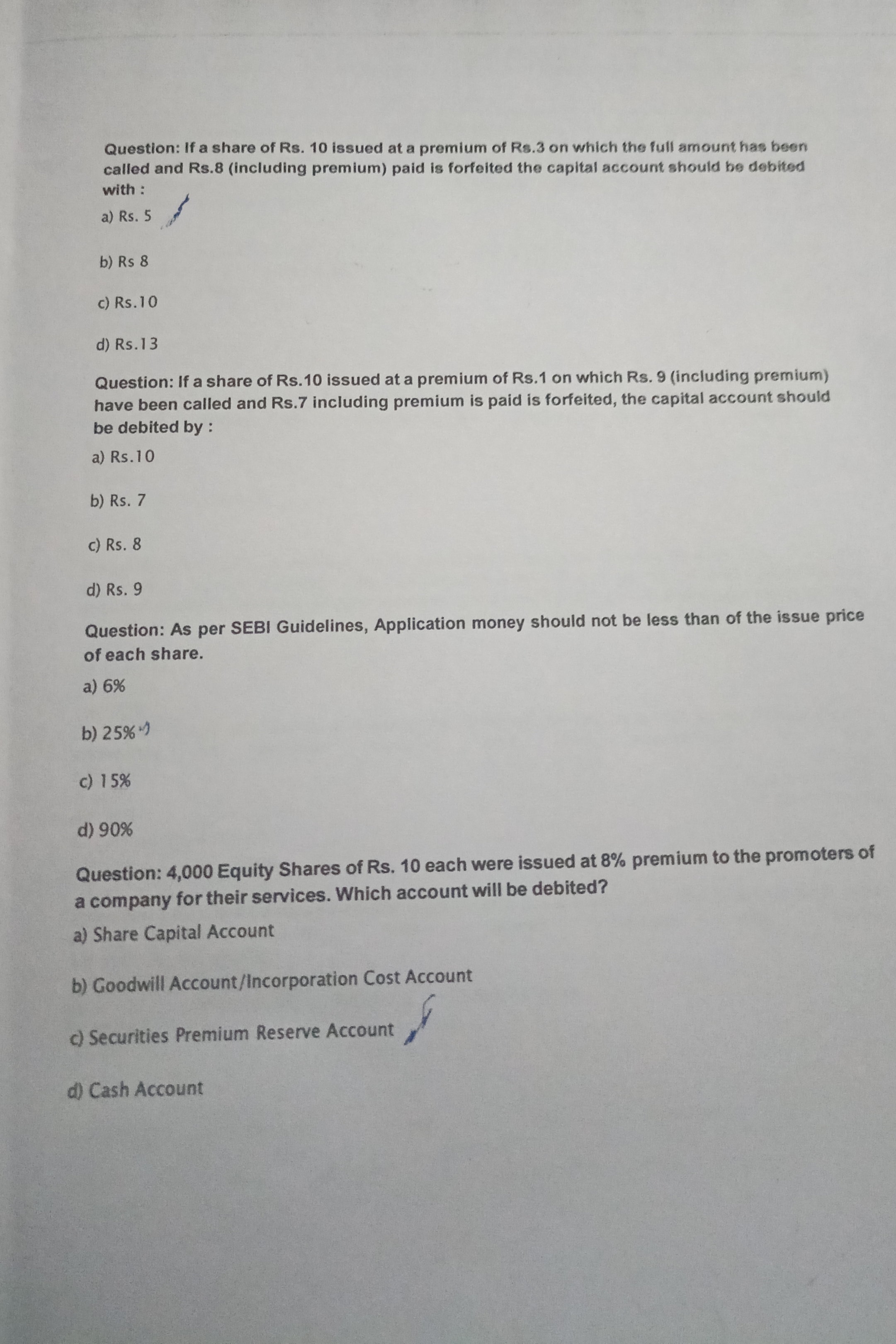

If a share of Rs. 10 issued at a premium of Rs. 3 on which the full amount has been called and Rs. 8 (including premium) paid is forfeited, the capital account should be debited wi... If a share of Rs. 10 issued at a premium of Rs. 3 on which the full amount has been called and Rs. 8 (including premium) paid is forfeited, the capital account should be debited with: If a share of Rs. 10 issued at a premium of Rs. 1 on Rs. 9 (including premium) paid is forfeited, the capital account should be debited by: As per SEBI Guidelines, Application money should not be less than the issue price of each share. 4,000 Equity Shares of Rs. 10 each were issued at 8% premium to the promoters of a company for their services. Which account will be debited?

Understand the Problem

The questions are related to accounting principles, specifically dealing with share premium issues, capital accounts, and SEBI guidelines on application money. The first part asks what amount should be debited to the capital account in cases of share forfeiture. The final question concerns which account to debit when shares are issued at a premium for services rendered.

Answer

Rs. 8 and Rs. 7

The capital account should be debited with Rs. 8 in the first scenario and Rs. 7 in the second.

Answer for screen readers

The capital account should be debited with Rs. 8 in the first scenario and Rs. 7 in the second.

More Information

For forfeiture, the share capital account is adjusted based on unpaid nominal value only.

Tips

A common mistake is to include the premium in the capital account debit calculation. Only the nominal value affects this account.

Sources

- If a share of Rs. 10 issued at a premium... - doubtnut.com

- If a share of Rs. 10 on which Rs. 8 is called... - toppr.com

AI-generated content may contain errors. Please verify critical information