Podcast

Questions and Answers

What is one significant disadvantage of accepting complex agreements in startup financing?

What is one significant disadvantage of accepting complex agreements in startup financing?

They can restrict future fundraising or decision-making.

List one advantage of leasing equipment for new businesses.

List one advantage of leasing equipment for new businesses.

Leasing is easy for new businesses to acquire.

What is a major benefit of obtaining grants for a business project?

What is a major benefit of obtaining grants for a business project?

There is no need for repayments or interest rates.

Explain a potential drawback of relying on grants for funding.

Explain a potential drawback of relying on grants for funding.

What factors should a business consider when choosing between short-term and long-term financing?

What factors should a business consider when choosing between short-term and long-term financing?

What are the main advantages of using friends and family for financing?

What are the main advantages of using friends and family for financing?

What is a significant disadvantage of peer-to-peer lending?

What is a significant disadvantage of peer-to-peer lending?

How do business angels typically engage with startups?

How do business angels typically engage with startups?

What is the primary difference between ordinary shares and preference shares?

What is the primary difference between ordinary shares and preference shares?

What role does venture capital play in the growth of companies?

What role does venture capital play in the growth of companies?

Flashcards are hidden until you start studying

Study Notes

Friends and Family

- Cheaper if interest rates are lower

- No repayments if gifted

- No stake in business required

- Can lead to loss of friendship or family relationship breakdown

Peer-to-Peer Lending

- Individuals lend money to each other

- Sites charge 1% commission

- Lender can choose borrower

- Loans are unsecured

- Takes place online

- No government protection

Business Angels

- Invest between £1,000 - £100,000+

- Usually for an exchange of stake in the business

- Angels and business owner must share interests and vision

Crowdfunding

- Individuals or businesses raise small amounts from a large group

- Commonly used for creative projects, startups, charities, and personal needs

Bank Loan

- Unsecured loan

- Quick to obtain

- High interest due to high risk

- No collateral required

- Based on borrower creditworthiness, financial history, and income

Mortgages

- Secured loan

- Lower interest due to lower risk

- Collateral is required

Ordinary Shares

- No guaranteed dividends

- Voting rights

Preference Shares

- Fixed dividends

- No voting rights

Deferred Shares

- Held by company founders

- Dividends received after ordinary shares are paid a minimum amount

Venture Capital

- Investors take an active role in the company

- Invest after initial stage and prefer technology

Venture Capital Advantages

- Access to capital

- Expertise and mentoring

- Faster scaling

Venture Capital Disadvantages

- Complex agreements restrict future fundraising

- Loss of control over decision making

- Pressure for high growth

Lease

- Users do not bear maintenance or repair costs

- No large sums needed to buy or use equipment

- Easy for new businesses to acquire

- Leasing companies have up-to-date equipment

Lease Disadvantages

- More expensive than buying equipment

- Leased equipment cannot be used as collateral

Grants

- No repayments required

- Formal agreement for specific projects

- Funds have a specific time frame for usage

Grant Advantages

- Businesses can receive generous funds

- Cheaper due to no interest or repayments

- Minimized risk due to no collateral

Grant Disadvantages

- Future grants may be lost if the project fails

- Time-consuming research on granting agencies can be costly

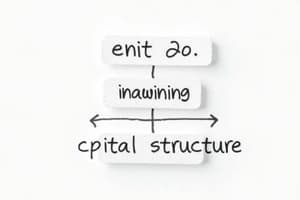

Choosing Appropriate Finance

- Short-term or long-term needs

- Business financial position (collateral ability)

- Legal status of the business (limited or unlimited)

- Cost

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.