A (in $ Millions)

Signup and view all the flashcards

EBIT (in $ Millions)

EBIT (in $ Millions)

Signup and view all the flashcards

EBIT % of Net Sales

EBIT % of Net Sales

Signup and view all the flashcards

Gross Profit % of Net Sales

Gross Profit % of Net Sales

Signup and view all the flashcards

Net Sales (in $Millions)

Net Sales (in $Millions)

Signup and view all the flashcards

Gross Profit ($ Millions)

Gross Profit ($ Millions)

Signup and view all the flashcards

F&D ($ Millions)

F&D ($ Millions)

Signup and view all the flashcards

SG&A ($ Millions)

SG&A ($ Millions)

Signup and view all the flashcards

EBIT ($ Millions)

EBIT ($ Millions)

Signup and view all the flashcards

Gross Profit %

Gross Profit %

Signup and view all the flashcards

F&D % of Net Sales

F&D % of Net Sales

Signup and view all the flashcards

P&L Statement

P&L Statement

Signup and view all the flashcards

Revenue Overview

Revenue Overview

Signup and view all the flashcards

Revenue Impact

Revenue Impact

Signup and view all the flashcards

Profit and Loss

Profit and Loss

Signup and view all the flashcards

P&L Calculation

P&L Calculation

Signup and view all the flashcards

P&L Importance

P&L Importance

Signup and view all the flashcards

What is a P&L Statement?

What is a P&L Statement?

Signup and view all the flashcards

P&L

P&L

Signup and view all the flashcards

How to estimate total profit?

How to estimate total profit?

Signup and view all the flashcards

Study Notes

Practical Financial Acumen: Intentional Development

- The opportunity exists to impact business performance.

- Reasons for learning focus include:

- Informed Decision Making: Enables leaders to make strategic choices aligned with the organization's financial goals. Resources are allocated effectively for maximum impact.

- Increased Accountability: Helps leaders take ownership of decisions and outcomes. A culture of responsibility and transparency is fostered for organizational success.

- Strategic Alignment: Ensures leaders understand their roles and team contributions to achieve long-range organizational strategy, improving alignment and collaboration.

Training Agenda

- The agenda includes several rotations:

- Rotation #1: Understanding Revenue & Profitability

- Rotation #2: Managing Operating Expenses & Profitability

- Rotation #3: Achieving Net Profit & Business Impact

- Rotation #4: Investment Decision & Analysis: Business Case

- Includes a Lunch Break

Finance Team Presenting Today

- Ownership of Workplace Furnishings P&L management. This includes:

- Profitability P&L projections

- Investment decisions and analysis

- Portfolio management (cash) from dealers and direct customers

Finance Passport

- This is a visual representation for understanding

- Revenue & Profitability

- Operating Expenses & Profitability

- Net Profit & Business Impact

- Investment Decision & Analysis

P&L Introduction

- Introduction to Profit and Loss statements.

What is a P&L Statement?

- Also known as an Income Statement.

- Revenue - Expenses = Profit/Loss

- Helpful for performance measurement, decision-making, and trend analysis.

Revenue Overview

- Total Revenue = Number of Units Sold x Price per Unit

Revenue Metrics at HNI

- List Sales: Total revenue from goods and services, "top line" of a business.

- Discounts: Factors that impact list sales.

- Invoice Sales: Revenue tracked as goods/services are sold.

- Programs: Includes things like early pay discounts.

- Net Sales: Revenue that remains after subtracting any discounts, allowances, or adjustments.

Expense Overview

- Variable Expenses: Expenses that change according to quantity produced.

- Fixed Expenses: Expenses that don't change according to quantity produced.

DCM Overview

- Direct Contribution Margin (DCM): Calculated by subtracting variable costs from revenue.

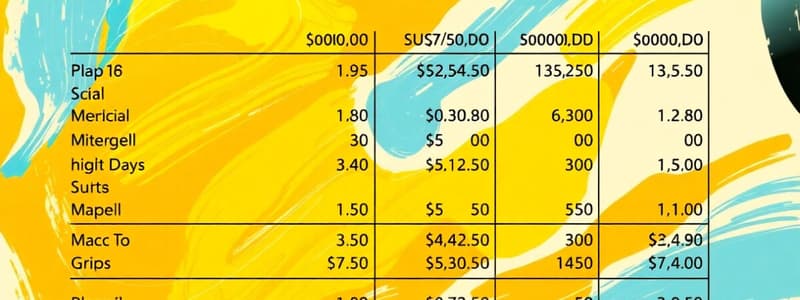

HNI P&L Statement - 5 Line P&L

- A presentation illustrating HNI's financial performance.

- Data points including, Net Sales, Gross Profit, F&D, SG&A and EBIT metrics are included.

- The data is illustrative, and doesn't reflect actual financial results.

- Note: The figures for the HNI P&L Statement vary slightly in the different sections of the document.

Seating Corporation Scenario

- Shows profit/loss scenarios for a seating company

Active Perspective

- A call to action in which the owner of Seating Corp is asked to consider what would be next step

Summary

- P&L statement is a useful tool for understanding company's financial health.

- All individuals within a company play a part in business performance.

Breakout Assignments

- Group assignments for learning sessions 1 and 2, and session 3 and 4.

- Instructions for group activities, including dividing the table and workbook.

Investment Analysis

- A presentation slide of investment analysis

- Planned investments include:

- LRP (Long Range Plan) - Hoshin activity

- New product process

- Budget

- Unplanned investments include:

- Equipment repair

- Competitive opportunity

- Regulation change

- Planned investments include:

Investment Analysis Process

- A presentation slide explaining the process for investment analysis.

Business Case Examples

- Examples of business cases (Fulton Market, IMA Rebuild, Solar Panels at 505, and Avion Task Chair) demonstrating the investment analysis process.

Closing

- The P&L statement includes several components: Revenue, Cost, SG&A and EBIT

- The most effective business case is one that informs the best business decisions.

Financial Definitions

- Definitions for key financial terms, such as Profit & Loss Statement, Revenue, Cost of Goods Sold, List Sales, Invoice Sales, Net Sales, Direct Contribution Margin, Earnings Before Interest and Taxes, Freight & Distribution, Sales, General & Administration.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.