Podcast

Questions and Answers

A corporation's life is continuous and is affected by the death of a stockholder.

A corporation's life is continuous and is affected by the death of a stockholder.

False (B)

A corporation's charter details the amount of stock the corporation is permitted to sell.

A corporation's charter details the amount of stock the corporation is permitted to sell.

True (A)

The issuance of common stock impacts both retained earnings and paid-in capital accounts.

The issuance of common stock impacts both retained earnings and paid-in capital accounts.

False (B)

When a corporation reacquires its shares at a price higher than the original sale price, it debits treasury stock for the price paid to reacquire the shares.

When a corporation reacquires its shares at a price higher than the original sale price, it debits treasury stock for the price paid to reacquire the shares.

Corporations expense organization costs only when the company starts earning revenue.

Corporations expense organization costs only when the company starts earning revenue.

Ford Motor Company and Salvation Army are both classified as not-for-profit organizations.

Ford Motor Company and Salvation Army are both classified as not-for-profit organizations.

Stockholders' liability extends to the full extent of the corporation's debts and other obligations.

Stockholders' liability extends to the full extent of the corporation's debts and other obligations.

Privately held and publicly held corporations are classified by purpose.

Privately held and publicly held corporations are classified by purpose.

Stockholders have preemptive rights, meaning they can maintain the same percentage of ownership when new shares are issued.

Stockholders have preemptive rights, meaning they can maintain the same percentage of ownership when new shares are issued.

The market value per share of a stock is precisely the same as the book value per share.

The market value per share of a stock is precisely the same as the book value per share.

Flashcards

Separate Legal Existence

Separate Legal Existence

A separate legal entity that acts under its own name, distinct from its stockholders.

Limited Liability

Limited Liability

Stockholders are only liable up to their investment amount, protecting personal assets.

Transferable Ownership Rights

Transferable Ownership Rights

Shareholders can sell their stock, allowing easy transfer of ownership.

Ability to Acquire Capital

Ability to Acquire Capital

Signup and view all the flashcards

Authorized Stock

Authorized Stock

Signup and view all the flashcards

Treasury Stock

Treasury Stock

Signup and view all the flashcards

Paid-in Capital

Paid-in Capital

Signup and view all the flashcards

Retained Earnings

Retained Earnings

Signup and view all the flashcards

Ownership Rights of Stockholders

Ownership Rights of Stockholders

Signup and view all the flashcards

Book Value Per Share

Book Value Per Share

Signup and view all the flashcards

Study Notes

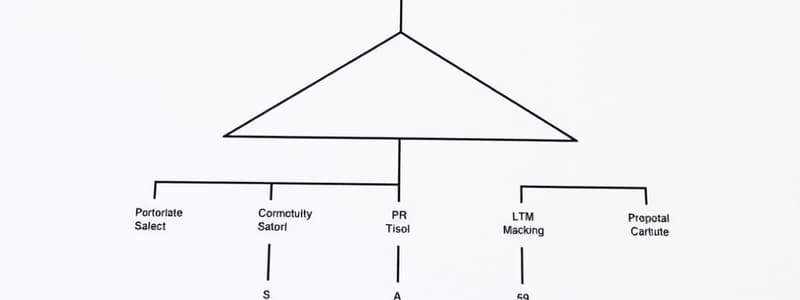

- Corporations can be classified by purpose as either not-for-profit or for-profit.

- Corporations can be classified by ownership as either publicly held or privately held.

- Publicly held corporations: McDonald's, Ford Motor Company, PepsiCo, Google

- Privately held corporations: Cargill Inc.

Characteristics of a Corporation

- Advantages of a corporation include separate legal existence, limited liability of stockholders, transferable ownership rights, ability to acquire capital, and continuous life.

- Disadvantages of a corporation include government regulations, additional taxes, and corporate management.

- A corporation acts under its own name rather than in the name of its stockholders, demonstrating separate legal existence.

- Stockholders' liability is limited to their investment.

- Shareholders can sell their stock, illustrating transferable ownership rights.

- Corporations can obtain capital through the issuance of stock.

- Forming a corporation involves filing an application with the Secretary of State, receiving a state charter, and developing by-laws.

- Many companies incorporate in states like Delaware and New Jersey due to favorable corporate laws.

- Organization costs are expensed as incurred.

Ownership Rights of Stockholders

- Stockholders have the right to vote in the election of the board of directors and on actions requiring stockholder approval.

- Stockholders can share in corporate earnings through dividends.

- Stockholders maintain the same percentage ownership when new shares are issued via preemptive rights.

- Stockholders share in assets upon liquidation in proportion to their holdings, known as a residual claim.

Stock Issue Considerations

- A corporate charter indicates the amount of stock a corporation can sell.

- The number of authorized shares is reported in the stockholders’ equity section.

- Factors influencing the price of a new stock issue: anticipated future earnings, expected dividend rate per share, current financial position, state of the economy, and state of the securities market.

- Stock of publicly held companies is traded on organized exchanges.

- Stock prices are determined by the interaction between buyers and sellers.

- Market prices tend to follow the trend of a company’s earnings and dividends.

- Market prices may experience fluctuations due to factors beyond the company’s control.

- Par value used to determine the legal capital per share that a company must retain to protect corporate creditors.

- Many states do not require par value, and no-par value stock is common.

- A board of directors assigns a stated value to no-par shares in many states.

Corporate Capital

- Paid-in capital includes common stock and preferred stock accounts.

- The sources of equity include paid-in capital and retained earnings accounts.

- Paid-in capital is the total amount of cash and assets paid into the corporation by stockholders in exchange for capital stock.

- Retained earnings is the net income a corporation retains for future use.

- Accounting for common stock issues involves identifying the specific sources of paid-in capital and maintaining the distinction between paid-in capital and retained earnings.

- The issuance of common stock affects only paid-in capital accounts.

- Common stock can be issued for services or noncash assets.

- The cost is determined by the fair market value of the consideration given up or received, whichever is more clearly determinable.

Treasury Stock

- Treasury stock is a corporation's own stock that it has reacquired but not retired.

- Corporations purchase their outstanding stock to reissue shares, enhance stock market value, have shares for acquisitions, increase earnings per share, and rid the company of disgruntled investors.

- Treasury Stock is debited for price paid to reacquire shares.

- Treasury is a contra stockholders' equity account, and not an asset.

- Purchase of treasury stock reduces stockholders' equity.

- Sales of treasury stock above or below cost increase total assets and stockholders’ equity.

Preferred Stock

- Dividends, assets during liquidation, and nonvoting rights are features often associated with preferred stock.

- Accounting for preferred stock issuance is similar to common stock.

Dividend Preferences

- Preferred stockholders have the right to receive dividends before common stockholders.

- The per-share dividend amount is a percentage of the preferred stock’s par value, or a specified amount.

- Cumulative dividends are paid to preferred stockholders, including any dividends in arrears, before common stockholders.

Statement Analysis and Presentation

- Book Value Per Share = Total Stockholders’ Equity / Number of Common Shares Outstanding

- Book value per share generally does not equal market value per share.

- When a company has preferred stock, the preferred stockholders' claim on net assets must be deducted from total stockholders’ equity.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.