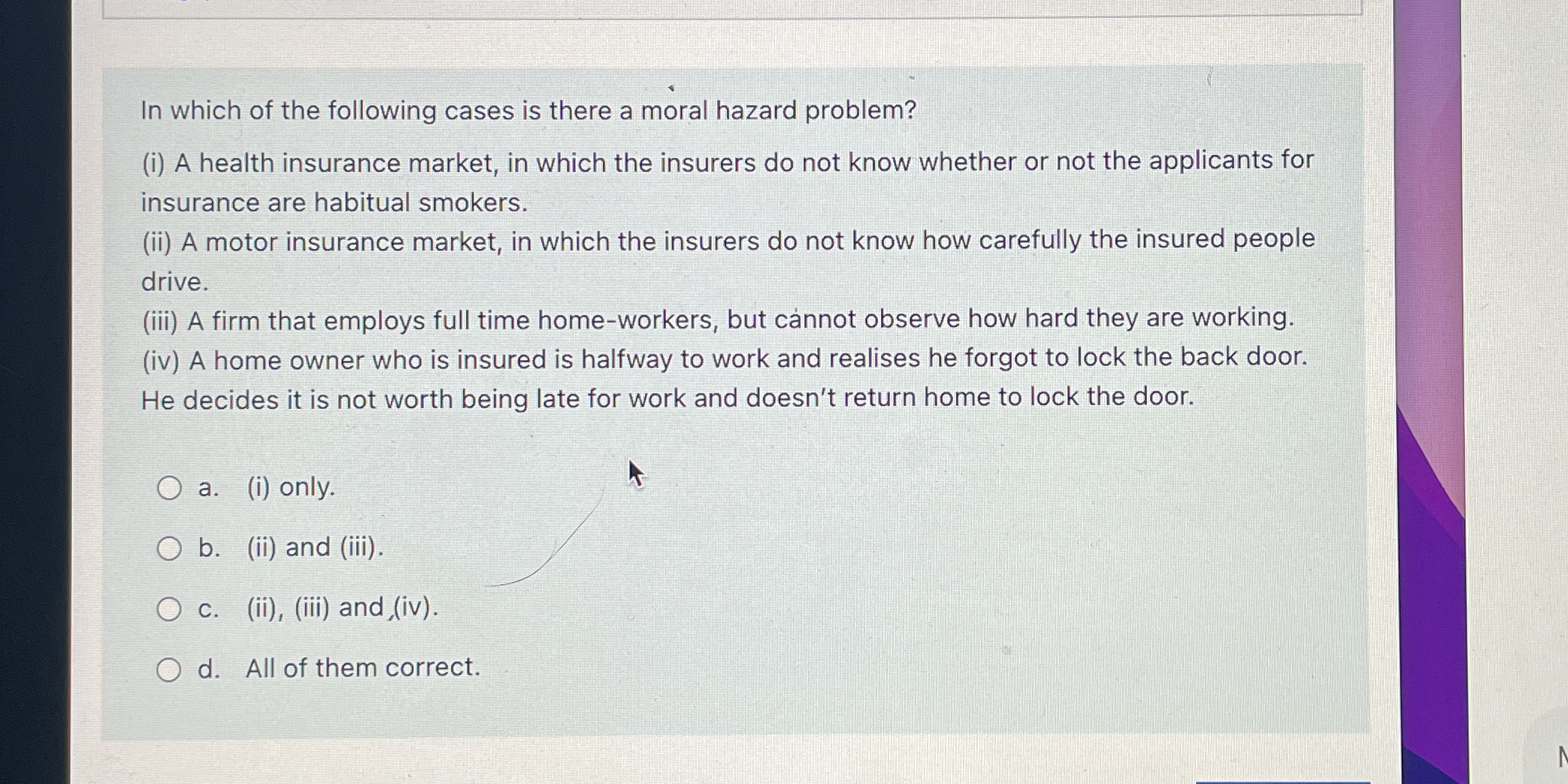

In which of the following cases is there a moral hazard problem? (i) A health insurance market, in which the insurers do not know whether or not the applicants for insurance are ha... In which of the following cases is there a moral hazard problem? (i) A health insurance market, in which the insurers do not know whether or not the applicants for insurance are habitual smokers. (ii) A motor insurance market, in which the insurers do not know how carefully the insured people drive. (iii) A firm that employs full time home-workers, but cannot observe how hard they are working. (iv) A home owner who is insured is halfway to work and realizes he forgot to lock the back door. He decides it is not worth being late for work and doesn’t return home to lock the door.

Understand the Problem

The question is asking which of the given scenarios demonstrates a moral hazard problem, indicating where one party may take risks because they do not bear the full consequences of their actions. It provides four situations and asks to identify all applicable cases.

Answer

(ii), (iii), and (iv) have a moral hazard problem.

The final answer is cases (ii), (iii), and (iv) have a moral hazard problem.

Answer for screen readers

The final answer is cases (ii), (iii), and (iv) have a moral hazard problem.

More Information

Moral hazard arises in cases where behavior changes post-agreement due to reduced perceived consequences. In these cases, driving carelessly (ii), working less diligently (iii), and neglecting home security (iv) illustrate this risk.

Tips

A common mistake is confusing moral hazard with adverse selection. Moral hazard involves changes in behavior post-agreement.

AI-generated content may contain errors. Please verify critical information