Podcast

Questions and Answers

What is the basic accounting equation?

What is the basic accounting equation?

- Assets = Liabilities + Shareholders’ Equity (correct)

- Shareholders’ Equity = Assets - Liabilities

- Liabilities = Assets + Shareholders’ Equity

- Assets + Shareholders’ Equity = Liabilities

When can a firm recognize a resource as an asset?

When can a firm recognize a resource as an asset?

- If it predicts the future benefits will be high

- Only if the firm has acquired rights to its use through a past transaction (correct)

- If it is classified as a current asset

- Whenever the firm intends to utilize it

Which of the following is NOT a method of asset valuation?

Which of the following is NOT a method of asset valuation?

- Market value at acquisition (correct)

- Present value of future net cash flows

- Current replacement cost

- Net realizable value

What is an example of a classification of assets?

What is an example of a classification of assets?

What defines an asset?

What defines an asset?

In what context is the term 'dual-entry recording' important?

In what context is the term 'dual-entry recording' important?

Which of the following liabilities is generally due within one year?

Which of the following liabilities is generally due within one year?

What distinguishes 'current assets' from other types of assets?

What distinguishes 'current assets' from other types of assets?

What must occur for an obligation to be recognized as a liability?

What must occur for an obligation to be recognized as a liability?

Which method is typically used to value liabilities due within a year?

Which method is typically used to value liabilities due within a year?

What distinguishes current liabilities from long-term liabilities?

What distinguishes current liabilities from long-term liabilities?

Which of the following is considered part of shareholders' equity?

Which of the following is considered part of shareholders' equity?

What is the relationship between total assets, total liabilities, and shareholders' equity?

What is the relationship between total assets, total liabilities, and shareholders' equity?

Which component is NOT part of Contributed Capital?

Which component is NOT part of Contributed Capital?

How is Additional Paid-In Capital defined?

How is Additional Paid-In Capital defined?

Which of these statements about liabilities is correct?

Which of these statements about liabilities is correct?

What is the impact on cash when the company issues 10,000 shares?

What is the impact on cash when the company issues 10,000 shares?

What type of account is affected when inventory is purchased on account?

What type of account is affected when inventory is purchased on account?

What is the definition of a debit in accounting?

What is the definition of a debit in accounting?

How are journal entries related to the ledger?

How are journal entries related to the ledger?

What occurs when a supplier is paid in cash for a portion of the amount owed?

What occurs when a supplier is paid in cash for a portion of the amount owed?

What is recorded on the right side of a journal entry?

What is recorded on the right side of a journal entry?

What is shown in a T-Account?

What is shown in a T-Account?

When a customer pays for merchandise to be delivered in the future, what happens to accounts?

When a customer pays for merchandise to be delivered in the future, what happens to accounts?

How are retained earnings affected by the payment of dividends to shareholders?

How are retained earnings affected by the payment of dividends to shareholders?

What is the formula to calculate ending retained earnings for an accounting period?

What is the formula to calculate ending retained earnings for an accounting period?

Which of the following represents a valid combination of effects on the accounting equation?

Which of the following represents a valid combination of effects on the accounting equation?

In the dual-entry recording framework, what must every economic event reflect?

In the dual-entry recording framework, what must every economic event reflect?

What impact does a positive net income have on retained earnings?

What impact does a positive net income have on retained earnings?

When a company issues new shares for cash, what is the immediate effect on the accounting equation?

When a company issues new shares for cash, what is the immediate effect on the accounting equation?

If a company pays $8,000 cash to suppliers of a total $15,000 owed, what effect does this transaction have?

If a company pays $8,000 cash to suppliers of a total $15,000 owed, what effect does this transaction have?

In the basic accounting equation, what is meant by maintaining balance?

In the basic accounting equation, what is meant by maintaining balance?

What is the purpose of journalizing in the accounting process?

What is the purpose of journalizing in the accounting process?

Which statement is true regarding the balance sheet?

Which statement is true regarding the balance sheet?

In which stage of the accounting process is the trial balance prepared?

In which stage of the accounting process is the trial balance prepared?

What do owners expect from management concerning the assets?

What do owners expect from management concerning the assets?

What is involved in the preparation of adjustments in the accounting process?

What is involved in the preparation of adjustments in the accounting process?

The asset side of the balance sheet provides information about what?

The asset side of the balance sheet provides information about what?

What comes after the preparation of the unadjusted trial balance in the accounting process?

What comes after the preparation of the unadjusted trial balance in the accounting process?

What is the final goal of the accounting process?

What is the final goal of the accounting process?

Flashcards are hidden until you start studying

Study Notes

Balance Sheet Basics

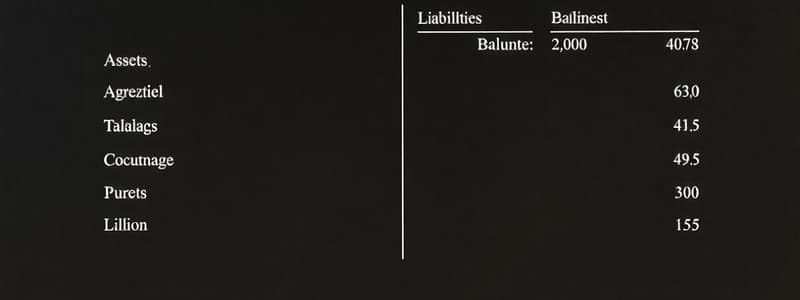

- The balance sheet presents the accounting concepts of assets, liabilities, and shareholders' equity.

- It explains the dual-entry recording framework, where every transaction has two sides.

Assets

- Assets are resources with future economic benefit acquired through past transactions.

- Valuation is the process of assigning monetary value to assets.

- Common asset valuation methods include historical cost, current replacement cost, net realizable value, and present value of future net cash flows.

- Assets are classified into categories like current assets, investments, property, plant and equipment, and intangible assets.

Liabilities

- Liabilities arise from receiving benefits and promising to pay in the future.

- Liabilities are valued at the amount of cash payment for short-term liabilities and at the net present value of future cash payments for long-term liabilities.

- Liabilities are categorized into current liabilities, long-term debt, and other long-term liabilities.

Shareholders' Equity

- Shareholders' equity represents the residual interest in the firm after liabilities are satisfied.

- It's calculated as total assets minus total liabilities.

- Shareholders' equity is divided into contributed capital (initial investment) and retained earnings (accumulated earnings after dividends).

- Contributed capital is comprised of par or stated value and additional paid-in capital.

- Retained earnings increase with net income, decrease with losses, and are reduced by dividend payments.

- The accounting equation for a period is: Beginning Retained Earnings + Net Income (or - Net Losses) - Dividends Declared = Ending Retained Earnings.

Dual-Entry Recording

- Every economic event has two sides, a give and a take.

- Transactions are recorded with both sides, ensuring that the basic accounting equation remains balanced.

- Transactions can increase an asset and a liability/equity by the same amount.

- Alternatively, they can decrease an asset and a liability/equity.

- Transactions can also involve an increase in one asset and a decrease in another.

- Finally, transactions may result in an increase in one liability/equity and a decrease in another.

Debits and Credits

- Debits increase assets and decrease liabilities or owners’ equity.

- Credits increase liabilities or owners’ equity and decrease assets.

- For all transactions and the basic equation, Debits = Credits.

Journal Entries and Ledger

- Accountants use journal entries to record transactions.

- Journal entries show the accounts and their debits or credits.

- The ledger summarizes changes to individual accounts, often represented using T-accounts.

Balance Sheet Analysis

- The balance sheet reflects the effects of a firm’s investing and financing decisions.

- The asset side shows the resources available to the firm.

- Owners expect management to use these assets efficiently.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.