Podcast

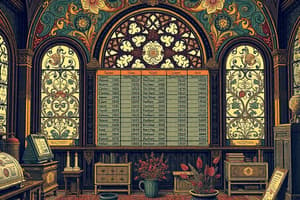

Questions and Answers

Manufacturing costs include?

Manufacturing costs include?

- Direct materials and direct labor only.

- Direct materials and manufacturing overhead only.

- Direct materials, direct labor, and manufacturing overhead. (correct)

- Direct labor and manufacturing overhead only.

Manufacturing costs that cannot be classified as either direct materials or direct labor are known as?

Manufacturing costs that cannot be classified as either direct materials or direct labor are known as?

- Nonmanufacturing costs.

- Manufacturing overhead. (correct)

- Period costs.

- Selling and administrative expenses.

Manufacturing overhead applied is added to direct labor incurred and to what other item to equal total manufacturing costs for the period?

Manufacturing overhead applied is added to direct labor incurred and to what other item to equal total manufacturing costs for the period?

- Raw materials purchased.

- Goods available for sale.

- Direct materials used. (correct)

- Work in process.

Process costing is not used when?

Process costing is not used when?

Process costing is used when?

Process costing is used when?

Product costs consist of?

Product costs consist of?

Sales commissions are classified as?

Sales commissions are classified as?

The flow of costs in a job order cost system?

The flow of costs in a job order cost system?

The high-low method is often employed in analyzing?

The high-low method is often employed in analyzing?

The product cost that is most difficult to associate with a product is?

The product cost that is most difficult to associate with a product is?

The relevant range of activity refers to the?

The relevant range of activity refers to the?

The two basic types of cost accounting systems are?

The two basic types of cost accounting systems are?

The two major steps in the flow of costs are?

The two major steps in the flow of costs are?

The wages of a timekeeper in the factory would be classified as?

The wages of a timekeeper in the factory would be classified as?

The work of factory employees that can be physically and directly associated with converting raw materials into finished goods is?

The work of factory employees that can be physically and directly associated with converting raw materials into finished goods is?

When determining costs of jobs, how does a company account for indirect materials?

When determining costs of jobs, how does a company account for indirect materials?

Which of the following are period costs?

Which of the following are period costs?

Which of the following is not a cost classification?

Which of the following is not a cost classification?

Which of the following is not a fixed cost?

Which of the following is not a fixed cost?

Which of the following is not a manufacturing cost category?

Which of the following is not a manufacturing cost category?

Which of the following is not another name for the term manufacturing overhead?

Which of the following is not another name for the term manufacturing overhead?

Which of the following is not classified as direct labor?

Which of the following is not classified as direct labor?

Which of the following is not true about the graph of a mixed cost?

Which of the following is not true about the graph of a mixed cost?

Which of the following is not viewed as part of accumulating manufacturing costs in a job order cost system?

Which of the following is not viewed as part of accumulating manufacturing costs in a job order cost system?

Which of the following would be accounted for using a job order cost system?

Which of the following would be accounted for using a job order cost system?

Which one of the following costs would not be inventoriable?

Which one of the following costs would not be inventoriable?

Which one of the following is an example of a period cost?

Which one of the following is an example of a period cost?

Which one of the following is not a cost element in manufacturing a product?

Which one of the following is not a cost element in manufacturing a product?

Which one of the following is not a direct material?

Which one of the following is not a direct material?

Which one of the following is not considered as material costs?

Which one of the following is not considered as material costs?

Which one of the following represents a period cost?

Which one of the following represents a period cost?

Which one of the following would not be classified as manufacturing overhead?

Which one of the following would not be classified as manufacturing overhead?

Why is identification of a relevant range important?

Why is identification of a relevant range important?

Flashcards are hidden until you start studying

Study Notes

Manufacturing Costs

- Manufacturing costs encompass direct materials, direct labor, and manufacturing overhead.

- Manufacturing overhead accounts for costs that are not classified as direct materials or direct labor.

Cost Systems

- Process costing applies when a continuous production process is in place.

- Job order costing is necessary for jobs with distinct characteristics or that produce unique products.

Product Costs

- Product costs are comprised of direct materials, direct labor, and manufacturing overhead.

- Selling expenses are categorized as period costs, not product costs.

Cost Flow

- In job order cost systems, costs are accumulated and assigned to work completed.

- Indirect materials are transferred to manufacturing overhead when utilized.

Cost Classifications

- Mixed costs combine fixed and variable components, and understanding their graph is essential for cost behavior analysis.

- Fixed costs remain constant within a relevant range, while variable costs fluctuate with activity levels.

Job Order Costing

- Job order cost systems include costs incurred for raw materials, factory labor, and manufacturing overhead.

- Period costs, like selling expenses, are not inventory costs and are recognized immediately.

Accountability in Costing

- Certain jobs, such as construction projects, require a job order cost system to track their specific costs.

- Wages of supervisors are classified as indirect labor, not direct labor.

Cost Elements

- Elements in manufacturing costs include manufacturing overhead, direct materials, and direct labor, while office salaries do not count as material costs.

- Identifying non-direct materials helps in assessing overall manufacturing costs.

Importance of Relevant Range

- Recognizing the relevant range is crucial as cost behaviors become non-linear outside of this range, affecting cost-volume-profit analysis.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.