Podcast

Questions and Answers

Which bank is considered the world's oldest still operating bank?

Which bank is considered the world's oldest still operating bank?

- Banco di Sicilia

- Banca Popolare di Milano

- Monte dei Paschi di Siena (correct)

- Casa delle compere e dei banchi di San Giorgio

Which function of banks involves the management of potential financial risks?

Which function of banks involves the management of potential financial risks?

- Processing information

- Offering liquidity and payment services

- Transforming assets

- Managing risk (correct)

The Casa delle compere e dei banchi di San Giorgio is known for which significant milestone in banking?

The Casa delle compere e dei banchi di San Giorgio is known for which significant milestone in banking?

- Being the first modern bank in public form (correct)

- Introducing the concept of credit scores

- Being the first bank to offer savings accounts

- Creating the first stock exchange

What role do financial intermediaries primarily serve?

What role do financial intermediaries primarily serve?

Which of the following is NOT one of the major functions of banks?

Which of the following is NOT one of the major functions of banks?

What is the primary role of a bank within the financial intermediary system?

What is the primary role of a bank within the financial intermediary system?

What does the fractional reserves banking model imply about a bank's assets and liabilities?

What does the fractional reserves banking model imply about a bank's assets and liabilities?

Which of the following accurately describes the implications of fractional reserve banking?

Which of the following accurately describes the implications of fractional reserve banking?

What risks are associated with the fractional reserves banking model?

What risks are associated with the fractional reserves banking model?

In the context of the Goldsmith anecdote, what serves as the medium of exchange?

In the context of the Goldsmith anecdote, what serves as the medium of exchange?

How do banks fund themselves according to the fractional reserve model?

How do banks fund themselves according to the fractional reserve model?

What does qualitative asset transformation refer to in the banking sector?

What does qualitative asset transformation refer to in the banking sector?

Why is the fractional reserve banking system considered potentially unstable?

Why is the fractional reserve banking system considered potentially unstable?

What is the value of M0 after deposits have been made at three different banks?

What is the value of M0 after deposits have been made at three different banks?

What total amount represents M1 after the deposits at the three banks?

What total amount represents M1 after the deposits at the three banks?

How does the fractional reserves banking model affect the money supply?

How does the fractional reserves banking model affect the money supply?

Which bank has the highest amount in loans in the given model?

Which bank has the highest amount in loans in the given model?

What is the role of central banks in relation to money supply?

What is the role of central banks in relation to money supply?

Which function of money allows it to transfer purchasing power from the present to the future?

Which function of money allows it to transfer purchasing power from the present to the future?

What characterized the transition from a barter economy to the use of money?

What characterized the transition from a barter economy to the use of money?

The introduction of which form of money marked a significant shift in the evolution of value exchange around 0 AD?

The introduction of which form of money marked a significant shift in the evolution of value exchange around 0 AD?

What is the primary role of banks in the evolution of modern banking?

What is the primary role of banks in the evolution of modern banking?

Which of the following best describes the nature of fiat money?

Which of the following best describes the nature of fiat money?

Which of the following forms of money allows for transactions without physical bank notes since 2009?

Which of the following forms of money allows for transactions without physical bank notes since 2009?

Which statement accurately describes the evolution of money from gold coins?

Which statement accurately describes the evolution of money from gold coins?

Which option describes an important feature of using credit cards in finance?

Which option describes an important feature of using credit cards in finance?

What is the primary service provided by goldsmiths in the context of gold storage?

What is the primary service provided by goldsmiths in the context of gold storage?

What consequence arises from the confidence in the goldsmith's ability to redeem warehouse receipts?

What consequence arises from the confidence in the goldsmith's ability to redeem warehouse receipts?

What happens to the volatility of goldsmiths' inventories as the use of receipts increases?

What happens to the volatility of goldsmiths' inventories as the use of receipts increases?

What is the main risk associated with goldsmiths issuing extra receipts backed by gold?

What is the main risk associated with goldsmiths issuing extra receipts backed by gold?

What transformation service do goldsmiths provide through the issuance of receipt-backed loans?

What transformation service do goldsmiths provide through the issuance of receipt-backed loans?

Which factor primarily limits the number of extra receipts a goldsmith can issue?

Which factor primarily limits the number of extra receipts a goldsmith can issue?

What type of service do goldsmiths provide by allowing the lending of extra receipts to borrowers?

What type of service do goldsmiths provide by allowing the lending of extra receipts to borrowers?

What is a crucial understanding for the owner of gold when receiving a warehouse receipt?

What is a crucial understanding for the owner of gold when receiving a warehouse receipt?

What situation could lead to a bank run in relation to goldsmiths?

What situation could lead to a bank run in relation to goldsmiths?

What is implied about the relationship between warehouse receipts and physical gold over time?

What is implied about the relationship between warehouse receipts and physical gold over time?

What is the primary function of a central bank acting as a lender of last resort?

What is the primary function of a central bank acting as a lender of last resort?

How does the introduction of a central bank with unlimited capacity introduce moral hazard?

How does the introduction of a central bank with unlimited capacity introduce moral hazard?

In the fractional reserves banking model, what constitutes the money multiplier?

In the fractional reserves banking model, what constitutes the money multiplier?

Why is deposit insurance scheme important in the banking system?

Why is deposit insurance scheme important in the banking system?

What is the main drawback of the fractional reserve banking model?

What is the main drawback of the fractional reserve banking model?

What does a 10% reserve ratio imply for a bank's lending capacity?

What does a 10% reserve ratio imply for a bank's lending capacity?

What is the social convention that gives money its value in the economy?

What is the social convention that gives money its value in the economy?

What is a potential consequence of the absence of prudential regulation in banking?

What is a potential consequence of the absence of prudential regulation in banking?

Flashcards

Bartering

Bartering

The exchange of goods or services directly for other goods or services, without using money.

Physical goods as money

Physical goods as money

Physical objects like livestock, grain, or precious metals used as a means of exchange.

Commodity money

Commodity money

A system where the value of money is based on its intrinsic worth, like gold or silver.

Fiat money

Fiat money

Signup and view all the flashcards

Liquidity

Liquidity

Signup and view all the flashcards

Store of value

Store of value

Signup and view all the flashcards

Unit of account

Unit of account

Signup and view all the flashcards

Medium of exchange

Medium of exchange

Signup and view all the flashcards

Financial intermediaries

Financial intermediaries

Signup and view all the flashcards

Money exchange

Money exchange

Signup and view all the flashcards

Banks' role in the economy

Banks' role in the economy

Signup and view all the flashcards

Asset transformation

Asset transformation

Signup and view all the flashcards

Bank

Bank

Signup and view all the flashcards

Fractional Reserve Banking

Fractional Reserve Banking

Signup and view all the flashcards

Bankruptcy

Bankruptcy

Signup and view all the flashcards

Bank Run

Bank Run

Signup and view all the flashcards

Loan

Loan

Signup and view all the flashcards

Deposit

Deposit

Signup and view all the flashcards

Reserve Requirement

Reserve Requirement

Signup and view all the flashcards

Bank Failure

Bank Failure

Signup and view all the flashcards

Lender of last resort

Lender of last resort

Signup and view all the flashcards

Deposit insurance

Deposit insurance

Signup and view all the flashcards

Moral hazard with central banks

Moral hazard with central banks

Signup and view all the flashcards

Prudential regulation

Prudential regulation

Signup and view all the flashcards

Money Multiplier

Money Multiplier

Signup and view all the flashcards

Money creation process

Money creation process

Signup and view all the flashcards

Goldsmith Receipts

Goldsmith Receipts

Signup and view all the flashcards

Fractional Reserve System

Fractional Reserve System

Signup and view all the flashcards

Goldsmith Receipts as Medium of Exchange

Goldsmith Receipts as Medium of Exchange

Signup and view all the flashcards

Goldsmith Lending

Goldsmith Lending

Signup and view all the flashcards

Liquidity Transformation

Liquidity Transformation

Signup and view all the flashcards

Bankruptcy Risk

Bankruptcy Risk

Signup and view all the flashcards

Over-Issuing Receipts

Over-Issuing Receipts

Signup and view all the flashcards

Confidence in Goldsmith

Confidence in Goldsmith

Signup and view all the flashcards

Evolution of Banking

Evolution of Banking

Signup and view all the flashcards

Study Notes

Banking and Finance Fundamentals

- The presentation covers the evolution of value exchange, from bartering to credit cards and online payments.

- Early methods of exchange included bartering (6000 BC), physical goods (2000 BC), gold and coins (600 BC), fiat money (0), and credit cards (1950).

- Automated Clearing House (ACH) emerged in 1972.

- ATMs were introduced in 1984.

- Online payments became prevalent from 1995.

Functions of Money

- Money serves as a store of value, transferring purchasing power from the present to the future.

- Money acts as a unit of account, providing a standard for quoting and stating prices.

- Money facilitates exchange as a medium, streamlining transactions compared to bartering.

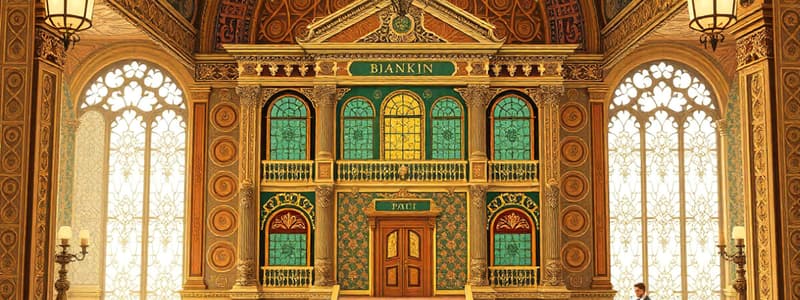

Origins of Modern Banking

- Banks play a crucial role in offering liquidity and payment services.

- Banks transitioned from commodity-based mediums like gold coins to mediums guaranteed by institutions.

- Casa delle compere e dei banchi di San Giorgio in Genoa (1407) is identified as the first modern public bank.

- Monte dei Paschi di Siena (1472) is the world's oldest bank still operating.

Banks' Special Role in the Economy

- Banks are vital for allocating capital in the economy.

- Key functions of banks include offering liquidity and payment services, transforming assets, managing risk, and processing information.

Financial Intermediation

- Financial intermediaries facilitate the flow of funds between providers (like households) and users (like corporations) of financial capital.

- Brokerage and qualitative asset transformation are key functions of financial intermediaries.

- Banks are a specialised type of intermediary, taking deposits and making loans as their core function.

Fractional Reserve Banking Model

- Banks hold a fraction of deposits as reserves.

- Deposits are liabilities, and loans are assets for the bank.

- The possibility of withdrawals exceeding available cash creates inherent risks for the system.

- The Goldsmith anecdote illustrates the concept of fractional reserve banking, and the initial social contracts allowing for the acceptability of receipts as a form of money.

- Issues like risk of runs, the need for deposit protection schemes, central banks as lenders of last resort, the need for prudential regulation, are important.

- There is a money multiplier effect. (e.g., a $100 deposit can lead to more than $100 in circulation within the banking system)

- Central banks manage money supply and costs via reserve requirements, key policy rates, open market operations and other tools (e.g., quantitative easing).

- Independent central bank operation is recommended.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.