Podcast

Questions and Answers

What does a balance sheet represent?

What does a balance sheet represent?

- A report of income over a period of time

- A statement of a firm's performance over several years

- A summary of cash inflows and outflows during a period

- A snapshot of a firm's financial position at a specific point in time (correct)

Which statement is included as part of financial statements?

Which statement is included as part of financial statements?

- Cash flow statement (correct)

- Budget analysis

- Sales projections

- Statement of changes in ownership

On a balance sheet, what is typically found on the left-hand side?

On a balance sheet, what is typically found on the left-hand side?

- Liabilities

- Equity

- Current liabilities

- Investments in assets (correct)

Which of the following is true about the right-hand side of the balance sheet?

Which of the following is true about the right-hand side of the balance sheet?

What does the income statement primarily illustrate?

What does the income statement primarily illustrate?

What is included under current liabilities in a balance sheet?

What is included under current liabilities in a balance sheet?

Which of the following represents an increase in capital on the income statement?

Which of the following represents an increase in capital on the income statement?

Which of the following statements about the statement of retained earnings is correct?

Which of the following statements about the statement of retained earnings is correct?

Flashcards

Financial Statement Types

Financial Statement Types

Documents used to present a company's financial status, including balance sheet, income statement, cash flow statement, and retained earnings statement.

Balance Sheet

Balance Sheet

A snapshot of a company's financial position at a specific time, showing assets, liabilities, and equity.

Balance Sheet: Assets

Balance Sheet: Assets

A company's possessions and resources, such as cash, accounts receivable, and equipment.

Balance Sheet: Liabilities

Balance Sheet: Liabilities

Signup and view all the flashcards

Balance Sheet: Equity

Balance Sheet: Equity

Signup and view all the flashcards

Income Statement

Income Statement

Signup and view all the flashcards

Income Statement: Revenue/Sales

Income Statement: Revenue/Sales

Signup and view all the flashcards

Cash Flow Statement

Cash Flow Statement

Signup and view all the flashcards

What is an expense?

What is an expense?

Signup and view all the flashcards

What is net income?

What is net income?

Signup and view all the flashcards

What does the Income Statement show?

What does the Income Statement show?

Signup and view all the flashcards

What is Retained Earnings?

What is Retained Earnings?

Signup and view all the flashcards

What does the Statement of Retained Earnings show?

What does the Statement of Retained Earnings show?

Signup and view all the flashcards

What does the Statement of Cash Flows show?

What does the Statement of Cash Flows show?

Signup and view all the flashcards

What are the 3 parts of a Cash Flow Statement?

What are the 3 parts of a Cash Flow Statement?

Signup and view all the flashcards

What are EPS and DPS?

What are EPS and DPS?

Signup and view all the flashcards

Study Notes

Chapter 2: Understanding Financial Statements

- The chapter focuses on understanding financial statements, differentiating types, and recognizing their importance.

Learning Objectives

- Identify different financial statement documents.

- Grasp the role and significance of financial statements.

Financial Statements

- Balance sheet

- Income statement

- Cash flow statement

- Retained earnings statement

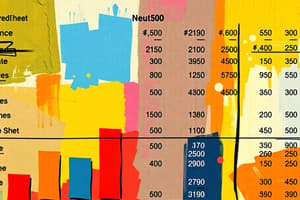

Balance Sheet

- Presents a snapshot of a firm's financial position at a specific point in time.

- Left side (assets): Shows investment decisions.

- Right side (liabilities and equity): Shows financing decisions.

- Assets include current assets (e.g., cash, marketable securities, accounts receivables, inventory) and fixed assets (e.g., gross fixed assets, less depreciation).

- Liabilities include short-term (current) liabilities (e.g., accounts payable, notes payable, other current liabilities) and long-term liabilities (e.g., long-term debt).

- Equity includes preferred equity, common equity, and retained earnings.

Income Statement

- Summarizes a company's financial performance over a period of time.

- Revenues/sales: Increases in capital from sales.

- Expenses: Decreases due to sales activities (e.g., COGS, general and administrative expenses).

- Shows net income or earnings after tax (EAT/NI) and earnings before tax (EBT).

Statement of Retained Earnings

- Tracks the distribution of income.

- Affected by dividend policies.

Statement of Cash Flows

- Presents actual cash generated over a period.

- Categorized into operating activities, investing activities, and financing activities.

Market and Per Share Data (Example: Mekar Inc)

- Presents share outstanding, earnings per share (EPS), dividends per share (DPS), and closing market price data for a specific company (Mekar Inc) for different years.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.