Podcast

Questions and Answers

What is the purpose of the balance sheet?

What is the purpose of the balance sheet?

It reports the financial position of the company.

What does the accounting equation state?

What does the accounting equation state?

- Assets = Liabilities - Stockholders' Equity

- Liabilities = Assets + Stockholders' Equity

- Assets = Liabilities + Stockholders' Equity (correct)

- Assets + Liabilities = Stockholders' Equity

What does the balance sheet also refer to as?

What does the balance sheet also refer to as?

The statement of financial position.

From which perspectives does the balance sheet report financial position?

From which perspectives does the balance sheet report financial position?

What do the other four financial statements report?

What do the other four financial statements report?

How are the elements of the income statement measured?

How are the elements of the income statement measured?

What do the elements of the comprehensive income statement measure?

What do the elements of the comprehensive income statement measure?

What does the statement of cash flows explain?

What does the statement of cash flows explain?

What does the statement of shareholders' equity report?

What does the statement of shareholders' equity report?

What three factors must a company determine to provide relevant information on the balance sheet?

What three factors must a company determine to provide relevant information on the balance sheet?

What establishes the principles and standards for balance sheet recognition?

What establishes the principles and standards for balance sheet recognition?

What is recognition in financial statements?

What is recognition in financial statements?

What must an item of information meet to be recognized on a balance sheet?

What must an item of information meet to be recognized on a balance sheet?

What defines the elements of financial statements?

What defines the elements of financial statements?

What are the elements of the balance sheet?

What are the elements of the balance sheet?

What is a key definition established by U.S. GAAP and IFRS regarding resources?

What is a key definition established by U.S. GAAP and IFRS regarding resources?

How would Con 6 define an asset?

How would Con 6 define an asset?

What is the primary attribute of all assets?

What is the primary attribute of all assets?

What characteristics must an economic resource have to be considered an asset?

What characteristics must an economic resource have to be considered an asset?

What does probable future economic benefit mean?

What does probable future economic benefit mean?

What must a company do if it has assets on the balance sheet that no longer represent future economic benefits?

What must a company do if it has assets on the balance sheet that no longer represent future economic benefits?

Flashcards are hidden until you start studying

Study Notes

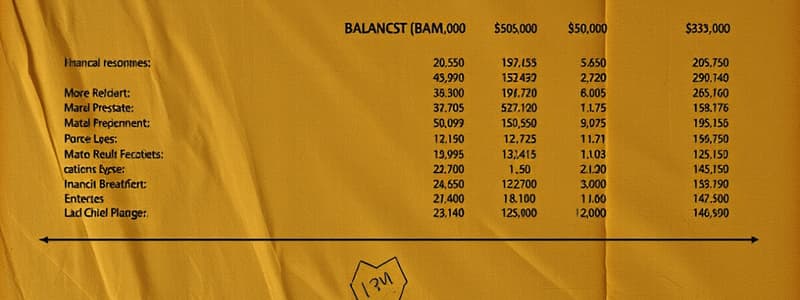

Purpose of the Balance Sheet

- Serves as the cornerstone of financial reporting, defining the company's financial position.

- Reports the company's resources (assets) and claims against those resources (liabilities and shareholders' equity) at a specific date.

Accounting Equation

- Expressed as: Assets = Liabilities + Stockholders' Equity.

Balance Sheet Overview

- Also known as the statement of financial position.

- Provides insights into the specific resources a company controls and the claims on those resources by stakeholders.

Comparison to Other Financial Statements

- Unlike the balance sheet, other financial statements report changes in the financial position over a specific period.

Elements of Financial Statements

- Income statement elements track changes in assets and liabilities.

- Comprehensive income statement elements focus on changes in the values of particular assets and liabilities.

- Statement of cash flows highlights cash inflows and outflows during a given period.

- Statement of shareholders’ equity details the changes in owners' claims during the period.

Recognition of Elements

- To ensure relevant and accurate reporting, a company must determine:

- What elements to recognize on the balance sheet.

- Measurement methods for these elements.

- Classification and reporting of these elements.

Standards and Principles

- U.S. GAAP and IFRS set principles to help companies recognize balance sheet elements.

Formal Recognition Process

- Recognition involves the formal recording and reporting of an element in financial statements.

- For an item to be recognized, it must be definable, measurable, relevant, and faithfully represented.

Elements of the Balance Sheet

- The balance sheet consists of three essential elements: assets, liabilities, and shareholders' equity.

Asset Definition and Characteristics

- Defined by Con 6 as probable future economic benefits stemming from past transactions.

- Key characteristics of an asset include:

- Probable future economic benefits.

- Control over the resource.

- Acquisition of the resource.

Importance of Service Potential

- The primary attribute of all assets is "service potential," referring to the ability to provide benefits or services to the company.

Addressing Impaired Assets

- If assets no longer represent future economic benefits, they must be removed from the balance sheet, such as uncollectible receivables or obsolete inventory.

Future Economic Benefits of Assets

- Probable future economic benefits may come from:

- Covering costs or settling liabilities (e.g., cash).

- Collecting cash (e.g., accounts receivable).

- Exchanging assets for cash or other valuable resources (e.g., inventory or investments).

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.