Podcast

Questions and Answers

What is another term for Paid in Capital in Excess of Par?

What is another term for Paid in Capital in Excess of Par?

- Investment

- Retained Earnings

- Common Stock

- Additional Paid in Capital (correct)

What is the definition of preferred stock?

What is the definition of preferred stock?

Capital stock

What is capital stock?

What is capital stock?

Common stock

What type of asset is Accounts Receivable?

What type of asset is Accounts Receivable?

What type of asset is Accrued Interest on Bond Receivable?

What type of asset is Accrued Interest on Bond Receivable?

What type of asset is Accrued Interest on Notes Receivable?

What type of asset is Accrued Interest on Notes Receivable?

What type of asset are Advances to suppliers?

What type of asset are Advances to suppliers?

What is the classification of Allowance for Doubtful Accounts?

What is the classification of Allowance for Doubtful Accounts?

Inventory is classified as what type of asset?

Inventory is classified as what type of asset?

What type of asset does Machinery retired from use and held for sell belong to?

What type of asset does Machinery retired from use and held for sell belong to?

Merchandise Inventory falls under which category?

Merchandise Inventory falls under which category?

What type of asset is Notes Receivable?

What type of asset is Notes Receivable?

What type of asset is Office Supplies?

What type of asset is Office Supplies?

What type of asset is Petty Cash?

What type of asset is Petty Cash?

What type of asset is Prepaid Insurance?

What type of asset is Prepaid Insurance?

Trading Securities are classified as what type of asset?

Trading Securities are classified as what type of asset?

What type of liability is Accrued Interest on Notes Payable?

What type of liability is Accrued Interest on Notes Payable?

What type of liability are wages payable?

What type of liability are wages payable?

What classification does trade accounts payable fall under?

What classification does trade accounts payable fall under?

Notes payable that are due next year are classified as what?

Notes payable that are due next year are classified as what?

What type of liability are taxes payable?

What type of liability are taxes payable?

What type of liability is Discount Payable?

What type of liability is Discount Payable?

Unearned rent revenue falls under which category?

Unearned rent revenue falls under which category?

What type of asset is described as copyrights?

What type of asset is described as copyrights?

Goodwill is classified as what type of asset?

Goodwill is classified as what type of asset?

What is the definition of patents?

What is the definition of patents?

What type of asset is classified as property, plant, and equipment?

What type of asset is classified as property, plant, and equipment?

What type of asset is defined as Land held for future use?

What type of asset is defined as Land held for future use?

What type of liability does the term Preferred Stock represent?

What type of liability does the term Preferred Stock represent?

What is common stock?

What is common stock?

What is accumulated depreciation?

What is accumulated depreciation?

Salaries the company budget shows will be paid to employees within the next year should be reported in the balance sheet.

Salaries the company budget shows will be paid to employees within the next year should be reported in the balance sheet.

Flashcards are hidden until you start studying

Study Notes

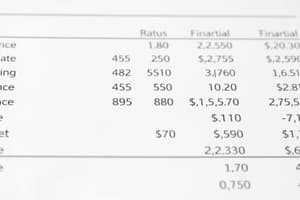

Balance Sheet Classification

-

Paid in Capital in Excess of Par refers to Additional Paid in Capital, indicating funds received over the par value of stocks.

-

Preferred Stock is a type of capital stock often with fixed dividends and priority over common stock in asset liquidation.

-

Capital Stock encompasses Common Stock, representing ownership shares in a company.

Current Assets

-

Accounts Receivable consists of amounts owed by customers for goods or services delivered but not yet paid for.

-

Accrued Interest on Bond Receivable indicates interest that has accumulated on bonds held but not yet received.

-

Accrued Interest on Notes Receivable refers to earned but unpaid interest on promissory notes.

-

Advances to Suppliers reflect payments made in advance for goods or services to be received in the future.

-

Allowance for Doubtful Accounts is a contra-asset account that estimates future uncollectible accounts receivable.

-

Inventory includes all goods available for sale and is classified as a current asset.

-

Machinery Retired from Use and Held for Sale is treated as a current asset until sold.

-

Merchandise Inventory specifically refers to goods held for resale.

-

Notes Receivable represent written promises to pay a certain sum of money at a future date.

-

Office Supplies are items purchased for use in business operations, categorized as current assets.

-

Petty Cash is a small amount of cash on hand used for minor transactions.

-

Prepaid Insurance denotes insurance premiums paid in advance and recognized as current assets.

-

Trading Securities are investments expected to be converted to cash within the year, classified as current assets.

Current Liabilities

-

20-Year Bonds Payable maturing within the next year are considered current liabilities if no sinking fund exists.

-

Accrued Interest on Bond Payable signifies interest payable on bonds that has been incurred but not yet paid.

-

Wages Payable reflects salaries owed to employees but not yet disbursed.

-

Trade Accounts Payable represent amounts owed to suppliers for goods and services purchased on credit.

-

Current Portion of Long-Term Debt is the amount of debt due within the next year from long-term borrowings.

-

Notes Payable due within a year indicate short-term obligations taken on by the company.

-

Taxes Payable consists of tax obligations a company must remit to the government.

-

Discount Payable relates to bonds payable and represents the discount on bond issuance yet to be amortized.

-

Sales Tax Payable is the sales tax collected from customers that has not yet been remitted to the tax authority.

-

Unearned Rent Revenue is received in advance for services that have not yet been rendered.

-

Unearned Subscription Revenue reflects income received from subscriptions that will be recognized in future periods.

-

Accrued Vacation Pay represents vacation pay owed to employees for earned time off not yet taken.

-

Dividends Payable indicates dividends that have been declared but not yet paid to shareholders.

Intangible Assets

-

Copyrights protect original works of authorship and are classified as intangible assets.

-

Goodwill arises from the acquisition of one company by another and represents brand reputation and customer loyalty.

-

Patents give exclusive rights to inventions or processes for a specified period.

Investments

-

Bond Sinking Fund is set aside by a company to pay off debt obligations.

-

Cash Surrender Value of Life Insurance represents the amount a policyholder would receive upon terminating their policy.

-

Land Held for Future Use indicates land owned for investment purposes or future development.

-

Stock Owned in Affiliated Companies represents investments in the stock of other companies.

Long-Term Liabilities

-

Premium on Bonds Payable reflects the additional amount received over the face value of bonds.

-

Bonds Payable are long-term debts that must be repaid at their maturity date.

-

Discount on Bond Payable represents a reduction in the bond’s face value due to issuance below par.

Owner’s Equity

-

Preferred Stock provides dividends and has priority over common stock in asset distribution.

-

Common Stock represents residual ownership in a company after all debts and preferred shares have been accounted for.

-

Additional Paid-In Capital on Preferred Stock refers to funds received above the par value of preferred shares.

Property, Plant, and Equipment (PPE)

-

Fully Depreciated Machine Still in Use should be reported in notes to the financial statements despite having no remaining book value.

-

Accumulated Depreciation reflects the total depreciation expense noted for fixed assets.

-

Buildings and Land are significant assets classified as property, plant, and equipment necessary for operations.

Unique Classifications

-

Deficits in retained earnings indicate accumulated losses over profits.

-

Treasury Stock represents shares that were repurchased by the company and are held in its treasury.

Reporting Guidelines

- Salaries projected to be paid to employees within the next year should not be reported in the balance sheet as liabilities.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.