Podcast

Questions and Answers

The cash flow statement represents how much cash has been generated over a period of time.

The cash flow statement represents how much cash has been generated over a period of time.

True (A)

All of the options mentioned are characteristics of the cash flow statement.

All of the options mentioned are characteristics of the cash flow statement.

False (B)

A functional cash flow statement separates cash flows by type of household activity.

A functional cash flow statement separates cash flows by type of household activity.

True (A)

Operating activities refer to the cash left over after all financial activities.

Operating activities refer to the cash left over after all financial activities.

Capital expenditures provide benefit beyond the current year.

Capital expenditures provide benefit beyond the current year.

Financing activities are defined as outlays on household related matters.

Financing activities are defined as outlays on household related matters.

The day-to-day financial functions of a household are termed financing activities.

The day-to-day financial functions of a household are termed financing activities.

Savings can be defined as additions or subtractions from debt.

Savings can be defined as additions or subtractions from debt.

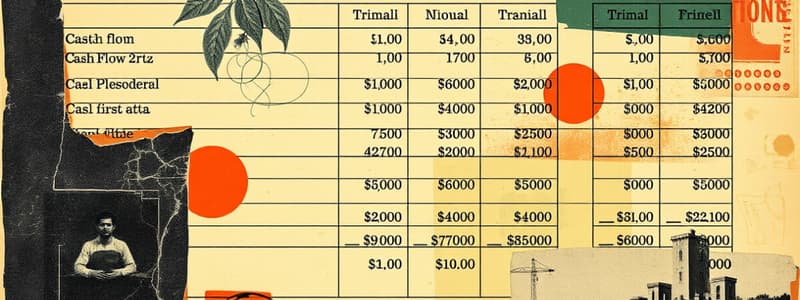

Total assets amount to $397,050.

Total assets amount to $397,050.

Total liabilities are $240,000.

Total liabilities are $240,000.

Equity is derived from total assets minus total liabilities.

Equity is derived from total assets minus total liabilities.

Capital expenditures are typically involved in purchasing or improving long-term assets.

Capital expenditures are typically involved in purchasing or improving long-term assets.

Financing activities only include the acquisition of inventory.

Financing activities only include the acquisition of inventory.

Operating activities in households consist of regular daily transactions like income and expenses.

Operating activities in households consist of regular daily transactions like income and expenses.

Functional cash flow statements do not differentiate between types of cash transactions.

Functional cash flow statements do not differentiate between types of cash transactions.

Investments total $39,800.

Investments total $39,800.

Household equity is reported at $150,000.

Household equity is reported at $150,000.

Liabilities include both short-term and long-term obligations.

Liabilities include both short-term and long-term obligations.

Cash flow statements primarily focus on the inflow and outflow of cash in an organization.

Cash flow statements primarily focus on the inflow and outflow of cash in an organization.

Functional cash flow statements exclude operating activities.

Functional cash flow statements exclude operating activities.

Payments for mortgage interest are considered operating activities in household cash flow.

Payments for mortgage interest are considered operating activities in household cash flow.

Capital expenditures refer to investments in physical assets that improve or extend the life of an existing asset.

Capital expenditures refer to investments in physical assets that improve or extend the life of an existing asset.

Financing activities include transactions like issuing stock and borrowing money.

Financing activities include transactions like issuing stock and borrowing money.

The cash flow statement for a household includes only cash transactions.

The cash flow statement for a household includes only cash transactions.

Capital expenditures should be recorded as an expense on the cash flow statement.

Capital expenditures should be recorded as an expense on the cash flow statement.

Operating activities in households typically include expenses related to food and clothing.

Operating activities in households typically include expenses related to food and clothing.

Financing activities include transactions related to the purchase of a car.

Financing activities include transactions related to the purchase of a car.

Depreciation refers to the decrease in asset value over time due to wear and tear.

Depreciation refers to the decrease in asset value over time due to wear and tear.

Household cash flow statements are similar to business income statements because they both report profit.

Household cash flow statements are similar to business income statements because they both report profit.

Functional cash flow statements emphasize the sources and uses of cash for operational activities.

Functional cash flow statements emphasize the sources and uses of cash for operational activities.

Charitable contributions are typically considered operating activities in household cash flow statements.

Charitable contributions are typically considered operating activities in household cash flow statements.

All financing activities impact the balance sheet but do not affect cash flow.

All financing activities impact the balance sheet but do not affect cash flow.

Inflation rates are typically irrelevant when projecting household operating activities.

Inflation rates are typically irrelevant when projecting household operating activities.

Flashcards are hidden until you start studying

Study Notes

Cash Flow Statement Characteristics

- Key measurement of household financial performance.

- Reflects cash generated over a specific timeframe.

- Includes all financial operations needing resources.

- Can be complex to understand and measure.

Functional Cash Flow Statement

- Separates cash flows by specific household activity types.

- Distinguishes between activities by household member.

- Differentiates cash flows related to discretionary vs. nondiscretionary expenses.

- Simplifies analysis by summarizing actual cash flow.

Operating Activities

- Relate to everyday financial functions of the household.

- Not concerned with outlays that benefit beyond the current year.

- Focus on cash generated from daily expenses.

Capital Expenditures

- Include expenditures that provide benefits over multiple years.

- Not involved in day-to-day financial operations.

- Different from cash flows stemming from debt changes.

Financing Activities

- Concerned with cash flows resulting from changes in debt.

- Not related to regular operating functions or expenditures.

- Distinct from cash left after covering operating and capital activities.

Savings

- Refer to the funds accumulated from income after expenses.

- Pertains to investments and obligations settled over time.

Accounting Principles

- GAAP dictates how household and business performances are recorded differently.

- Household results focus on cash flows whereas business results are reported through income statements.

- Depreciation is the anticipated reduction in asset value over time.

Depreciation

- Reflects value loss due to wear and tear or obsolescence.

- Not a non-tax deductible household income expense.

- Recorded as an expense, affecting financial statements.

Household vs. Business Accounting

- Households record cash matters exclusively, contrasting with businesses that report both cash and non-cash transactions.

- All statements about differences between household and business reporting methods hold true.

Dorothy's Household Balance Sheet Construction

- Assets include cash, stocks, bonds, valuable personal property.

- Liabilities consist of credit card payments and mortgage obligations.

- Total assets and liabilities need to balance as per accounting standards.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.