Podcast

Questions and Answers

What is the main objective in conventional corporate financial theory?

What is the main objective in conventional corporate financial theory?

Maximize the value of the business or firm.

What is the main disagreement between corporate finance theorists and practitioners?

What is the main disagreement between corporate finance theorists and practitioners?

The view they have about the real objective of the firm.

Why do some critics argue that firms should have multiple objectives?

Why do some critics argue that firms should have multiple objectives?

To satisfy multiple interests (stockholders, labor, and customers).

What do some experts suggest companies focus on as simpler and more direct objectives?

What do some experts suggest companies focus on as simpler and more direct objectives?

What impact does a flawed main objective have on the theory of corporate finance?

What impact does a flawed main objective have on the theory of corporate finance?

What is the unifying objective that all models of the theory of corporate finance are built around?

What is the unifying objective that all models of the theory of corporate finance are built around?

What are the two main types of decisions that corporations make according to the text?

What are the two main types of decisions that corporations make according to the text?

What is the significance of managing assets already in place in the investment decision process?

What is the significance of managing assets already in place in the investment decision process?

What risks does the corporation have to manage in relation to its investments?

What risks does the corporation have to manage in relation to its investments?

What does the financing decision involve besides raising cash today?

What does the financing decision involve besides raising cash today?

Why is timing important in assessing project returns according to the text?

Why is timing important in assessing project returns according to the text?

What are some examples of intangible assets that corporations need to invest in?

What are some examples of intangible assets that corporations need to invest in?

Why do financial managers say that 'value comes mainly from the asset side of the balance sheet'?

Why do financial managers say that 'value comes mainly from the asset side of the balance sheet'?

How can financing decisions potentially destroy value for a corporation?

How can financing decisions potentially destroy value for a corporation?

What risks should a financial manager be aware of and manage properly?

What risks should a financial manager be aware of and manage properly?

How can a company be affected by recessions and changes in external factors?

How can a company be affected by recessions and changes in external factors?

What is the role of working capital in a firm?

What is the role of working capital in a firm?

Why is it important for companies to hedge or insure against certain risks?

Why is it important for companies to hedge or insure against certain risks?

What is the responsibility of the treasurer?

What is the responsibility of the treasurer?

What is the role of the controller?

What is the role of the controller?

Apart from financial specialists, who else is involved in financial decisions according to the text?

Apart from financial specialists, who else is involved in financial decisions according to the text?

How are rejected designs by engineers considered investment decisions?

How are rejected designs by engineers considered investment decisions?

What does the term 'financial manager' encompass according to the text?

What does the term 'financial manager' encompass according to the text?

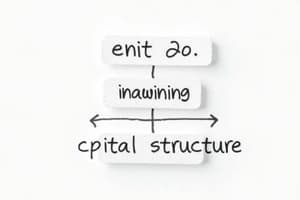

What is the essential role of the financial manager based on Figur02?

What is the essential role of the financial manager based on Figur02?

What are the three things each stockholder wants?

What are the three things each stockholder wants?

Why do stockholders not need the financial manager's help for the best time pattern of consumption?

Why do stockholders not need the financial manager's help for the best time pattern of consumption?

How can the financial manager help the firm's stockholders according to the text?

How can the financial manager help the firm's stockholders according to the text?

What principle have economists proved regarding value maximization?

What principle have economists proved regarding value maximization?

What is the main goal of shareholders according to the text?

What is the main goal of shareholders according to the text?

What is the widely accepted goal in both theory and practice?

What is the widely accepted goal in both theory and practice?

Flashcards are hidden until you start studying