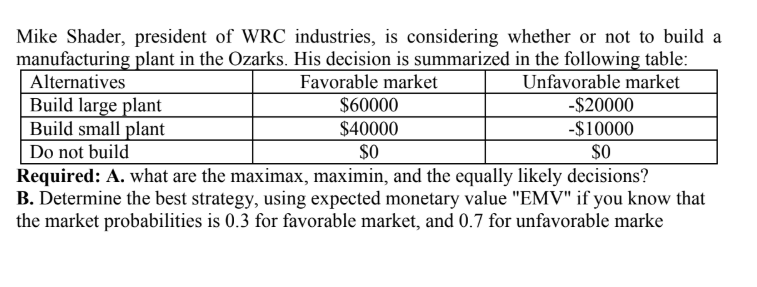

What are the maxmax, maximin, and equally likely decisions? Determine the best strategy using expected monetary value if the market probabilities are 0.3 for favorable market and 0... What are the maxmax, maximin, and equally likely decisions? Determine the best strategy using expected monetary value if the market probabilities are 0.3 for favorable market and 0.7 for unfavorable market.

Understand the Problem

The question is asking for two parts: A. To determine the maximin, maximax, and equally likely decisions based on the given financial outcomes for different alternatives. B. To calculate the best strategy using the expected monetary value (EMV), considering the probabilities of market conditions.

Answer

A. Maximin: Do not build ($0), Maximax: Build large plant ($60000), Equally Likely: Build large plant ($20000). B. Best strategy: Build small plant ($5000).

Answer for screen readers

A. Maximin: Do not build ($0), Maximax: Build large plant ($60000), Equally Likely: Build large plant ($20000).

B. Best strategy (EMV): Build small plant ($5000).

Steps to Solve

- Calculate Maximin Decision To find the maximin, we look at the minimum profit for each alternative.

- Build large plant: Minimum profit = $-20000

- Build small plant: Minimum profit = $-10000

- Do not build: Minimum profit = $0

The maximin decision is the alternative with the highest minimum profit, which is $0 from "Do not build."

- Calculate Maximax Decision For the maximax, we determine the maximum profit for each alternative.

- Build large plant: Maximum profit = $60000

- Build small plant: Maximum profit = $40000

- Do not build: Maximum profit = $0

The maximax decision is the alternative with the highest maximum profit, which is $60000 from "Build large plant."

- Calculate Equally Likely Decision Here, we assume each market condition is equally likely (50% chance for each).

- Build large plant: Average $$ = \frac{60000 + (-20000)}{2} = \frac{40000}{2} = 20000$$

- Build small plant: Average $$ = \frac{40000 + (-10000)}{2} = \frac{30000}{2} = 15000$$

- Do not build: Average $$ = \frac{0 + 0}{2} = 0$$

The equally likely decision is the alternative with the highest average profit, which is $20000 from "Build large plant."

- Calculate Expected Monetary Value (EMV) Using given probabilities to calculate EMV:

-

Build large plant:

$$ EMV = 0.3(60000) + 0.7(-20000) = 18000 - 14000 = 4000 $$ -

Build small plant:

$$ EMV = 0.3(40000) + 0.7(-10000) = 12000 - 7000 = 5000 $$ -

Do not build:

$$ EMV = 0.3(0) + 0.7(0) = 0 $$

The best strategy based on EMV is the option with the highest EMV, which is $5000 from "Build small plant."

A. Maximin: Do not build ($0), Maximax: Build large plant ($60000), Equally Likely: Build large plant ($20000).

B. Best strategy (EMV): Build small plant ($5000).

More Information

Understanding maximin, maximax, and equally likely decisions helps in making risk-informed choices. The EMV method is particularly useful when probabilities of outcomes are known.

Tips

- Confusing maximin with maximax: Remember maximin focuses on the worst-case scenario, while maximax deals with the best-case scenario.

- Not calculating the averages correctly for the equally likely decision.

- Failing to apply the correct probabilities when calculating EMV.

AI-generated content may contain errors. Please verify critical information