Podcast

Questions and Answers

What is the formula to calculate Earnings Per Share (EPS)?

What is the formula to calculate Earnings Per Share (EPS)?

EPS = (Earnings After Tax - Preference Dividends) / No. of Equity Shares

In the given scenario, how much is the total equity share capital of GD Ltd?

In the given scenario, how much is the total equity share capital of GD Ltd?

Rs. 5,00,000

What is the tax rate used in the calculation of EPS?

What is the tax rate used in the calculation of EPS?

50%

Which financial scheme resulted in the highest EPS?

Which financial scheme resulted in the highest EPS?

What is the effect of including preference shares on the EPS in Plan D?

What is the effect of including preference shares on the EPS in Plan D?

What is the significance of EBIT in the calculation of EPS?

What is the significance of EBIT in the calculation of EPS?

How is the Price Earnings ratio calculated?

How is the Price Earnings ratio calculated?

What is the formula for calculating EPS?

What is the formula for calculating EPS?

What are the three financing alternatives available for the company's expansion program?

What are the three financing alternatives available for the company's expansion program?

How does the company's capital structure break down based on the given information?

How does the company's capital structure break down based on the given information?

What is the impact of tax rate on the company's earnings?

What is the impact of tax rate on the company's earnings?

How does the company's earnings before interest and tax (EBIT) affect the financing decision?

How does the company's earnings before interest and tax (EBIT) affect the financing decision?

Calculate the EPS when the entire capital is raised through equity shares of Rs. 100 each.

Calculate the EPS when the entire capital is raised through equity shares of Rs. 100 each.

Calculate the EPS when 50% is raised from equity shares and 50% is raised through 10% debentures.

Calculate the EPS when 50% is raised from equity shares and 50% is raised through 10% debentures.

Calculate the EPS when 50% is raised through 10% debentures, 20% through 9% preference shares, and the balance through equity shares.

Calculate the EPS when 50% is raised through 10% debentures, 20% through 9% preference shares, and the balance through equity shares.

Why is Case-C preferred based on EPS?

Why is Case-C preferred based on EPS?

If 12.A Ltd. company has a share capital of 1,00,000 divided into shares of Rs.10 each, and requires an additional investment of Rs. 50,000, how might it finance this expansion?

If 12.A Ltd. company has a share capital of 1,00,000 divided into shares of Rs.10 each, and requires an additional investment of Rs. 50,000, how might it finance this expansion?

How does the tax rate of 40% impact the Earnings after tax (EAT) and subsequently the EPS?

How does the tax rate of 40% impact the Earnings after tax (EAT) and subsequently the EPS?

Flashcards

Earnings Per Share (EPS)

Earnings Per Share (EPS)

Profit earned per outstanding share of stock.

Total Equity Share Capital

Total Equity Share Capital

Number of shares multiplied by their face value.

Tax Rate in EPS

Tax Rate in EPS

Percentage of earnings paid as taxes.

Earnings Before Interest and Taxes (EBIT)

Earnings Before Interest and Taxes (EBIT)

Net profit before interest and taxes; indicates operational profitability.

Signup and view all the flashcards

Price Earnings (P/E) Ratio

Price Earnings (P/E) Ratio

Share price relative to its per-share earnings.

Signup and view all the flashcards

Financing Alternatives for Expansion

Financing Alternatives for Expansion

Issuing equity, debentures, or preference shares to help a company grow.

Signup and view all the flashcards

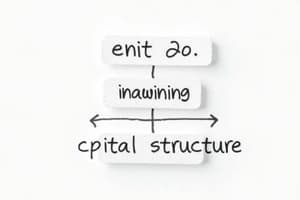

Company’s Capital Structure

Company’s Capital Structure

Mix of equity, preference shares, and debt a company uses.

Signup and view all the flashcards

Earnings After Tax (EAT)

Earnings After Tax (EAT)

Net profit after all expenses, interest, and taxes are paid.

Signup and view all the flashcards

Influence of EBIT on Financing Decisions

Influence of EBIT on Financing Decisions

EBIT affects if a company will get money from shares or loans.

Signup and view all the flashcards

EPS with Fully Equity Funding

EPS with Fully Equity Funding

Calculating EPS when all money comes from stocks.

Signup and view all the flashcards

EPS with Mixed Funding

EPS with Mixed Funding

Calculating EPS when some money comes from stocks, some from loans.

Signup and view all the flashcards

Preference Shares Effect on EPS

Preference Shares Effect on EPS

Dividends paid to preference shareholders decrease profit available for EPS.

Signup and view all the flashcards

Impact of Tax Rate on Earnings

Impact of Tax Rate on Earnings

A higher tax rate reduces the EAT, which then reduces the EPS.

Signup and view all the flashcards

Financing Expansion Scenario

Financing Expansion Scenario

Money is needed to help a business get bigger.

Signup and view all the flashcards

Preference Shares Effect on EPS

Preference Shares Effect on EPS

Fixed dividend payments on these shares reduce earnings for common shareholders.

Signup and view all the flashcards

Effect of Preference Shares

Effect of Preference Shares

Fixed dividend payment on preference share reduces EPS for shareholders.

Signup and view all the flashcards

Effect of 40% Tax Rate on EAT

Effect of 40% Tax Rate on EAT

Application of 40% tax on earnings.

Signup and view all the flashcards

Fixed Costs associated with preference dividends

Fixed Costs associated with preference dividends

Fixed payments dilute earnings available to shareholders.

Signup and view all the flashcardsStudy Notes

Earnings Per Share (EPS) Calculation

- Formula: EPS = (Net Income - Preferred Dividends) / Average Outstanding Shares

- It is a key metric for evaluating a company's profitability on a per-share basis.

Total Equity Share Capital of GD Ltd

- Total equity share capital is determined by multiplying the number of shares by their nominal value, providing insight into the company's financial structure.

Tax Rate in EPS Calculation

- A tax rate of 40% is commonly used in EPS calculations, impacting the net income available for shareholders.

Financial Scheme and EPS

- Various financial schemes can result in differing EPS values, with some combinations of equity and debt leading to higher EPS due to lower interest costs or more efficient capital use.

Preference Shares Effect on EPS in Plan D

- Including preference shares generally dilutes the EPS as fixed dividends are paid, reducing the income available for ordinary shareholders.

Significance of EBIT

- Earnings Before Interest and Taxes (EBIT) is critical as it reflects a company's operational performance without the effects of capital structure and tax strategy.

Price Earnings (P/E) Ratio Calculation

- P/E Ratio = Market Price per Share / Earnings Per Share (EPS)

- This ratio measures investor expectations and relative valuation.

Financing Alternatives for Expansion

- Common alternatives include issuing equity shares, debentures, or preference shares, each influencing capital structure and EPS differently.

Company’s Capital Structure Breakdown

- The capital structure may include a mix of equity, preference shares, and debt instruments, which helps in understanding the risk and return dynamics.

Impact of Tax Rate on Earnings

- A higher tax rate reduces Earnings After Tax (EAT), which in turn decreases the EPS, affecting investor perception and valuation.

Influence of EBIT on Financing Decisions

- Higher EBIT implies greater capacity to service debt, influencing decisions on whether to raise funds through equity or debt.

EPS Calculation Scenarios

- EPS using fully equity funding: Calculation based on total profits available to equity shareowners, reflecting potential maximum EPS.

- EPS with mixed funding (50% equity, 50% debentures): Interest expenses reduce taxable income, affecting overall EPS.

- EPS with debentures, preference shares, and equity funding: Further dilution of earnings through fixed costs associated with preference dividends and interest on debentures.

Preference for Case-C Based on EPS

- A particular financing option, Case-C, may yield the highest EPS, indicating a more favorable outcome for shareholders.

A Ltd’s Financing Expansion Scenario

- With a share capital of Rs. 1,00,000 divided into Rs. 10 shares and requiring an additional Rs. 50,000, options may include issuing more shares, taking loans, or other financing routes.

Effect of 40% Tax Rate on Earnings After Tax (EAT)

- The application of a 40% tax rate will significantly decrease EAT, affecting the net income available for distribution as dividends, directly impacting EPS calculations.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.