Podcast

Questions and Answers

Which of the following is the MOST direct way an organization assesses its current standing?

Which of the following is the MOST direct way an organization assesses its current standing?

- Reviewing historical financial data and comparing against benchmarks (correct)

- Implementing new productivity measures

- Analyzing competitor strategies

- Conducting employee satisfaction surveys

A company's vision is BEST described as:

A company's vision is BEST described as:

- What the organization aspires to become. (correct)

- A detailed operational plan for the next fiscal year.

- A report on the current financial performance.

- A statement of the organization's core values.

When an organization's vision and mission statements align, it typically results in:

When an organization's vision and mission statements align, it typically results in:

- Decreased employee engagement as goals become too rigid.

- Confusion among stakeholders due to mixed messaging.

- A clear understanding of the organization's direction and purpose. (correct)

- Duplication of effort, wasting resources.

Which aspect of the Balanced Scorecard directly addresses how the organization aims to sustain improvement and create value?

Which aspect of the Balanced Scorecard directly addresses how the organization aims to sustain improvement and create value?

How does 'Market Share' BEST assist in understanding a firm's position?

How does 'Market Share' BEST assist in understanding a firm's position?

Which financial ratio would be MOST helpful in determining if a company is overvalued?

Which financial ratio would be MOST helpful in determining if a company is overvalued?

What is the PRIMARY focus of the Triple Bottom Line (TBL) framework?

What is the PRIMARY focus of the Triple Bottom Line (TBL) framework?

When conducting a SWOT analysis, which of the following elements is considered an external factor?

When conducting a SWOT analysis, which of the following elements is considered an external factor?

According to the concept of Economic Value Creation (EVC), what happens when competitive advantage increases?

According to the concept of Economic Value Creation (EVC), what happens when competitive advantage increases?

Why is an external audit considered crucial for strategic planning?

Why is an external audit considered crucial for strategic planning?

Which analysis is BEST suited for understanding the competitive forces within an industry?

Which analysis is BEST suited for understanding the competitive forces within an industry?

During external analysis, what is the PRIMARY reason for monitoring demographic forces?

During external analysis, what is the PRIMARY reason for monitoring demographic forces?

Which of the following is MOST directly impacted by government fiscal and monetary policies?

Which of the following is MOST directly impacted by government fiscal and monetary policies?

What impact does increased cybersecurity MOST directly have on a company's strategic planning?

What impact does increased cybersecurity MOST directly have on a company's strategic planning?

In competitive intelligence, how do competitor weaknesses primarily benefit a company?

In competitive intelligence, how do competitor weaknesses primarily benefit a company?

What market condition is indicated by firms that operate in similar or overlapping markets?

What market condition is indicated by firms that operate in similar or overlapping markets?

What is the MAIN objective of an internal audit?

What is the MAIN objective of an internal audit?

Which framework is BEST suited to assess if a company's resources are valuable, rare, inimitable, and organized?

Which framework is BEST suited to assess if a company's resources are valuable, rare, inimitable, and organized?

What is the HIGHEST priority when there is good alignment between an organization's culture and strategy?

What is the HIGHEST priority when there is good alignment between an organization's culture and strategy?

In management, what does the 'Controlling' function primarily ensure?

In management, what does the 'Controlling' function primarily ensure?

Flashcards

Organizational Performance

Organizational Performance

Refers to how well an organization is doing to reach its Vision, Mission, and Goals

Performance Measure

Performance Measure

Data-driven metric to assess the effectiveness and efficiency of an agency, activity, or organization in achieving its objectives and goals.

Performance Benchmarks

Performance Benchmarks

Measuring and analyzing performance in products, services, and operations against competitors, industry leaders, or its own standards.

Balanced Scorecard

Balanced Scorecard

Signup and view all the flashcards

Triple Bottom Line (TBL)

Triple Bottom Line (TBL)

Signup and view all the flashcards

Strengths

Strengths

Signup and view all the flashcards

Weaknesses

Weaknesses

Signup and view all the flashcards

Opportunities

Opportunities

Signup and view all the flashcards

Threats

Threats

Signup and view all the flashcards

Economic Value Creation (EVC)

Economic Value Creation (EVC)

Signup and view all the flashcards

Competitive Advantage

Competitive Advantage

Signup and view all the flashcards

External Audit

External Audit

Signup and view all the flashcards

External Assessment

External Assessment

Signup and view all the flashcards

Ranking Factors

Ranking Factors

Signup and view all the flashcards

PESTEL Analysis

PESTEL Analysis

Signup and view all the flashcards

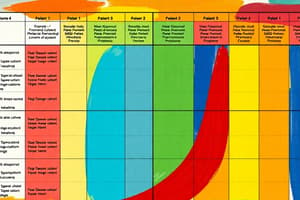

External Factor Evaluation Matrix (EFEM)

External Factor Evaluation Matrix (EFEM)

Signup and view all the flashcards

Competitive Profile Matrix (CPM)

Competitive Profile Matrix (CPM)

Signup and view all the flashcards

Competitive forces

Competitive forces

Signup and view all the flashcards

Internal Factor Evaluation (IFE) Matrix

Internal Factor Evaluation (IFE) Matrix

Signup and view all the flashcards

Resource-Based View

Resource-Based View

Signup and view all the flashcards

Study Notes

Assessing Organizational Performance

- Organizational performance is how well an organization achieves its vision, mission, and goals

- It includes financial results, operational efficiency, and employee engagement

Two Important Considerations

- Performance measures are data-driven metrics that assess how well an agency or organization achieves its objectives

- Performance benchmarks involve measuring and analyzing an organization's performance against competitors or industry standards

- This helps businesses compare financial measures and understand areas for improvement

- Performance benchmarking enables businesses to analyze past performance, compare operations against industry standards, and improve processes to increase customer satisfaction

The Balanced Scorecard

- A strategic management tool that offers a complete view of organizational performance

- It considers financial, customer, internal processes, and learning and growth perspectives

- It helps align activities with strategic goals

Goals

- Setting goals is crucial for managing a successful organization

- They provide standards to judge company success

- Goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound

Customer Measures

- Relate to customer attraction, satisfaction, and retention

Internal Business Process Measures

- Relate to organizational efficiency

Measuring Performance Using Triple Bottom Line

- The Triple Bottom Line (TBL) is a sustainability framework

- It considers people (social responsibility), planet (environmental sustainability), and profit

- These factors are considered when making decisions, not just financial performance

Learning and Growth Measures

- Focus on innovation and process

- Recognition that strategies change over time

Quantitative Analysis

- Used to perform organizational analysis

Financial Analysis

- This is ratio analysis

- It enables direct comparisons between firms or annual trends, regardless of firm size

Market-Based Analysis

- Helps determine how the firm compares to its competitors

Measures to Analyze a Firm's Market Position

- Market share is total product revenue divided by total revenue in the industry

- It indicates the firm’s percentage of market presence

- The price-earnings (PE) ratio is the stock price divided by earnings per share (EPS)

- It reflects the cost to invest in the company to earn $1.00

General Quantitative Analysis

- Includes diverse data sets, like trend analysis for tracking annual volume changes or extrapolating economic data for predictions

- Industry-specific data can further support comparisons for firms

Analyze a Firm's Market Position

- Utilizes a SWOT analysis, market analysis, and financial ratio analysis

- Helps assess internal capabilities, external factors, and financial health

SWOT Analysis

- Assesses internal capabilities, external factors, and financial health

- Strengths are internal capabilities that give the firm a competitive advantage

- For example, a strong brand or skilled workforce

- Weaknesses are internal limitations that hinder the firm's performance

- For example, outdated technology or poor customer service

- Opportunities are external factors that the firm can leverage

- For example, emerging markets or favorable regulations

- Threats are external factors that could negatively impact the firm

- For example, increased competition or changing consumer preferences

Market Analysis

- Understanding the overall size and potential for growth of the target market are key

- Identifying customer needs, wants, and behaviors is also key

- Analyzing the strengths, weaknesses, and strategies of competitors is important

- Evaluating the pricing strategies of competitors to identify opportunities for differentiation is also key

Financial Ratio Analysis

- Profitability ratios assess the firm's ability to generate profits

- For example, gross profit margin

- Liquidity ratios evaluate the firm's ability to meet short-term obligations

- For example, the current ratio

- Solvency ratios assess the firm's ability to meet long-term obligations

- For example, debt-to-equity ratio

- Efficiency ratios measure how effectively the firm uses assets

- For example, asset turnover ratio

- Market value ratios compare a company's stock price to its book value

- This is to determine if a stock is under or overpriced

Competitive Advantage

- The concept of Economic Value Creation (EVC)

- EVC is the difference between what a customer is willing to pay (WTP) for a product and the cost incurred to produce it

- Economic Value Creation may vary across firms, even if they sell the same product, due to different production costs

- EVC can be calculated with the equation EVC = WTP - Cost

Competitive Advantage Defined

- Unique characteristics enable a company to outperform competitors, achieving better market positioning and higher profits

- It involves creating value that is difficult for rivals to replicate

Components of Competitive Advantage

- Value Proposition refers to the feature or services that attract customers by offering genuine value

- Target Market is the segment that's been targeted for competitiveness

- Competitors: requires researching and understanding competitors in the marketplace and the value they offer

Types of Competitive Advantage - Michael Porter

- Competitive Advantage is not enough, the aim should be for Sustainable Competitive Advantage

- Cost Leadership involves producing the same quality product as competitors but selling it at a lower price

- Differentiation refers to when the product or service delivers different benefits than competitors

- Cost Focus: Lowest-cost producer in a concentrated market segment

- Differentiation Focus is for customized or specific value-add products in a narrow-targeted market segment

Relationship Between Economic Value Creation (EVC) & Competitive Advantage

- Direct Relationship: If competitive advantage increases, economic value creation will also increase, and vice versa

- A firm's competitive advantage grows if its economic value creation increases or if its competitor's decreases

- An organization holds a competitive advantage over others when it achieves greater economic value creation

External Assessment

- External Audit is used to avoid threats by developing a list of opportunities to benefit a firm

- Finite list suggests limits

- Aimed at actionable responses

- Verifies a company's financial statements, ensuring compliance with accounting standards and regulatory requirements

- In strategic management, external assessment is known as an environmental analysis.

- Identifies and analyzes factors outside the organization that could impact its performance to identify opportunities and threats

- Systematically examines the external environment of a business to identify opportunities and threats

Purpose

- Primary goal is to understand how external factors can influence an organization's ability to achieve its strategic objectives

- Managers rank the identified opportunities and threats from most to least important individually

- Consensus Building is used to find a consensus on critical factors

Communication of Findings

- The findings are shared to provide a prioritized list of opportunities and threats with stakeholders

- Strategies are formed to address the identified opportunities and threats

Tools and Techniques

- PESTEL Analysis is for examining political, economic, social, technological, environmental, and legal factors

- Porter's Five Forces is for analyzing industry rivalry, potential new entrants, substitute products, supplier power, and buyer power

- External Factor Evaluation Matrix (EFEM) evaluates the external environment and identify opportunities and threats

- Competitive Profile Matrix (CPM) compares a company's strengths and weaknesses against its competitors

The Industrial Organization (I/O) View

- Developed by Michael Porter

- The I/O View states that organizational performance is primarily determined by external industry forces

- It focuses on the external environment as the main driver of strategic success

- Emphasizes the need to analyze industry structure, competitive forces, and market trends

Key External Forces Divided

- Economic Forces

- Social, Cultural, Demographical, and Environmental Forces

- Political, Governmental, and Legal Forces

- Technological forces

- Competitive forces

Economic Forces

- Encompass macroeconomic factors that significantly impact a company's operations, competitiveness, and profitability

- Rising prices can erode consumer purchasing power, impacting demand and potentially leading to higher production costs

- Interest rate changes influence borrowing costs, affecting business investment decisions and consumer spending habits

- High unemployment rates can lead to decreased consumer spending and lower overall economic activity

- Economic growth creates opportunities, while recessions can lead to reduced demand and lower profits

- Exchange rate fluctuations can affect the cost of imported goods, impacting international businesses

- Government policies and regulations can have a significant impact

Consumer Spending

- Consumer confidence and disposable income levels directly influence demand

- Global economic conditions, such as trade wars, can create uncertainty and impact businesses operating internationally

Social, Cultural, Demographic, And Natural Environment Forces

- Significantly influence an organization's opportunities and threats, impacting decisions and success

- Trends are shaping the way people live, work, produce, and consume

- Social and cultural forces encompass societal values, beliefs, customs, and lifestyles, which shape consumer behavior and preferences

- Examples include changing attitudes towards sustainability and evolving family structures

- Demographic forces relate to the characteristics of a population, such as age and income

- Examples include an aging population and urbanization trends

- Natural environment forces involve ecological factors, including climate change, resource availability, and environmental regulations

Monitor Key Variables

- Consumer Behavior

- Ethical Concerns

- Attitudes Towards Saving

- Racial Equality

Political, Governmental, and Legal Forces

- Significantly impact an organization's operations and strategies

- Political forces encompass government policies, political stability, and the overall political climate that can influence business operations Government policies and trade restrictions can influence profits

- Political stability: creates certainty for businesses

- Political issues and trends can influence consumer behavior

- Businesses need to stay informed about political developments and adapt their strategies accordingly

Governmental Forces Defined

- Forces focus on the role of government in shaping the business environment

- Government regulations related to labor laws can impact operational costs and processes

- Government agencies can influence compliance and risk management

- Businesses need to anticipate changes in government policies and funding

- Businesses need to ensure compliance, navigate regulatory landscapes, and potentially influence policy decisions

Legal Forces Defined

- Encompass laws and legal frameworks that govern business activities

- Legal frameworks for contracts and agreements are crucial for business transactions and partnerships

- Laws related to consumer rights and safety can impact marketing

- Laws can affect human resource management Businesses need to ensure legal compliance and understand how legal frameworks can shape their competitive landscape

Technological Forces

- Encompass innovation and advancements in technology and impacts how businesses operate

- New technologies create new business models, requiring adaptation or risk obsolescence

- Automation can revolutionize production and improve efficiency

- Digital marketing and social media transform customer reach, brand building, and sales

- Internet enables faster communication, collaboration, and data sharing

- Technological innovation leads to industry disruptions, requiring new strategies

- The need to protect systems and data from cyber threats must be balanced as technology is used

Technological Examples

- Artificial Intelligence (AI) can automate tasks, analyze data, and personalize customer experiences

- Internet of Things (IoT) devices and sensors collect and transmit data, enabling real-time monitoring

- Cloud Computing offers flexibility, scalability, and cost savings

- Big Data Analytics helps companies gain insights to inform strategic decisions

- Augmented Reality (AR) and Virtual Reality (VR) can create immersive experiences and enhance training

Strategic Implications with Technology

- Companies need to develop a technology strategy that aligns with their overall business goals and leverages technology

- Adaptability and the rapid pace of technological change requires companies to be adaptable and agile

- Companies must manage their innovation processes to identify new technologies

- Companies must collaborate with technology providers to access new technologies and expertise

- Companies should allocate resources effectively to support technology investments

- As technology grows, companies need to consider the ethical implications

Competitive Intelligence (CI)

- A systematic and ethical process of gathering and analyzing information about competitors

- Used to further a business's own goals

- The more information a firm obtains about its competitors, the more effective strategies are formulated

- In CI, competitor weaknesses are opportunities and strengths pose key threats to a company

Three Basic Missions of Competitive Intelligence (CI) Program

- To provide a general understanding of an industry and its competitors

- Identify areas in which competitors are vulnerable and assess the impact of strategic actions

- Identify potential moves a competitor might make that would endanger a firm's position

Competitive Forces

- Can be analyzed through Porter's Five Forces

- Helps organizations assess their industry's attractiveness

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.