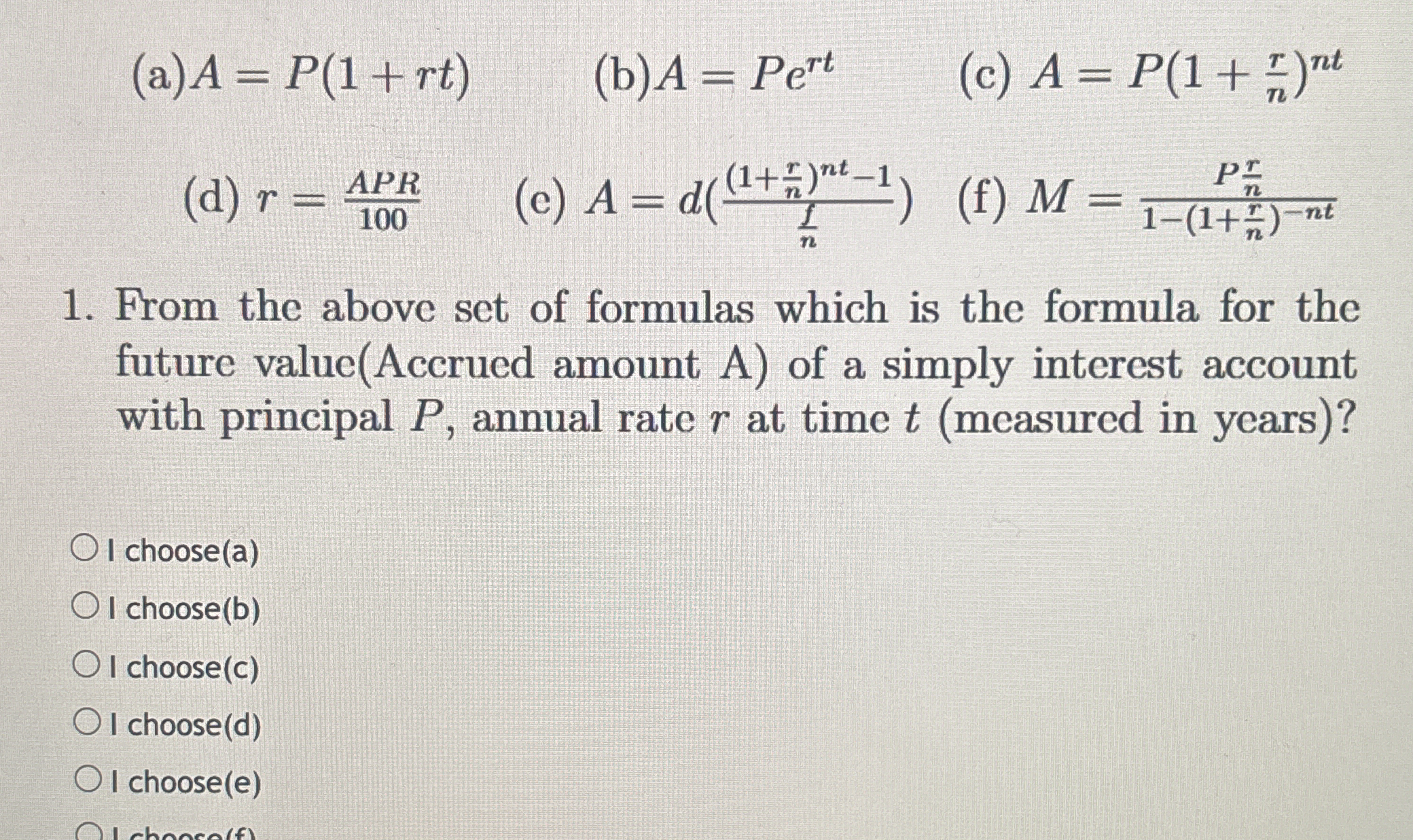

From the above set of formulas, which is the formula for the future value (Accrued amount A) of a simple interest account with principal P, annual rate r at time t (measured in yea... From the above set of formulas, which is the formula for the future value (Accrued amount A) of a simple interest account with principal P, annual rate r at time t (measured in years)?

Understand the Problem

The question is asking to identify the correct formula for calculating the future value (accrued amount A) of a simple interest account based on the principal, annual rate, and time in years from a given set of formulas.

Answer

The formula is $A = P(1 + rt)$.

Answer for screen readers

The correct formula for the future value (accrued amount A) of a simple interest account is given by option (a): $$ A = P(1 + rt) $$

Steps to Solve

-

Identify the formula for simple interest The formula for calculating the future value (A) in a simple interest scenario is based on the principal (P), rate (r), and time (t). The standard formula is: $$ A = P(1 + rt) $$

-

Evaluate the given options We need to match the identified formula with one of the options provided:

- Option (a): $A = P(1 + rt)$

- Option (b): $A = Pe^{rt}$

- Option (c): $A = P(1 + \frac{r}{n})^{nt}$

- Option (d): $r = \frac{APR}{100}$

- Option (e): $A = d\left(1 + \frac{r}{n}\right)^{\frac{nt - 1}{n}}$

- Option (f): $M = \frac{P \frac{r}{n}}{1 - (1 + \frac{r}{n})^{-nt}}$

- Choose the correct option From the evaluation, option (a) directly matches the standard formula for future value in a simple interest account. Therefore, we choose option (a).

The correct formula for the future value (accrued amount A) of a simple interest account is given by option (a): $$ A = P(1 + rt) $$

More Information

The formula $A = P(1 + rt)$ calculates the total amount (A) that you will have after ( t ) years, accounting for the interest earned on the principal amount ( P ) at a simple interest rate ( r ). Simple interest is typically used in short-term loans or investments.

Tips

Common mistakes include:

- Confusing simple interest with compound interest. Remember that in simple interest, the interest is calculated only on the principal.

- Misreading the formulas and not recognizing the correct variables (P, r, t) as components of the simple interest formula.

AI-generated content may contain errors. Please verify critical information